Terminology

Terminology explains all the terms used in the financial world in a simple language such as Investments, Insurance, Concept, Ideas and new words

Types of Debt funds & Hybrid mutual funds

Debt mutual funds invest in fixed income securities like bonds while hybrid mutual funds invest in both equity and debt securities Different types of Debt…

What is a Stock Exchange?

A stock exchange is a place where investors can purchase publicly traded companies' shares or sell them. It's comparable to a shopping mall for stock. From one…

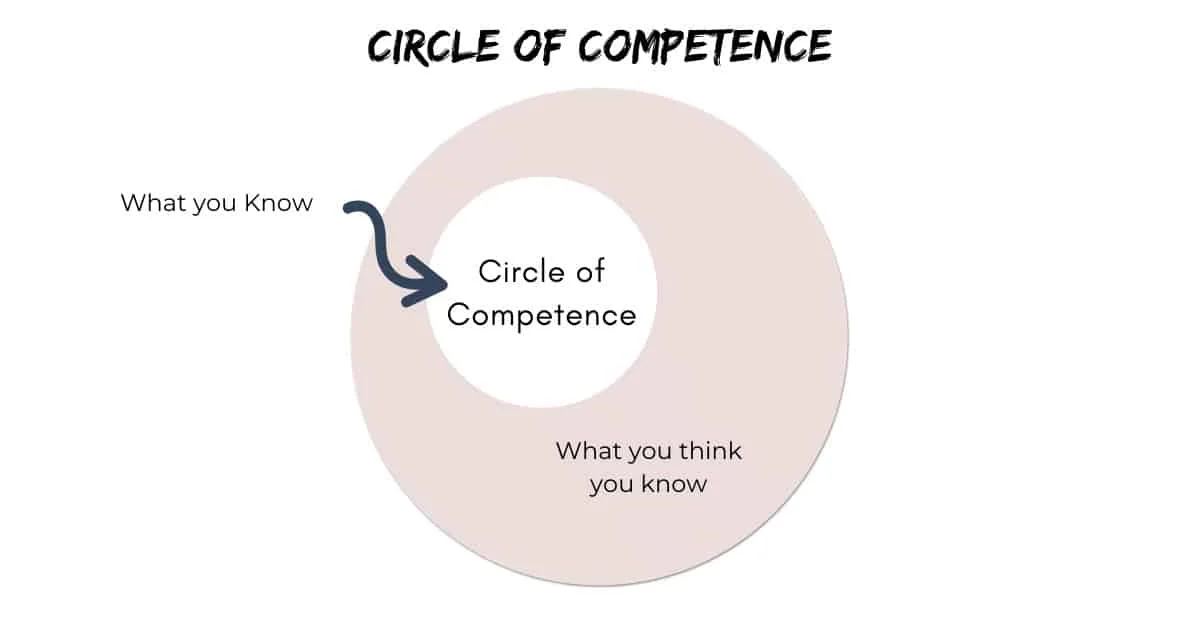

Understanding what is the circle of competence?

Anything that falls within your skill set, knowledge, or experience is considered to be within your Circle of competence. Amazon is really good at one…

Different types of Equity funds

A mutual fund scheme that invests primarily in company shares or stocks is known as an equity fund. Growth funds are another name for them.…

What are Real Returns?

Real returns are those earned by an investment that are effective in nature, i.e., in terms of purchasing power. Consider the following scenario: 10% return…

Stories

What is the Alpha & Beta of a stock?

Alpha of the stock After correcting for market-related volatility and random variations, alpha is the…

What are Preference Shares?

Preference shares, also known as preferred stocks, are stock issued by a company that pays…

What does Seigniorage mean?

The gap between the face value of money and the cost of producing it is…

MCLR Rates

The marginal cost of funds-based lending rate, often known as the MCLR, is the minimum…

Overdraft

With an overdraft option, you are able to withdraw more money from your bank account…

Share Premium Account

Share premium is the phrase used when shares are issued at a price higher than…