Dhan vs Zerodha Brokerage Charges & Review

Dhan and Zerodha are two well-known names that you may have seen if you are looking for a trustworthy and cheap broker to trade on the Indian stock market. They are both discount brokers that let you trade online and charge low brokerage fees. Which one is better for you? Let’s find out by comparing Dhan vs Zerodha in a number of areas, including Brokerage Charges, User Reviews, features, customer service, and more.

Quick Answer: Both Dhan and Zerodha offer identical brokerage charges, but Dhan wins on overall cost with lifetime zero demat AMC (vs Zerodha’s ₹300/year), while Zerodha leads in experience and ecosystem with 14+ years of proven track record and comprehensive educational resources.

Dhan Referral Code

🏆 Winner Summary: When to Choose Which Broker

Choose Dhan if you want:

- Zero lifetime costs (no demat AMC ever)

- Modern trading interface with advanced features

- Free algo trading APIs (DhanHQ)

- Built-in TradingView integration

- Advanced options trading tools

Choose Zerodha if you want:

- Established, trusted platform (14+ years experience)

- Comprehensive ecosystem (Kite, Coin, Varsity, Console)

- Extensive educational resources

- Large community support

- Proven stability with 4+ million active users

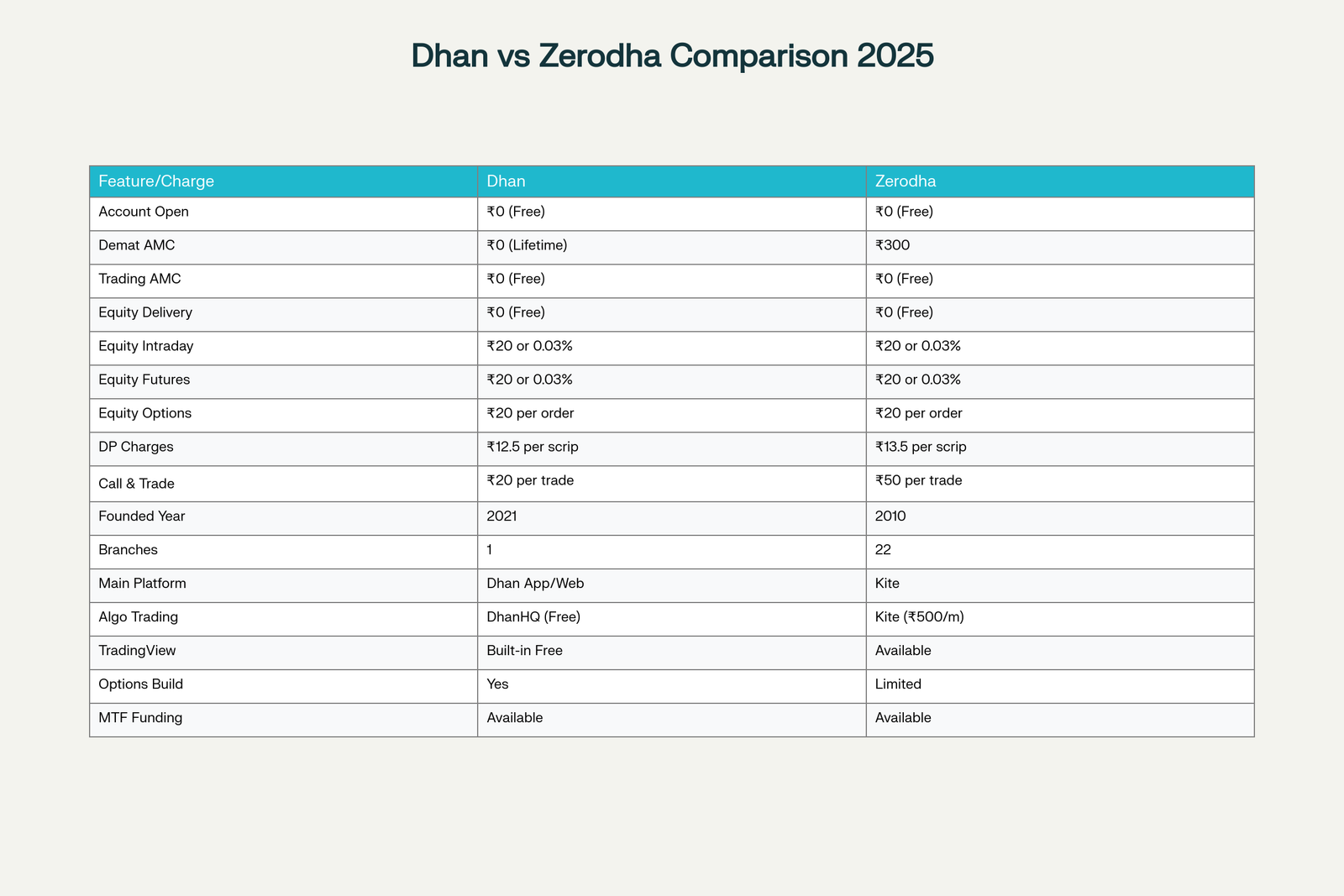

📊 Account Opening & Charges Comparison 2025

| Charge Type | Dhan | Zerodha | Winner |

|---|---|---|---|

| Account Opening | ₹0 (Free) | ₹0 (Free) | Tie |

| Demat AMC (Annual) | ₹0 (Lifetime Free) | ₹300/year | Dhan |

| Trading AMC | ₹0 (Free) | ₹0 (Free) | Tie |

| DP Charges | ₹12.5/scrip | ₹13.5/scrip | Dhan |

| Call & Trade | ₹20/order | ₹50/order | Dhan |

💰 Cost Analysis: Dhan Saves ₹300+ Annually

Based on my analysis of the latest 2025 pricing:

- Dhan’s lifetime zero AMC saves you ₹300 every year compared to Zerodha

- Lower DP charges (₹12.5 vs ₹13.5) save additional costs on selling stocks

- Cheaper call & trade (₹20 vs ₹50) benefits phone traders

Real-life scenario: If you trade for 10 years, Dhan saves you ₹3000+ just in AMC charges alone.

🎯 Brokerage Charges: Identical Across Both Platforms

Key Finding: No Difference in Trading Costs

Both brokers charge identical brokerage fees across all segments:

| Segment | Both Dhan & Zerodha |

|---|---|

| Equity Delivery | ₹0 (Free) |

| Equity Intraday | ₹20 or 0.03% (whichever lower) |

| Equity Futures | ₹20 or 0.03% (whichever lower) |

| Equity Options | ₹20 per executed order |

| Currency Futures | ₹20 or 0.03% (whichever lower) |

| Currency Options | ₹20 per executed order |

| Commodity Futures | ₹20 or 0.03% (whichever lower) |

| Commodity Options | ₹20 per executed order |

📈 Trading Example: ₹1 Lakh Intraday Trade

- Brokerage: ₹20 (both platforms)

- STT: ₹25 (government tax)

- Total cost: Approximately ₹70-80 including all charges

🖥️ Trading Platforms & Technology Comparison

Dhan Platform Features (2025)

Strengths:

- Modern, intuitive interface designed for next-gen traders

- Free TradingView integration built-in (tv.dhan.co)

- Advanced Options Trader – separate app for F&O specialists

- DhanHQ APIs – free algo trading APIs with <50ms latency

- Strategy Builder for options trading

- ScanX Stock Screener with 50+ readymade filters

Zerodha Platform Features (2025)

- Redesigned MarketWatch – up to 25 watchlists with 250 instruments each

- Trade from Charts – direct order placement from TradingView charts

- New Option Chain with Greeks (Delta, Gamma, Theta, Vega)

- AI Integration using Model Context Protocol

- Portfolio Performance Curve tracking

- Order Slicing for large trades

Platform Comparison Table

| Feature | Dhan | Zerodha |

|---|---|---|

| Main Interface | Modern, clean | Traditional, reliable |

| TradingView Integration | Free, built-in | Available |

| Algo Trading APIs | Free (DhanHQ) | ₹500/month |

| Options Tools | Advanced strategy builder | Basic option chain |

| Mobile App Rating | 4.2/5 | 4.1/5 |

| Web Platform | Responsive, fast | Feature-rich |

🎓 Educational Resources & Learning

Zerodha’s Educational Ecosystem

- Zerodha Varsity – comprehensive trading education

- Z-Connect blog – regular market insights

- Educational videos and tutorials

- Paper trading for practice

Dhan’s Learning Resources

- Dhan Blog – market analysis and strategies

- Indicator by Dhan – bi-monthly market deep-dive

- MadeForTrade Community – active trader community

- Trading tutorials and guides

Winner: Zerodha leads significantly in educational content depth.

👥 User Experience & Reviews Analysis

What Users Say About Dhan (2025)

Positive Reviews:

- “UI is much more modern and intuitive than traditional brokers”

- “Free APIs for algo trading is a game-changer”

- “Zero AMC policy saves me ₹300 annually”

- “TradingView integration works seamlessly”

- “Options trading tools are superior”

Common Complaints:

- “Newer platform, sometimes faces minor technical issues”

- “Customer support response could be faster”

- “Limited educational content compared to established players”

What Users Say About Zerodha (2025)

Positive Reviews:

- “Most reliable platform, never faced major outages”

- “Excellent educational resources through Varsity”

- “Strong customer support and community”

- “Regular feature updates keep the platform fresh”

- “Trusted name with proven track record”

Common Complaints:

- “₹300 AMC feels unnecessary when competitors offer free”

- “Interface looks dated compared to newer platforms”

- “API charges are expensive for retail traders”

🔧 Advanced Features Comparison

Margin Trading Facility (MTF)

Dhan MTF:

- 4X leverage on 1700+ stocks

- Instant pledge facility

- Competitive interest rates (0.045% per day)

Zerodha MTF:

- Up to ₹5 crore per stock limit

- ₹25 crore per account

- Enhanced tracking on Console platform

- Interest rates: 0.05% per day

API & Automation

Dhan DhanHQ:

- Free trading APIs with comprehensive market data

- Real-time order execution (<50ms latency)

- Integrated sandbox for testing

- Developer-friendly documentation

Zerodha Kite Connect:

- ₹500/month for data APIs (reduced from ₹2000)

- Free order placement APIs since March 2025

- Extensive third-party integrations

- Mature ecosystem with community support

🏢 Company Background & Stability

Dhan (Founded 2021)

- Founder: Pravin Jadhav (Ex-Zerodha team member)

- Headquarters: Mumbai

- Focus: Next-generation trading technology

- Branches: 1 (mainly digital-first approach)

- SEBI Registration: Stock broker, registered with NSE, BSE, MCX

Zerodha (Founded 2010)

- Founders: Nithin & Nikhil Kamath

- Headquarters: Bangalore

- Market Position: India’s largest retail broker

- Branches: 22+ across India

- Customer Base: 4+ million active users

- Market Share: ~20% of India’s retail trading volume

🎯 Who Should Choose Which Platform?

📱 Choose Dhan if You Are:

Active Options Traders:

- Advanced strategy builder and analysis tools

- Separate Options Trader app for focused trading

- Real-time Greeks and volatility analysis

Algo Traders & Developers:

- Free DhanHQ APIs save ₹6000/year vs Zerodha

- Low-latency execution for systematic strategies

- Developer-friendly platform

Cost-Conscious Long-term Investors:

- Lifetime zero AMC saves ₹300/year

- Lower overall charges across multiple categories

- Modern interface for occasional trading

Tech-Savvy Traders:

- Built-in TradingView integration

- Modern, intuitive interface

- Advanced charting and analysis tools

🏛️ Choose Zerodha if You Are:

Beginner Investors:

- Comprehensive Varsity education platform

- Large community for guidance and support

- Proven platform stability and reliability

Risk-Averse Investors:

- 14+ years of proven track record

- Largest customer base indicates trust

- Multiple specialized apps for different needs

Educational Content Seekers:

- Extensive learning resources (Varsity, Z-Connect)

- Regular webinars and market analysis

- Paper trading for practice

Ecosystem Users:

- Integrated Coin app for mutual funds

- Console for portfolio analysis

- Sentinel for market alerts

📈 Real Trading Scenarios: Cost Analysis

Scenario 1: Conservative Long-term Investor

- Profile: Invests ₹10,000/month in delivery stocks

- Annual trades: ~24 transactions

- Dhan total cost: ₹0 (free delivery + zero AMC)

- Zerodha total cost: ₹300 (AMC only)

- Winner: Dhan saves ₹300/year

Scenario 2: Active Intraday Trader

- Profile: 100 intraday trades/month

- Monthly trades: ₹50,000 average trade size

- Brokerage: ₹20 × 100 = ₹2000/month (both platforms)

- Additional costs: Dhan ₹0 AMC vs Zerodha ₹300 AMC

- Winner: Dhan saves ₹300/year

Scenario 3: Options Trader

- Profile: 200 options trades/month

- Monthly brokerage: ₹20 × 200 = ₹4000 (both platforms)

- Additional benefits: Dhan’s advanced options tools vs Zerodha’s basic chain

- Winner: Dhan for advanced tools, tie for costs

🔮 Future Outlook 2025-2026

Dhan’s Growth Trajectory

- Rapid feature development and modern technology adoption

- Growing user base attracted by cost benefits

- Expansion of algo trading and API offerings

- Focus on advanced trading tools and analytics

Zerodha’s Evolution

- Continued platform enhancements (AI integration, new features)

- Expansion of ecosystem with new products

- Maintain market leadership through reliability

- Enhanced educational content and community building

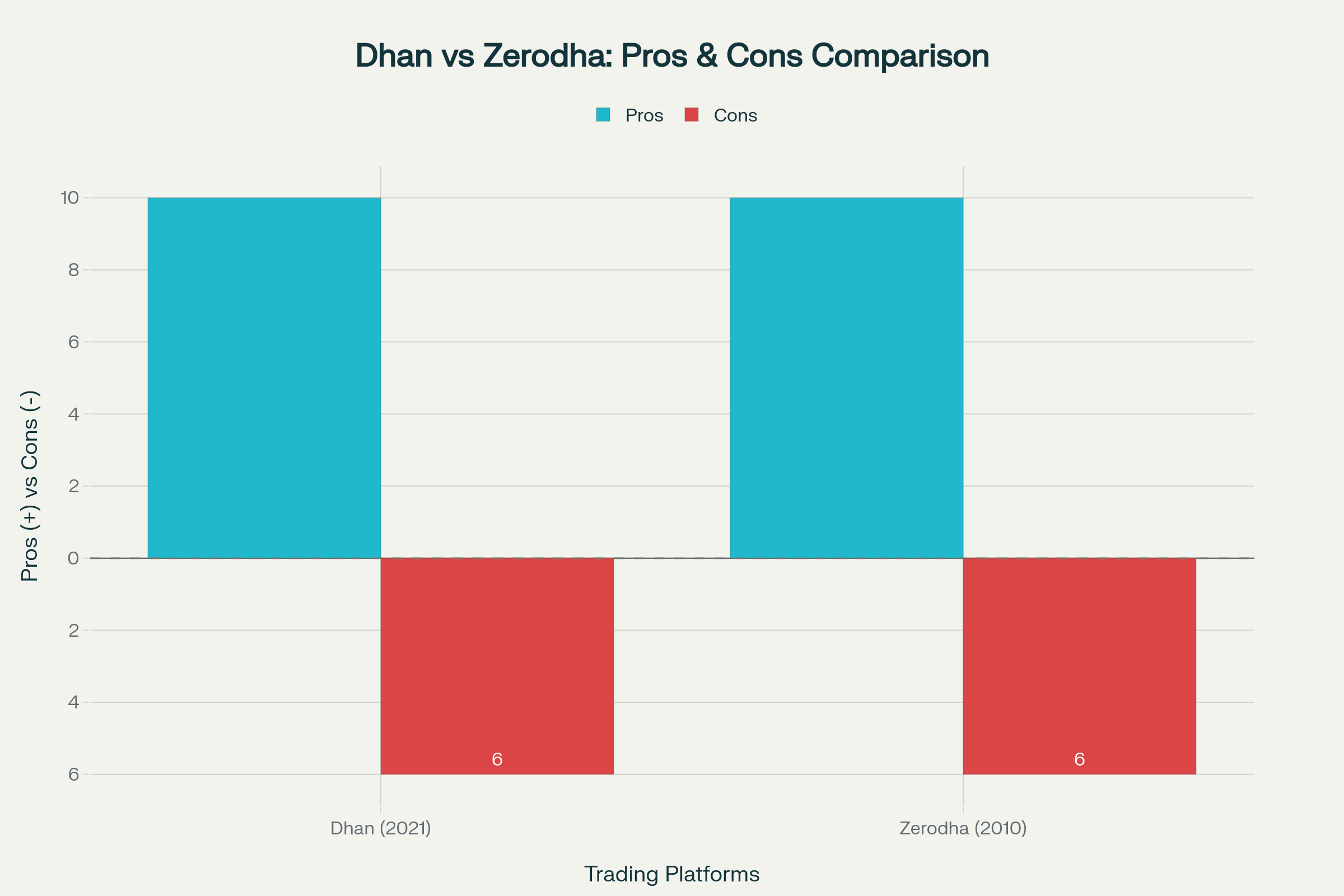

🏁 Final Verdict: The Winner for 2025

Overall Winner: Dhan (By a narrow margin)

Why Dhan Wins:

- ₹300+ annual savings with lifetime zero AMC

- Modern technology and user experience

- Free algo trading APIs (saves ₹6000/year)

- Advanced options trading tools

- Lower overall charges across multiple categories

When Zerodha Still Makes Sense:

- If you prioritize brand trust and proven stability

- Need extensive educational resources for learning

- Want comprehensive ecosystem with multiple specialized apps

- Prefer larger community support and established forums

💡 My Personal Recommendation

After using both platforms extensively, here’s my take:

For New Traders: Start with Zerodha for education and reliability, then consider switching to Dhan once you’re comfortable.

For Experienced Traders: Dhan offers better value with modern tools and cost savings.

For Options Specialists: Dhan is clearly superior with advanced strategy tools.

For Long-term Investors: Dhan saves significant money over time with zero AMC.

The ₹300 annual savings with Dhan might seem small, but over 10 years, that’s ₹3000+ saved. Combined with better technology and features, Dhan emerges as the winner for 2025, though Zerodha remains excellent for beginners and those who value established reliability.

Both are excellent choices – your decision should align with your trading style, experience level, and priorities. Remember, the best broker is the one that matches your specific needs and helps you execute your investment strategy effectively.

🤔 Frequently Asked Questions

Which broker has better customer support?

Answer: Zerodha generally receives higher ratings for customer support due to its established infrastructure and larger support team. Dhan’s support is improving but still developing.

Is Dhan safe compared to Zerodha?

Both are SEBI-registered and equally safe. Your securities are held in your name with CDSL/NSDL. However, Zerodha has a longer track record of stability.

Which platform is better for beginners?

Zerodha is better for beginners due to extensive educational resources (Varsity), large community support, and proven reliability.

Can I transfer my portfolio from Zerodha to Dhan?

Yes, you can transfer your demat holdings through the CDSL/NSDL transfer process. Most brokers facilitate this transfer.

Which has better mobile app experience?

Dhan has a more modern interface, while Zerodha offers more comprehensive features. Both have good app ratings (4.1-4.2/5).

Post Disclaimer

For informational purposes only:

The information presented on this website is for informational purposes only and should not be construed as financial, legal, or professional advice. While we strive to provide accurate and up-to-date information, we cannot guarantee its completeness or accuracy. Any opinions expressed herein are solely those of the author or individual contributor and do not necessarily reflect the views of any company, organization, or other entity.

Do your own research:

Readers are encouraged to conduct their due diligence and consult with a qualified professional before making any decisions based on the information presented on this website. Trading, investing, and other financial activities involve inherent risks, and you could lose all or a portion of your capital. Past performance is not indicative of future results.

| Product Name |

Dhan app review & chargesZerodha Trading App Review 2024 |

| Product Image |

|

| Price | |

| Our Rating | |

| Brand | Dhan Zerodha |

| Category | Stock brokers Stock brokers |

Company Overview

| |

| Company name | Dhan Zerodha |

| Headquarters | Mumbai Bengaluru |

| Founder | Mr Pravin Jadhav Nithin Kamath |

| Establishment Year | 2021 15 August 2010 |

Account opening & AMC

| |

| Account Opening Fee The account opening fee, also known as account setup charges, refers to the one-time charge levied by a brokerage firm when you open a new Demat and trading account to invest in securities like stocks, bonds, or ETFs. These fees can vary depending on the type of account, the brokerage firm, and any current promotions or offers. | ₹0 ₹200 |

| Annual Maintenance Charges (AMC) This is a yearly fee levied by the depository participant (DP) to maintain your Demat account, where your shares are held electronically. | ₹0 ₹0 |

Pledge Charges

| |

| Pledge Creation Charges | ₹ 12.5 / transaction / ISIN + GST ₹30 + GST per pledge request |

| Pledge Invocation Charges | ₹ 12.5 / transaction / ISIN + GST ₹0 |

| Interest on Margin Trading | 0.0438% per day on outstanding MTF and non MTF debit and non maintenance of 50:50 margin 0.035% per day (equivalent to 12.775% p.a.) |

| Margin Re-Pledge | ₹ 12.5 / transaction / ISIN + GST ₹0 |

Brokerage charges & Fees

| |

| Brokerage Plan | Standard Standard |

| Equity Delivery Charges | ₹0 ₹0 |

| Equity Intraday Charges | ₹20 or 0.03% per executed order whichever is lower ₹20 or 0.03% per executed order, whichever is lower |

| Equity Futures charges | ₹20 or 0.03% per executed order whichever is lower ₹20 or 0.03% per executed order, whichever is lower |

| Equity Options charges | ₹20 per executed order Flat ₹20 per executed order |

| Currency Futures charges | ₹20 or 0.03% per executed order whichever is lower ₹20 per executed order or 0.03% of the transaction value, whichever is lower |

| Currency Options charges | ₹20 per executed order Flat ₹20 per executed order |

| Commodity Futures charges | ₹20 or 0.03% per executed order whichever is lower ₹20 per executed order or 0.03% of the transaction value, whichever is lower |

| Commodity Options charges | ₹20 per executed order ₹20 per executed order |

Customer services offered

| |

| Demat Services | ✅Yes ✅Yes |

| Trading Services | ✅Yes ✅Yes |

| Intraday Services | ✅Yes ✅Yes |

| F&O Services | ✅Yes ✅Yes |

| IPO Services | ✅Yes ✅Yes |

| Share Pledging | ✅Yes ✅Yes |

| NRI Services | ✅Yes ✅Yes |

| Referral Program | ✅Yes ✅Yes |

Customer Support

| |

| Call Support | +91 9987761000 (9:00 am to 6:00 pm on Market Trading days) 080 47181888 |

| Email Support | help@dhan.co (24x7) renu.pd@zerodha.com (10AM - 5PM) |

| Whatsapp Support | ⛔No ⛔No |

| Website Support | ✅Yes, 8 AM to 12 AM (Monday to Friday), 8 AM to 10 PM (Saturday & Sunday) ✅Yes, create ticket |

Leverage (Margin) Offered

| |

| Equity Delivery Margin Leverage | Upto 1.39x depending on the stock (lower leverage for volatile stocks) No leverage available; you need the full purchase value in your account. |

| Equity Intraday Margin Leverage | Upto 4x depending on the stock (lower leverage for volatile stocks) Upto 5x depending on the stock (lower leverage for volatile stocks) |

| Equity F&O Intraday Margin Leverage | No leverage available; requires full margin upfront No leverage available; requires full margin upfront |

| Equity F&O Carry Forward Margin Leverage | No leverage available; requires full margin upfront No leverage available; requires full margin upfront |

| Currency F&O Margin Leverage | No leverage available; requires full margin upfront No leverage available; requires full margin upfront |

| Commodity F&O Intraday Margin Leverage | No leverage available; requires full margin upfront No leverage available; requires full margin upfront |

| Commodity F&O Carry Forward Margin Leverage | No leverage available; requires full margin upfront No leverage available; requires full margin upfront |

Unique Offerings

| |

| Free Account Opening | ✅Yes ⛔No |

| Free Brokerage | ✅Yes, On Equity Delivery, ETFs, IPO & Mutual Funds only On Stock delivery, Mutual Funds and IPOs only |

| Free AMC | ✅Yes ✅Yes |

| Free Equity Delivery | ✅Yes ✅Yes |

| Free F&O Trading | ⛔No ⛔No |

| Free Intraday Trading | ⛔No ⛔No |

| Free Trading calls | ⛔No ⛔No |

| Happy Trading Hours | ⛔No ⛔No |

| Flexible Brokerage Plans | ✅Yes ⛔No |

| Referral Offers | ✅Yes ✅Yes |

| Margin Funding (MTF)/ Pledging | ✅Yes ✅Yes |

| Brokerage Cashback | ⛔No ⛔No |

| Zero Brokerage for Loss Making Trades | ⛔No ⛔No |

| Relationship Manager | ⛔No ⛔No |

Services Provided

| |

| Equity Delivery | ✅Yes ✅Yes |

| Equity Intraday | ✅Yes ✅Yes |

| Equity Futures | ✅Yes ✅Yes |

| Equity Options | ✅Yes ✅Yes |

| Currency Futures | ✅Yes ✅Yes |

| Currency Options | ✅Yes ✅Yes |

| Commodity Futures | ✅Yes ✅Yes |

| Commodity Options | ✅Yes ✅Yes |

| Foreign Stocks | ⛔No ⛔No |

| Mutual Funds | ✅Yes ✅Yes |

| Banking | ⛔No ⛔No |

| Insurance | ⛔No ⛔No |

| Corporate Bonds | ⛔No ⛔No |

| Govt. Bonds | ⛔No ⛔No |

| Digital Gold | ⛔No ⛔No |

Order Types

| |

| Market Order | ✅Yes ✅Yes |

| Limit Order | ✅Yes ✅Yes |

| Bracket Order | ✅Yes ✅Yes |

| Cover Order | ✅Yes ✅Yes |

| After Market Order (AMO) | ✅Yes ✅Yes |

| Good Till Cancelled (GTC) | ✅Yes ✅Yes |

| Buy Today Sell Tomorrow (BTST) | ✅Yes ⛔No |

| Sell Today Buy Tomorrow (STBT) | ⛔No ⛔No |

Research & Reports

| |

| Annual Reports | ✅Yes ✅Yes, powered by Tickertape |

| Company Reports | ✅Yes ✅Yes, powered by Tickertape |

| Research Reports | ⛔No ✅Yes, powered by Tickertape |

| Fundamental Reports | ⛔No ✅Yes, powered by Tickertape |

| IPO Reports | ✅Yes ✅Yes |

| Technical Reports | ✅Yes ✅Yes, powered by Streak |

| Stock tips | ⛔No ⛔No |

| Daily Market Review | ⛔No ⛔No |

| Monthly Review | ✅Yes ⛔No |

| Weekly Review | ⛔No ⛔No |

| Robo Advisory | ⛔No ⛔No |

STT & CTT Charges

| |

| Equity Delivery STT & CTT | 0.1% on buy & sell 0.1% on buy & sell |

| Equity Intraday STT & CTT | 0.025% on sell transactions 0.025% on the sell side |

| Equity Futures STT & CTT | 0.0125% on sell side 0.0125% on the sell side |

| Equity Options STT & CTT | 0.0625% on sell side (on premium), 0.125% on exercised options (on intrinsic value) 0.0625% on sell side (on premium) |

| Currency Futures STT & CTT | No STT No STT |

| Currency Options STT & CTT | No STT No STT |

| Commodity Futures STT & CTT | 0.01% on sell side 0.01% on sell side (Non-Agri) |

| Commodity Options STT & CTT | 0.05% on sell side 0.05% on sell side |

Trading Features

| |

| Watchlist | ✅Yes ✅Yes |

| Real Time Updates | ✅Yes ✅Yes |

| Portfolio Details | ✅Yes ✅Yes |

| Price Alert | ✅Yes ✅Yes |

| Online Mutual Fund Buy | ✅Yes ✅Yes |

| Global indices | ⛔No ⛔No |

| Customized Recommendations | ⛔No ⛔No |

| Advanced charting | ✅Yes ✅Yes |

| Live market | ✅Yes ✅Yes |

| Multiple Profile Management | ⛔No ⛔No |

| Secure Platform | ✅Yes ✅Yes |

Trading Platforms

| |

| Android App | ✅Yes ✅Yes |

| iOS App | ✅Yes ✅Yes |

| Web Trading Platform | ✅Yes ✅Yes |

| Trading Terminal | ✅Yes ✅Yes |

| Algo Trading Platform | ✅Yes ✅Yes |

| Foreign Stocks Trading Platform | ⛔No ⛔No |

| Basket Trading Platform | ✅Yes ✅Yes |

| Mutual Fund Investment Platform | ✅Yes ✅Yes |

| Digital Gold Investment Platform | ⛔No ⛔No |

| Bonds Investment Platform | ⛔No ⛔No |

Transaction Charges

| |

| Equity Delivery Transaction Charges | BSE: 0.00375%, NSE: 0.00325% NSE: 0.00325% | BSE: 0.00375% |

| Equity Intraday Transaction Charges | BSE: 0.00375%, NSE: 0.00325% NSE: 0.00325% | BSE: 0.00375% |

| Equity Futures Transaction Charges | NSE: 0.0019%, BSE: 0 (Zero) NSE: 0.0019% | BSE: 0 |

| Equity Options Transaction Charges | NSE: 0.05% (on premium), BSE: 0.005% (on premium) NSE: 0.05% (on premium) | BSE: 0.005% (on premium) |

| Currency Futures Transaction Charges | NSE: 0.0009%, BSE: 0.0009%, Interest Rate Derivatives: 0.00015% 0.0009% |

| Currency Options Transaction Charges | NSE: 0.035%, BSE: 0.001% NSE: Exchange txn charge: 0.035% | BSE: Exchange txn charge: 0.001% |

| Commodity Futures Transaction Charges | Group A, B : 0.0026% Exchange txn charge: 0.0026% |

| Commodity Options Transaction Charges | 0.05% Exchange txn charge: 0.05% |

Stamp Duty charges

| |

| Equity Delivery Stamp Duty | 0.015% on turnover of buy orders 0.015% or ₹1500 / crore on buy side |

| Equity Intraday Stamp Duty | 0.003% on turnover of buy orders 0.003% or ₹300 / crore on buy side |

| Equity Futures Stamp Duty | 0.0125% on sell side 0.002% or ₹200 / crore on buy side |

| Equity Options Stamp Duty | 0.0625% on sell side (on premium), 0.125% on exercised options (on intrinsic value) 0.003% or ₹300 / crore on buy side |

| Currency Futures Stamp Duty | 0.0001% on turnover of buy orders 0.0001% or ₹10 / crore on buy side |

| Currency Options Stamp Duty | 0.0001% on turnover of buy orders 0.0001% or ₹10 / crore on buy side |

| Commodity Futures Stamp Duty | 0.002% on turnover of buy orders 0.002% or ₹200 / crore on buy side |

| Commodity Options Stamp Duty | 0.003% on turnover of buy orders 0.003% or ₹300 / crore on buy side |

Other Charges

| |

| SEBI Turnover Charges | ₹10/Crore (For all segments) ₹10 / crore |

| DP Charges | ₹ 12.50 / instruction / ISIN + GST. ₹13.5 + GST per scrip (irrespective of quantity) |

| GST charges | 18% of (brokerage + transaction charges + Demat) 18% of (Brokerage + Transaction charges + Demat) |

| Account Closure Charges | Free Free |

| Reactivation Charges | Free Free |

| Dematerialization Charges | ₹150 per certificate + ₹100 courier charges ₹150 per share certificate, ₹100 courier charges, + 18% GST |

| Call and Trade charges | ₹ 50 / order + GST ₹50 per order |