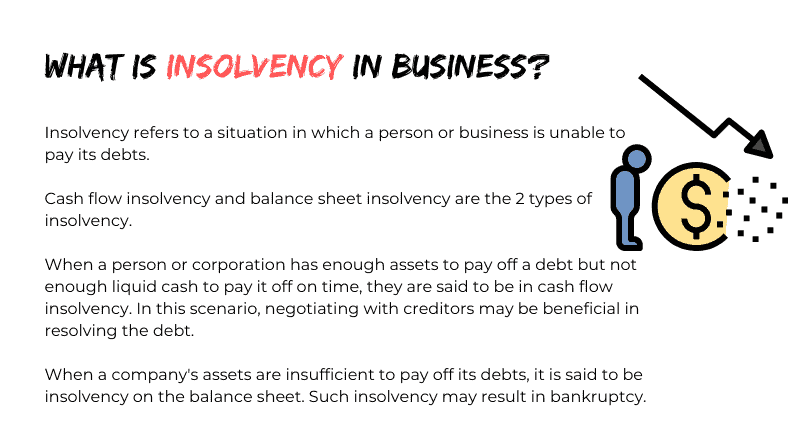

Insolvency refers to a situation in which a person or business is unable to pay its debts.

Cash flow insolvency and balance sheet insolvency are the 2 types of insolvency.

Cash flow insolvency

When a person or corporation has enough assets to pay off a debt but not enough liquid cash to pay it off on time, they are said to be in cash flow insolvency. In this scenario, negotiating with creditors may be beneficial in resolving the debt.

Balance sheet insolvency

When a company’s assets are insufficient to pay off its debts, it is said to be insolvency on the balance sheet. Such insolvency may result in bankruptcy.

During insolvency procedures, the insolvent individual or company may face legal action, and assets may be liquidated to pay off current debts.

The company can also try to restructure the debt payment with its creditors.

Insolvency is not the same as bankruptcy. Bankruptcy is the result of a court order that establishes a strategy to sell the company’s assets. A business might be insolvent but not bankrupt.