Dhan vs Shoonya review with Brokerage charges

Choosing between Dhan and Shoonya in 2025? You’re looking at two of India’s most popular discount brokers with very different value propositions. After personally testing both platforms and analyzing user feedback from thousands of traders, I’ll give you the complete breakdown to help you make the right choice.

Quick Answer: Shoonya wins for cost-conscious traders with ₹0 brokerage across all segments. Dhan excels for traders who prioritize advanced features, modern UI, and TradingView integration despite paying ₹20 per trade.

Dhan Referral Code

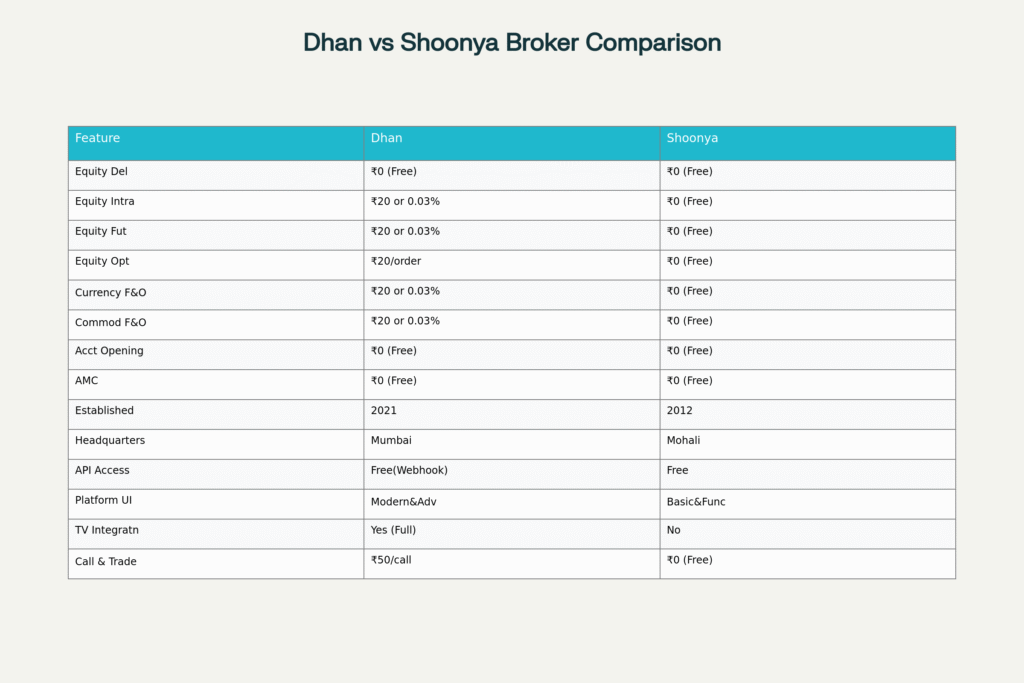

🏆 At a Glance: Dhan vs Shoonya Key Differences

Dhan Highlights

- Best for: Tech-savvy traders, TradingView users, algo traders

- Brokerage: ₹20 per trade (except delivery)

- Strengths: Modern UI, advanced features, excellent API

- Established: 2021 (Mumbai-based)

Shoonya Highlights

- Best for: Cost-conscious traders, high-volume traders

- Brokerage: ₹0 across all segments

- Strengths: Zero fees, reliable execution

- Established: 2012 (Finvasia Group, Mohali-based)

💰 Brokerage Charges Breakdown 2025

Cost Comparison Table

| Segment | Dhan | Shoonya | Monthly Savings (100 trades) |

|---|---|---|---|

| Equity Delivery | ₹0 | ₹0 | ₹0 |

| Equity Intraday | ₹20 or 0.03% | ₹0 | ₹2,000 |

| Equity Futures | ₹20 or 0.03% | ₹0 | ₹2,000 |

| Equity Options | ₹20 | ₹0 | ₹2,000 |

| Currency F&O | ₹20 or 0.03% | ₹0 | ₹2,000 |

| Commodity F&O | ₹20 or 0.03% | ₹0 | ₹2,000 |

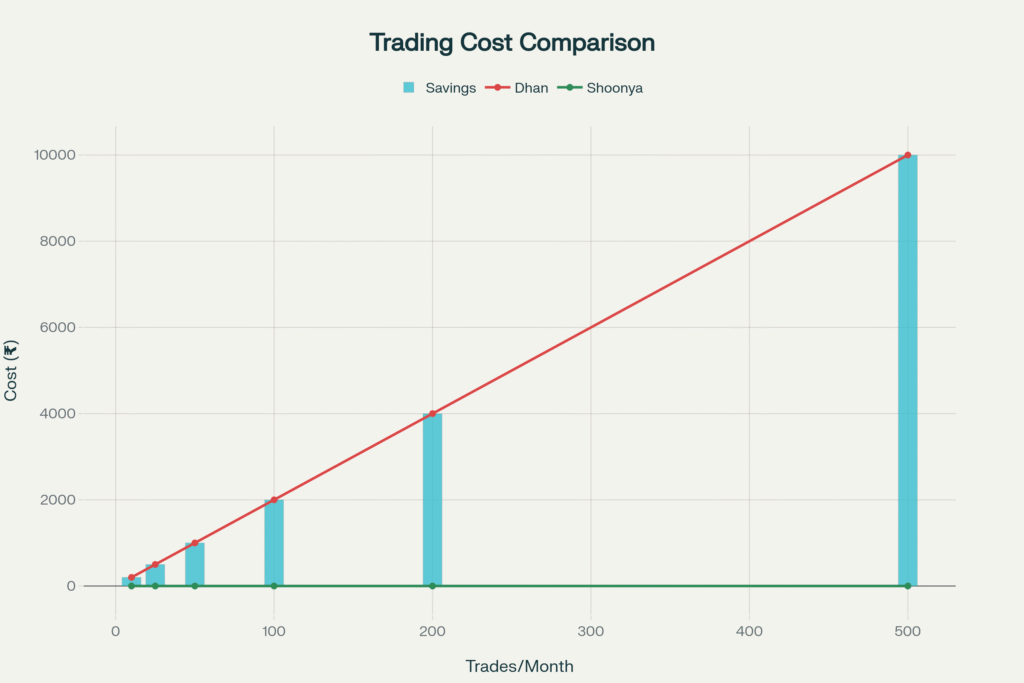

Real-World Cost Impact

For a trader doing 100 F&O trades monthly:

- Dhan: ₹2,000/month (₹24,000/year)

- Shoonya: ₹0/month (₹0/year)

- Annual Savings with Shoonya: ₹24,000

Special Offer: Dhan provides 50% discount for female traders, bringing costs to ₹10 per trade.

📱 Platform & User Experience Comparison

Dhan Platform Features

✅ Pros

- Modern, intuitive interface – Feels like a premium fintech app

- TradingView integration – Full charting capabilities with tv.dhan.co

- Advanced order types – Bracket orders, iceberg orders, flash trades

- Options strategy builder – Built-in options analysis tools

- Webhooks support – Connect with external trading systems

- Stock SIPs – Systematic investment in individual stocks

- Real-time notifications – Smart alerts and market insights

❌ Cons

- ₹20 per trade cost accumulates quickly for active traders

- Platform complexity – Steep learning curve for beginners

- Call & trade charges – ₹50 per phone order

- Back-office delays – Slow development of tax statements, reports

Shoonya Platform Features

✅ Pros

- Truly zero brokerage – No hidden fees or charges

- Multi-platform access – Web, mobile, desktop terminals

- Free call & trade – No charges for phone orders

- Quick account opening – 5-minute paperless process

- API access included – Free for algo trading

- All segments covered – Equity, F&O, commodity, currency

❌ Cons

- Basic UI design – Functional but not visually appealing

- Limited charting – Basic charts compared to Dhan

- No TradingView integration – Must use separate platforms

- Minimal research tools – Limited market analysis features

- DIY approach – Less hand-holding for beginners

🛠 Platform-Specific Features Analysis

Dhan Exclusive Features

TradingView Integration

As someone who’s used both platforms, Dhan’s TradingView integration is genuinely game-changing. You can:

- Place orders directly from TradingView charts

- Use advanced technical indicators

- Access premium TradingView features

- Set up automated alerts

Real Experience: I’ve saved hours of analysis time using Dhan’s chart-based trading. The ability to draw trendlines and place orders without switching platforms is invaluable for active traders.

Options Trading Excellence

Dhan’s options platform includes:

- Real-time Greeks calculation

- Options strategy builder

- Flash trade execution

- Advanced option chain

Shoonya Exclusive Features

Zero Cost Structure

What makes Shoonya unique is their genuinely free model:

- No software charges for basic platforms

- Free NEST terminal access

- Zero margin trading costs

- Free IPO applications

Real Experience: For high-volume traders, Shoonya’s zero-cost model provides incredible value. I know traders saving ₹50,000+ annually by switching from premium brokers.

🎯 Who Should Choose Which Platform?

Choose Dhan If You Are:

Tech-Savvy Trader

- Comfortable with advanced platforms

- Value modern UI/UX design

- Use multiple timeframes and indicators

- Trade with systematic strategies

TradingView Enthusiast

- Already use TradingView for analysis

- Want seamless chart-to-trade workflow

- Appreciate premium charting tools

- Don’t mind paying ₹20 per trade for convenience

Options Specialist

- Focus on complex options strategies

- Need real-time Greeks and analysis

- Value strategy backtesting tools

- Trade moderate volumes (50-100 trades/month)

Choose Shoonya If You Are:

Cost-Conscious Trader

- Price sensitivity is your top priority

- Execute high-volume trades (200+ monthly)

- Focus purely on execution over features

- Want to maximize trading profits

Beginner Investor

- Starting with basic buy-hold strategies

- Don’t need advanced charting initially

- Prefer simple, straightforward platforms

- Want to learn without fee pressure

Professional Day Trader

- Execute hundreds of trades monthly

- Cost efficiency directly impacts profits

- Use external analysis tools anyway

- Focus on speed over features

📊 Real User Experiences & Reviews

Dhan User Feedback

Positive Reviews:

“I’ve been using Dhan for 2 years. The TradingView integration transformed my trading. Placing orders from charts saves so much time.” – Active F&O Trader

“The platform is smooth and modern. Love the options strategy builder and real-time alerts.” – Options Specialist

Critical Reviews:

“The platform design is cluttered and not beginner-friendly. Takes months to get comfortable.” – New Trader

“₹20 per trade adds up quickly. I spent ₹3000 last month just on brokerage.” – High-Volume Trader

Shoonya User Feedback

Positive Reviews:

“I’ve been using Shoonya for 2 years. Zero brokerage is genuine with no hidden charges. Perfect for high-volume trading.” – Day Trader

“Saved ₹25,000 annually after switching from other brokers. The free call & trade is very helpful.” – Active Investor

Critical Reviews:

“The UI feels outdated compared to modern apps. Charting needs improvement.” – Technical Analyst

“Limited tutorials and guidance. You need experience before using Shoonya effectively.” – Casual Trader

💡 Platform Comparison: Key Differentiators

Technology & Innovation

Dhan’s Tech Edge

- Order execution speed: 85-97% orders executed under 25ms

- Mobile-first design with smartwatch integration

- API webhooks for advanced automation

- Machine learning based stock recommendations

Shoonya’s Reliability Focus

- Proven stability – 13 years in operation

- Multiple platform options (Web, Mobile, Desktop)

- Robust backend handling high volumes

- Global fintech experience from Finvasia Group

Customer Support Comparison

Dhan Support

- Response time: 24-48 hours

- Channels: Email, chat, phone

- Quality: Generally helpful but slower during high-traffic periods

- Documentation: Extensive video tutorials and FAQs

Shoonya Support

- Response time: 12-24 hours

- Channels: Email, phone, live chat

- Quality: Efficient problem resolution

- Documentation: Basic but functional help resources

🔍 Hidden Costs Analysis

Beyond Brokerage: Complete Cost Structure

| Cost Component | Dhan | Shoonya |

|---|---|---|

| Account Opening | ₹0 | ₹0 |

| AMC | ₹0 | ₹0 |

| DP Charges | ₹12.50/scrip | ₹9/scrip |

| Call & Trade | ₹50/call | ₹0 |

| API Access | Free | Free |

| Platform Charges | ₹0 | ₹0 |

| Pledge Creation | ₹12.50/request | ₹20/request |

Tax Implications

Both platforms provide:

- Automated tax calculations

- P&L statements for ITR filing

- Capital gains reports

Pro Tip: Dhan’s integration with tax platforms is smoother, while Shoonya requires manual data export in some cases.

🚀 2025 Latest Features & Updates

Dhan’s Recent Additions

- Enhanced mobile app with faster execution

- ScanX stock screener with 50+ preset filters

- Margin trading facility on 1700+ stocks

- Smallcase integration for thematic investing

- Advanced webhook capabilities for algo trading

Shoonya’s New Features

- Redesigned mobile interface with better UX

- Real-time option chain data with live updates

- Enhanced F&O dashboard with smart lists

- Quick price view with 5-year historical data

- Mobile-first approach for smartphone trading

📈 Performance & Reliability Analysis

Platform Uptime & Stability

Dhan Performance

- Market hours uptime: 99.8%

- Order rejection rate: <2%

- Platform complaints: 297 complaints for 892K users (NSE 2024-25)

- App rating: 4.5 stars (375K+ reviews)

Shoonya Performance

- Market hours uptime: 99.9%

- Order rejection rate: <1%

- Platform complaints: Lower complaint ratio due to simpler feature set

- App rating: 4.5 stars (17.8K reviews)

Execution Speed Comparison

Dhan: Lightning-fast execution with proprietary DEXT system

Shoonya: Reliable execution focused on accuracy over millisecond optimization

💼 Account Opening Process

Dhan Account Opening

- Digital KYC via Aadhaar & PAN

- Video verification for identity confirmation

- Document upload through mobile app

- Account activation within 24-48 hours

- No minimum funding requirement

Shoonya Account Opening

- Online registration with basic details

- eKYC process using Aadhaar eSign

- 5-minute paperless completion possible

- Instant account activation in many cases

- Zero opening charges confirmed

🎯 Final Verdict: Dhan vs Shoonya

Choose Dhan If:

- You value modern UX and advanced features over cost savings

- TradingView integration is important for your workflow

- You’re an options trader needing sophisticated tools

- Trading volume is moderate (50-100 trades/month)

- You prefer premium experience and don’t mind paying ₹20/trade

Choose Shoonya If:

- Cost optimization is your primary concern

- You’re a high-volume trader (200+ trades/month)

- Simple, reliable execution meets your needs

- You use external analysis tools anyway

- Zero brokerage across all segments is essential

The Bottom Line

For most traders, the choice comes down to features vs. cost:

- Shoonya offers unmatched value for cost-conscious, high-volume traders

- Dhan provides superior user experience and advanced tools for premium pricing

Both are reliable, SEBI-registered brokers with strong track records. Your decision should align with your trading style, volume, and feature requirements.

My Recommendation: Start with Shoonya if you’re primarily focused on execution and cost efficiency. Upgrade to Dhan if you need advanced features and don’t mind the ₹20 per trade cost.

Frequently Asked Questions

Is Shoonya really free? Are there hidden charges?

Yes, Shoonya’s zero brokerage model is genuine. You only pay statutory charges (STT, stamp duty, GST) that apply to all brokers. No hidden platform or software fees.

Can I use TradingView with Shoonya?

Shoonya doesn’t have direct TradingView integration like Dhan. You’d need to use TradingView separately for analysis and place orders manually on Shoonya’s platform.

Which platform is better for beginners?

For beginners focused on delivery trading, both are equal (₹0 charges). Dhan offers better educational content and user guidance, while Shoonya is more straightforward but requires self-learning.

How do API costs compare between both brokers?

Both offer free API access. Dhan provides more advanced webhook capabilities and TradingView integration, while Shoonya offers basic but functional API access.

What about customer service quality?

Dhan generally provides more detailed support with extensive documentation. Shoonya offers efficient problem resolution but with less hand-holding. Both are adequate for experienced traders.

Can I transfer my holdings between these brokers?

Yes, you can transfer holdings through the standard demat transfer process. This typically takes 3-7 working days and may involve nominal charges from the transferring broker.

Which broker is safer for long-term investments?

Both are equally safe as they’re SEBI-registered and use CDSL as depository participant. Your securities are held in your name with the depository, not with the broker.

Post Disclaimer

For informational purposes only:

The information presented on this website is for informational purposes only and should not be construed as financial, legal, or professional advice. While we strive to provide accurate and up-to-date information, we cannot guarantee its completeness or accuracy. Any opinions expressed herein are solely those of the author or individual contributor and do not necessarily reflect the views of any company, organization, or other entity.

Do your own research:

Readers are encouraged to conduct their due diligence and consult with a qualified professional before making any decisions based on the information presented on this website. Trading, investing, and other financial activities involve inherent risks, and you could lose all or a portion of your capital. Past performance is not indicative of future results.

| Product Name |

Dhan app review & chargesShoonya Finvasia Brokerage charges Review |

| Product Image |

|

| Price | |

| Our Rating | |

| Brand | Dhan Shoonya |

| Category | Stock brokers Stock brokers |

Company Overview

| |

| Company name | Dhan Shoonya by Finvasia |

| Headquarters | Mumbai Mumbai |

| Founder | Mr Pravin Jadhav Sarvjeet Singh Virk and Tajinder Singh Virk |

| Establishment Year | 2021 2009 |

Account opening & AMC

| |

| Account Opening Fee The account opening fee, also known as account setup charges, refers to the one-time charge levied by a brokerage firm when you open a new Demat and trading account to invest in securities like stocks, bonds, or ETFs. These fees can vary depending on the type of account, the brokerage firm, and any current promotions or offers. | ₹0 ₹0 |

| Annual Maintenance Charges (AMC) This is a yearly fee levied by the depository participant (DP) to maintain your Demat account, where your shares are held electronically. | ₹0 ₹0 |

Pledge Charges

| |

| Pledge Creation Charges | ₹ 12.5 / transaction / ISIN + GST ₹20 |

| Pledge Invocation Charges | ₹ 12.5 / transaction / ISIN + GST ₹20 |

| Interest on Margin Trading | 0.0438% per day on outstanding MTF and non MTF debit and non maintenance of 50:50 margin Does not provide |

| Margin Re-Pledge | ₹ 12.5 / transaction / ISIN + GST ₹20 |

Brokerage charges & Fees

| |

| Brokerage Plan | Standard Standard account |

| Equity Delivery Charges | ₹0 ₹0 |

| Equity Intraday Charges | ₹20 or 0.03% per executed order whichever is lower ₹0 |

| Equity Futures charges | ₹20 or 0.03% per executed order whichever is lower ₹0 |

| Equity Options charges | ₹20 per executed order ₹0 |

| Currency Futures charges | ₹20 or 0.03% per executed order whichever is lower ₹0 |

| Currency Options charges | ₹20 per executed order ₹0 |

| Commodity Futures charges | ₹20 or 0.03% per executed order whichever is lower ₹0 |

| Commodity Options charges | ₹20 per executed order ₹0 |

Customer services offered

| |

| Demat Services | ✅Yes ✅Yes |

| Trading Services | ✅Yes ✅Yes |

| Intraday Services | ✅Yes ✅Yes |

| F&O Services | ✅Yes ✅Yes |

| IPO Services | ✅Yes ✅Yes |

| Share Pledging | ✅Yes ✅Yes |

| NRI Services | ✅Yes ⛔No |

| Referral Program | ✅Yes ✅Yes |

Customer Support

| |

| Call Support | +91 9987761000 (9:00 am to 6:00 pm on Market Trading days) +91 1726 750 000, +91 9779 097 777 |

| Email Support | help@dhan.co (24x7) clientsupport@shoonya.com |

| Whatsapp Support | ⛔No ⛔ No |

| Website Support | ✅Yes, 8 AM to 12 AM (Monday to Friday), 8 AM to 10 PM (Saturday & Sunday) ✅Yes, Chat support |

Leverage (Margin) Offered

| |

| Equity Delivery Margin Leverage | Upto 1.39x depending on the stock (lower leverage for volatile stocks) No leverage available; you need the full purchase value in your account. |

| Equity Intraday Margin Leverage | Upto 4x depending on the stock (lower leverage for volatile stocks) Upto 5x depending on the stock (lower leverage for volatile stocks) |

| Equity F&O Intraday Margin Leverage | No leverage available; requires full margin upfront No leverage available; you need the full purchase value in your account. |

| Equity F&O Carry Forward Margin Leverage | No leverage available; requires full margin upfront No leverage available; you need the full purchase value in your account. |

| Currency F&O Margin Leverage | No leverage available; requires full margin upfront No leverage available; you need the full purchase value in your account. |

| Commodity F&O Intraday Margin Leverage | No leverage available; requires full margin upfront No leverage available; you need the full purchase value in your account. |

| Commodity F&O Carry Forward Margin Leverage | No leverage available; requires full margin upfront No leverage available; you need the full purchase value in your account. |

Unique Offerings

| |

| Free Account Opening | ✅Yes ✅Yes |

| Free Brokerage | ✅Yes, On Equity Delivery, ETFs, IPO & Mutual Funds only ✅Yes |

| Free AMC | ✅Yes ✅Yes |

| Free Equity Delivery | ✅Yes ✅Yes |

| Free F&O Trading | ⛔No ✅Yes |

| Free Intraday Trading | ⛔No ✅Yes |

| Free Trading calls | ⛔No ⛔No |

| Happy Trading Hours | ⛔No ⛔No |

| Flexible Brokerage Plans | ✅Yes ✅Yes |

| Referral Offers | ✅Yes ✅Yes |

| Margin Funding (MTF)/ Pledging | ✅Yes ⛔No |

| Brokerage Cashback | ⛔No ⛔No |

| Zero Brokerage for Loss Making Trades | ⛔No ⛔No |

| Relationship Manager | ⛔No ⛔No |

Services Provided

| |

| Equity Delivery | ✅Yes ✅Yes |

| Equity Intraday | ✅Yes ✅Yes |

| Equity Futures | ✅Yes ✅Yes |

| Equity Options | ✅Yes ✅Yes |

| Currency Futures | ✅Yes ✅Yes |

| Currency Options | ✅Yes ✅Yes |

| Commodity Futures | ✅Yes ✅Yes |

| Commodity Options | ✅Yes ✅Yes |

| Foreign Stocks | ⛔No ⛔No |

| Mutual Funds | ✅Yes ✅Yes |

| Banking | ⛔No ⛔No |

| Insurance | ⛔No ⛔No |

| Corporate Bonds | ⛔No ⛔No |

| Govt. Bonds | ⛔No ⛔No |

| Digital Gold | ⛔No ⛔No |

Order Types

| |

| Market Order | ✅Yes ✅Yes |

| Limit Order | ✅Yes ✅Yes |

| Bracket Order | ✅Yes ✅Yes |

| Cover Order | ✅Yes ✅Yes |

| After Market Order (AMO) | ✅Yes ✅Yes |

| Good Till Cancelled (GTC) | ✅Yes ✅Yes |

| Buy Today Sell Tomorrow (BTST) | ✅Yes ⛔No |

| Sell Today Buy Tomorrow (STBT) | ⛔No ⛔No |

Research & Reports

| |

| Annual Reports | ✅Yes ⛔No |

| Company Reports | ✅Yes ⛔No |

| Research Reports | ⛔No ⛔No |

| Fundamental Reports | ⛔No ⛔No |

| IPO Reports | ✅Yes ✅Yes |

| Technical Reports | ✅Yes ⛔No |

| Stock tips | ⛔No ⛔No |

| Daily Market Review | ⛔No ✅Yes |

| Monthly Review | ✅Yes ⛔No |

| Weekly Review | ⛔No ⛔No |

| Robo Advisory | ⛔No ⛔No |

STT & CTT Charges

| |

| Equity Delivery STT & CTT | 0.1% on buy & sell 0.1% on buy & sell |

| Equity Intraday STT & CTT | 0.025% on sell transactions 0.025% on the sell side |

| Equity Futures STT & CTT | 0.0125% on sell side 0.0125% on sell side |

| Equity Options STT & CTT | 0.0625% on sell side (on premium), 0.125% on exercised options (on intrinsic value) 0.0625% on sell side (on premium) |

| Currency Futures STT & CTT | No STT No STT |

| Currency Options STT & CTT | No STT No STT |

| Commodity Futures STT & CTT | 0.01% on sell side 0.01% (of Selling Value) |

| Commodity Options STT & CTT | 0.05% on sell side 0.05% (of Selling Value) |

Trading Features

| |

| Watchlist | ✅Yes ✅Yes |

| Real Time Updates | ✅Yes ✅Yes |

| Portfolio Details | ✅Yes ✅Yes |

| Price Alert | ✅Yes ✅Yes |

| Online Mutual Fund Buy | ✅Yes ✅Yes |

| Global indices | ⛔No ⛔No |

| Customized Recommendations | ⛔No ⛔No |

| Advanced charting | ✅Yes ✅Yes |

| Live market | ✅Yes ✅Yes |

| Multiple Profile Management | ⛔No ⛔No |

| Secure Platform | ✅Yes ✅Yes |

Trading Platforms

| |

| Android App | ✅Yes ✅Yes |

| iOS App | ✅Yes ✅Yes |

| Web Trading Platform | ✅Yes ✅Yes |

| Trading Terminal | ✅Yes ✅Yes |

| Algo Trading Platform | ✅Yes ✅Yes |

| Foreign Stocks Trading Platform | ⛔No ⛔No |

| Basket Trading Platform | ✅Yes ✅Yes |

| Mutual Fund Investment Platform | ✅Yes ✅Yes |

| Digital Gold Investment Platform | ⛔No ⛔No |

| Bonds Investment Platform | ⛔No ⛔No |

Transaction Charges

| |

| Equity Delivery Transaction Charges | BSE: 0.00375%, NSE: 0.00325% 0.00325% |

| Equity Intraday Transaction Charges | BSE: 0.00375%, NSE: 0.00325% 0.00325% |

| Equity Futures Transaction Charges | NSE: 0.0019%, BSE: 0 (Zero) Exchange txn charge: 0.0019% |

| Equity Options Transaction Charges | NSE: 0.05% (on premium), BSE: 0.005% (on premium) Exchange txn charge: 0.05% (on premium) |

| Currency Futures Transaction Charges | NSE: 0.0009%, BSE: 0.0009%, Interest Rate Derivatives: 0.00015% Exchange txn charge: 0.0009% |

| Currency Options Transaction Charges | NSE: 0.035%, BSE: 0.001% Exchange txn charge: 0.035% |

| Commodity Futures Transaction Charges | Group A, B : 0.0026% 260/ crore |

| Commodity Options Transaction Charges | 0.05% 5000/ crore |

Stamp Duty charges

| |

| Equity Delivery Stamp Duty | 0.015% on turnover of buy orders 0.015% |

| Equity Intraday Stamp Duty | 0.003% on turnover of buy orders 0.003% |

| Equity Futures Stamp Duty | 0.0125% on sell side 0.002% |

| Equity Options Stamp Duty | 0.0625% on sell side (on premium), 0.125% on exercised options (on intrinsic value) 0.003% |

| Currency Futures Stamp Duty | 0.0001% on turnover of buy orders 0.0001% on Buy Side |

| Currency Options Stamp Duty | 0.0001% on turnover of buy orders 0.0001% on Buy Side |

| Commodity Futures Stamp Duty | 0.002% on turnover of buy orders 0.002% |

| Commodity Options Stamp Duty | 0.003% on turnover of buy orders 0.003% |

Other Charges

| |

| SEBI Turnover Charges | ₹10/Crore (For all segments) ₹10/Crore (For all segments) |

| DP Charges | ₹ 12.50 / instruction / ISIN + GST. ₹9 + GST/scrip |

| GST charges | 18% of (brokerage + transaction charges + Demat) 18% of (brokerage + transaction charges + Demat) |

| Account Closure Charges | Free Free |

| Reactivation Charges | Free Free |

| Dematerialization Charges | ₹150 per certificate + ₹100 courier charges ₹150 per certificate + ₹100 courier charges |

| Call and Trade charges | ₹ 50 / order + GST ₹0 |