Groww vs Zerodha charges

If you are looking for a platform to invest in mutual funds, stocks, or other securities, you might have come across Groww and Zerodha. What’s the difference between these two well-known Indian online brokers? Our goal for this blog post is to compare Groww vs Zerodha focusing on their features, fees, pros and cons, and customer reviews.

Table of Contents

Groww overview

With Groww’s simple and easy-to-use app, you can invest in mutual funds, stocks, US stocks, and initial public offerings (IPOs). Groww lets you open an account quickly with just your Aadhaar and PAN cards. You can then invest as little as ₹100 to get started. Groww also has blogs, videos, podcasts, and other educational content that can help you learn how to invest. There is Groww support to support you with any queries.

Zerodha overview

Many people in India use Zerodha to buy and sell stocks. It has more than 5 million clients. Zerodha has many different kinds of goods and services, plus Kite (a trading platform for the web and mobile devices), Coin (a platform for investing in direct mutual funds), Varsity (an online learning portal), and more. Zerodha also has partner offices and branches all over India where you can get help and support.

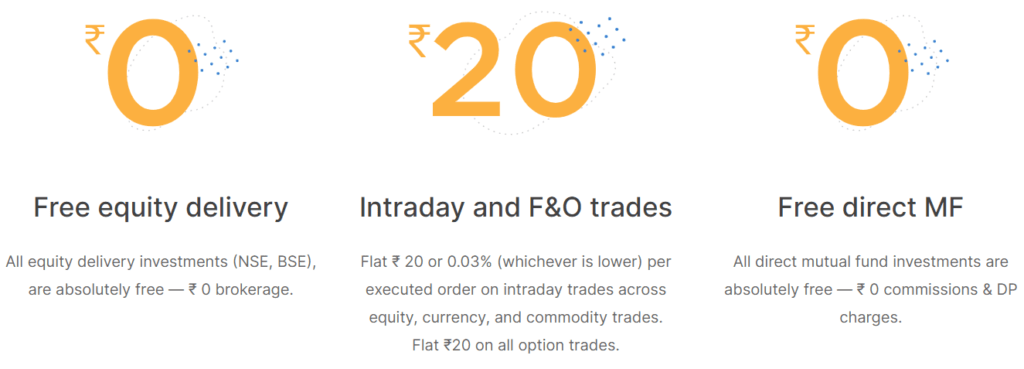

Groww vs Zerodha Charges

The charges a broker charges are one of the most important things to think about when picking one. Here is a look at how much Groww and Zerodha charge:

- Brokerage: Groww doesn’t charge anything to invest in mutual funds, but it does charge Rs. 20 or 0.05% of the trade price for stocks and other securities. Zerodha also doesn’t charge anything to invest in direct mutual funds. To trade stocks and other securities, it costs Rs. 20 or 0.03% of the trade, whichever is less.

- Setting up an account: Groww doesn’t charge anything to set up a demat and trading account, but Zerodha charges ₹200.

- AMC charges: It costs ₹500 + GST as yearly account maintenance charges (AMC) charges to maintain your demat account every year with Zerodha, but it doesn’t cost anything with Groww.

- Other fees: As required by the government, both Groww and Zerodha charge GST, STT, SEBI fees, stamp duty, and transaction fees.

The pros and cons of Groww vs Zerodha

The pros and cons of both Groww and Zerodha are different. These are some of them:

Groww Pros

- There are no account opening or yearly fees

- Website and app are simple to use

- Option to invest in US stocks

- Helpful and friendly customer service

Groww Cons

- Not as many products as Zerodha

- No physical locations or branches

- There are no advanced trading tools or features

Zerodha pros

- A lot of services and goods to choose from

- Low fees for brokers

- A strong trading platform with lots of extras

- Branch locations and offline presence

Zerodha cons

- Fees to open an account and keep it open every year

- There are bugs and problems with the platform, and customer service and support are bad.

Groww vs Zerodha: What Customers Say

One more way to contrast Groww and Zerodha is to read what real customers have said about each one. Here are some reviews from Google Play Store customers:

- Groww: “Best app for people who are just starting out and want to invest in stocks or mutual funds. Very simple to understand and use. Also, customer service is great.” a Google Play Store customer says

- “The app is good, but it needs to work faster and better.” It may take too long to load or crash at times.” another user says about groww.

- “Zerodha is the best broker in India. Their platform is quick, dependable, and easy to use. They also offer a lot of tools and resources for learning” said Zerodha.

- “Worst customer service ever. They never answer questions or deal with complaints. Also, their platform is glitchy at peak hours.” Said another user.

In conclusion

In India, both Groww and Zerodha are well-known online brokers. However, they have different fees, features, pros and cons, and customer reviews. You can pick the one that works best for you based on your tastes, goals, budget, and level of experience. You can also try them both for free and pick the one you like best.

Post Disclaimer

For informational purposes only:

The information presented on this website is for informational purposes only and should not be construed as financial, legal, or professional advice. While we strive to provide accurate and up-to-date information, we cannot guarantee its completeness or accuracy. Any opinions expressed herein are solely those of the author or individual contributor and do not necessarily reflect the views of any company, organization, or other entity.

Do your own research:

Readers are encouraged to conduct their due diligence and consult with a qualified professional before making any decisions based on the information presented on this website. Trading, investing, and other financial activities involve inherent risks, and you could lose all or a portion of your capital. Past performance is not indicative of future results.

| Product Name |

Groww app brokerage chargesZerodha Trading App Review 2024 |

| Product Image |

|

| Price | |

| Our Rating | |

| Brand | Groww Zerodha |

| Category | Stock brokers Stock brokers |

Company Overview

| |

| Company name | Groww Venture Zerodha |

| Headquarters | New Delhi Bengaluru |

| Founder | Lalit Keshre Nithin Kamath |

| Establishment Year | 2017 15 August 2010 |

Account opening & AMC

| |

| Account Opening Fee The account opening fee, also known as account setup charges, refers to the one-time charge levied by a brokerage firm when you open a new Demat and trading account to invest in securities like stocks, bonds, or ETFs. These fees can vary depending on the type of account, the brokerage firm, and any current promotions or offers. | ₹0 ₹200 |

| Annual Maintenance Charges (AMC) This is a yearly fee levied by the depository participant (DP) to maintain your Demat account, where your shares are held electronically. | ₹0 ₹0 |

Pledge Charges

| |

| Pledge Creation Charges | ₹0 ₹30 + GST per pledge request |

| Pledge Invocation Charges | ₹20 ₹0 |

| Interest on Margin Trading | Does not provide 0.035% per day (equivalent to 12.775% p.a.) |

| Margin Re-Pledge | ₹5 ₹0 |

Brokerage charges & Fees

| |

| Brokerage Plan | Standard Standard |

| Equity Delivery Charges | ₹20 or 0.05% per executed order, whichever is lower ₹0 |

| Equity Intraday Charges | ₹20 or 0.05% per executed order, whichever is lower ₹20 or 0.03% per executed order, whichever is lower |

| Equity Futures charges | Flat ₹20 per executed order ₹20 or 0.03% per executed order, whichever is lower |

| Equity Options charges | Flat ₹20 per executed order Flat ₹20 per executed order |

| Currency Futures charges | Does not offer ₹20 per executed order or 0.03% of the transaction value, whichever is lower |

| Currency Options charges | Does not offer Flat ₹20 per executed order |

| Commodity Futures charges | Does not offer ₹20 per executed order or 0.03% of the transaction value, whichever is lower |

| Commodity Options charges | Does not offer ₹20 per executed order |

Customer services offered

| |

| Demat Services | ✅Yes ✅Yes |

| Trading Services | ✅Yes ✅Yes |

| Intraday Services | ✅Yes ✅Yes |

| F&O Services | ✅Yes ✅Yes |

| IPO Services | ✅Yes ✅Yes |

| Share Pledging | ✅Yes ✅Yes |

| NRI Services | ✅Yes ✅Yes |

| Referral Program | ✅Yes ✅Yes |

Customer Support

| |

| Call Support | +91 9108800604 (24x7) 080 47181888 |

| Email Support | support@groww.in renu.pd@zerodha.com (10AM - 5PM) |

| Whatsapp Support | ⛔No ⛔No |

| Website Support | ✅Yes, create ticket ✅Yes, create ticket |

Leverage (Margin) Offered

| |

| Equity Delivery Margin Leverage | No leverage available; requires full margin upfront No leverage available; you need the full purchase value in your account. |

| Equity Intraday Margin Leverage | Upto 5x depending on the stock (lower leverage for volatile stocks) Upto 5x depending on the stock (lower leverage for volatile stocks) |

| Equity F&O Intraday Margin Leverage | No leverage available; requires full margin upfront No leverage available; requires full margin upfront |

| Equity F&O Carry Forward Margin Leverage | No leverage available; requires full margin upfront No leverage available; requires full margin upfront |

| Currency F&O Margin Leverage | Does not provide Currency trading No leverage available; requires full margin upfront |

| Commodity F&O Intraday Margin Leverage | Does not provide Commodity trading No leverage available; requires full margin upfront |

| Commodity F&O Carry Forward Margin Leverage | Does not provide Commodity trading No leverage available; requires full margin upfront |

Unique Offerings

| |

| Free Account Opening | ✅Yes ⛔No |

| Free Brokerage | On Mutual Funds and IPOs only On Stock delivery, Mutual Funds and IPOs only |

| Free AMC | ✅Yes ✅Yes |

| Free Equity Delivery | ⛔No ✅Yes |

| Free F&O Trading | ⛔No ⛔No |

| Free Intraday Trading | ⛔No ⛔No |

| Free Trading calls | ⛔No ⛔No |

| Happy Trading Hours | ⛔No ⛔No |

| Flexible Brokerage Plans | ⛔No ⛔No |

| Referral Offers | ✅Yes ✅Yes |

| Margin Funding (MTF)/ Pledging | ✅Yes ✅Yes |

| Brokerage Cashback | ⛔No ⛔No |

| Zero Brokerage for Loss Making Trades | ⛔No ⛔No |

| Relationship Manager | ⛔No ⛔No |

Services Provided

| |

| Equity Delivery | ✅Yes ✅Yes |

| Equity Intraday | ✅Yes ✅Yes |

| Equity Futures | ✅Yes ✅Yes |

| Equity Options | ✅Yes ✅Yes |

| Currency Futures | ⛔No ✅Yes |

| Currency Options | ⛔No ✅Yes |

| Commodity Futures | ⛔No ✅Yes |

| Commodity Options | ⛔No ✅Yes |

| Foreign Stocks | ✅Yes, US stocks ⛔No |

| Mutual Funds | ✅Yes ✅Yes |

| Banking | ⛔No ⛔No |

| Insurance | ⛔No ⛔No |

| Corporate Bonds | ⛔No ⛔No |

| Govt. Bonds | ⛔No ⛔No |

| Digital Gold | ⛔No ⛔No |

Order Types

| |

| Market Order | ✅Yes ✅Yes |

| Limit Order | ✅Yes ✅Yes |

| Bracket Order | ⛔No ✅Yes |

| Cover Order | ⛔No ✅Yes |

| After Market Order (AMO) | ✅Yes ✅Yes |

| Good Till Cancelled (GTC) | ✅Yes ✅Yes |

| Buy Today Sell Tomorrow (BTST) | ⛔No ⛔No |

| Sell Today Buy Tomorrow (STBT) | ⛔No ⛔No |

Research & Reports

| |

| Annual Reports | ✅Yes ✅Yes, powered by Tickertape |

| Company Reports | ✅Yes ✅Yes, powered by Tickertape |

| Research Reports | ⛔No ✅Yes, powered by Tickertape |

| Fundamental Reports | ✅Yes ✅Yes, powered by Tickertape |

| IPO Reports | ✅Yes ✅Yes |

| Technical Reports | ⛔No ✅Yes, powered by Streak |

| Stock tips | ⛔No ⛔No |

| Daily Market Review | ✅Yes ⛔No |

| Monthly Review | ✅Yes ⛔No |

| Weekly Review | ✅Yes ⛔No |

| Robo Advisory | ⛔No ⛔No |

STT & CTT Charges

| |

| Equity Delivery STT & CTT | 0.1% on buy & sell 0.1% on buy & sell |

| Equity Intraday STT & CTT | 0.025% on the sell side 0.025% on the sell side |

| Equity Futures STT & CTT | 0.0125% on the sell side 0.0125% on the sell side |

| Equity Options STT & CTT | 0.0625% on sell side (on premium) 0.0625% on sell side (on premium) |

| Currency Futures STT & CTT | ⛔ Does not offer No STT |

| Currency Options STT & CTT | ⛔ Does not offer No STT |

| Commodity Futures STT & CTT | ⛔ Does not offer 0.01% on sell side (Non-Agri) |

| Commodity Options STT & CTT | ⛔ Does not offer 0.05% on sell side |

Trading Features

| |

| Watchlist | ✅Yes ✅Yes |

| Real Time Updates | ✅Yes ✅Yes |

| Portfolio Details | ✅Yes ✅Yes |

| Price Alert | ✅Yes ✅Yes |

| Online Mutual Fund Buy | ✅Yes ✅Yes |

| Global indices | ⛔No ⛔No |

| Customized Recommendations | ⛔No ⛔No |

| Advanced charting | ⛔No ✅Yes |

| Live market | ✅Yes ✅Yes |

| Multiple Profile Management | ⛔No ⛔No |

| Secure Platform | ✅Yes ✅Yes |

Trading Platforms

| |

| Android App | ✅Yes ✅Yes |

| iOS App | ✅Yes ✅Yes |

| Web Trading Platform | ✅Yes ✅Yes |

| Trading Terminal | ⛔No ✅Yes |

| Algo Trading Platform | ⛔No ✅Yes |

| Foreign Stocks Trading Platform | ✅Yes, US stocks only ⛔No |

| Basket Trading Platform | ⛔No ✅Yes |

| Mutual Fund Investment Platform | ✅Yes ✅Yes |

| Digital Gold Investment Platform | ⛔No ⛔No |

| Bonds Investment Platform | ⛔No ⛔No |

Transaction Charges

| |

| Equity Delivery Transaction Charges | NSE: 0.00325% | BSE: 0.00375% NSE: 0.00325% | BSE: 0.00375% |

| Equity Intraday Transaction Charges | NSE: 0.00325% | BSE: 0.00375% NSE: 0.00325% | BSE: 0.00375% |

| Equity Futures Transaction Charges | NSE: 0.0019% | BSE: 0 NSE: 0.0019% | BSE: 0 |

| Equity Options Transaction Charges | NSE: 0.05% (on premium) | BSE: 0.0325% (on premium) NSE: 0.05% (on premium) | BSE: 0.005% (on premium) |

| Currency Futures Transaction Charges | Does not offer 0.0009% |

| Currency Options Transaction Charges | Does not offer NSE: Exchange txn charge: 0.035% | BSE: Exchange txn charge: 0.001% |

| Commodity Futures Transaction Charges | Does not offer Exchange txn charge: 0.0026% |

| Commodity Options Transaction Charges | Does not offer Exchange txn charge: 0.05% |

Stamp Duty charges

| |

| Equity Delivery Stamp Duty | 0.015% or ₹1500 / crore on buy side 0.015% or ₹1500 / crore on buy side |

| Equity Intraday Stamp Duty | 0.003% or ₹300 / crore on buy side 0.003% or ₹300 / crore on buy side |

| Equity Futures Stamp Duty | 0.002% or ₹200 / crore on buy side 0.002% or ₹200 / crore on buy side |

| Equity Options Stamp Duty | 0.003% or ₹300 / crore on buy side 0.003% or ₹300 / crore on buy side |

| Currency Futures Stamp Duty | ⛔ Does not offer 0.0001% or ₹10 / crore on buy side |

| Currency Options Stamp Duty | ⛔ Does not offer 0.0001% or ₹10 / crore on buy side |

| Commodity Futures Stamp Duty | ⛔ Does not offer 0.002% or ₹200 / crore on buy side |

| Commodity Options Stamp Duty | ⛔ Does not offer 0.003% or ₹300 / crore on buy side |

Other Charges

| |

| SEBI Turnover Charges | ₹10 / crore ₹10 / crore |

| DP Charges | ₹13.5 per company ₹13.5 + GST per scrip (irrespective of quantity) |

| GST charges | 18% 18% of (Brokerage + Transaction charges + Demat) |

| Account Closure Charges | Free Free |

| Reactivation Charges | Free Free |

| Dematerialization Charges | ₹150 per share certificate + courier charges ₹150 per share certificate, ₹100 courier charges, + 18% GST |

| Call and Trade charges | ₹50 per order ₹50 per order |