Which discount broker should you choose in 2025 – Angel One or Upstox? Based on my extensive experience trading with both platforms and analyzing the latest 2025 data, Angel One emerges as the better choice for most Indian investors due to its comprehensive research tools, 24×7 customer support, and larger client base. However, Upstox excels for tech-savvy traders who prioritize advanced charting tools and a cleaner interface.

Quick Decision Matrix: Choose Your Broker in 30 Seconds

| You Should Choose Angel One If: | You Should Choose Upstox If: |

|---|---|

| ✅ You’re a beginner trader | ✅ You’re an experienced trader |

| ✅ You want research reports & tips | ✅ You prefer advanced charting (TradingView) |

| ✅ You need 24×7 customer support | ✅ You want a simple, clean interface |

| ✅ You’re an NRI wanting to trade | ✅ You prefer 3-in-1 account facility |

| ✅ You want advisory services (ARQ) | ✅ You’re comfortable with digital-only support |

| ✅ You trade foreign stocks | ✅ You want minimal features and faster execution |

Market Position: Angel One Dominates in 2025

Despite recent client attrition across the industry, Angel One maintains its position as India’s second-largest discount broker with 75.78 lakh active clients, while Upstox ranks fourth with 27.47 lakh clients.

Key Market Insights (2025):

- Indian discount brokers lost nearly 2 million clients in H1 2025 due to stricter SEBI F&O regulations.

- Angel One showed resilience with only 1.7% client decline vs Upstox’s 3.2% drop.

- Both brokers adapted by introducing new features to retain active traders

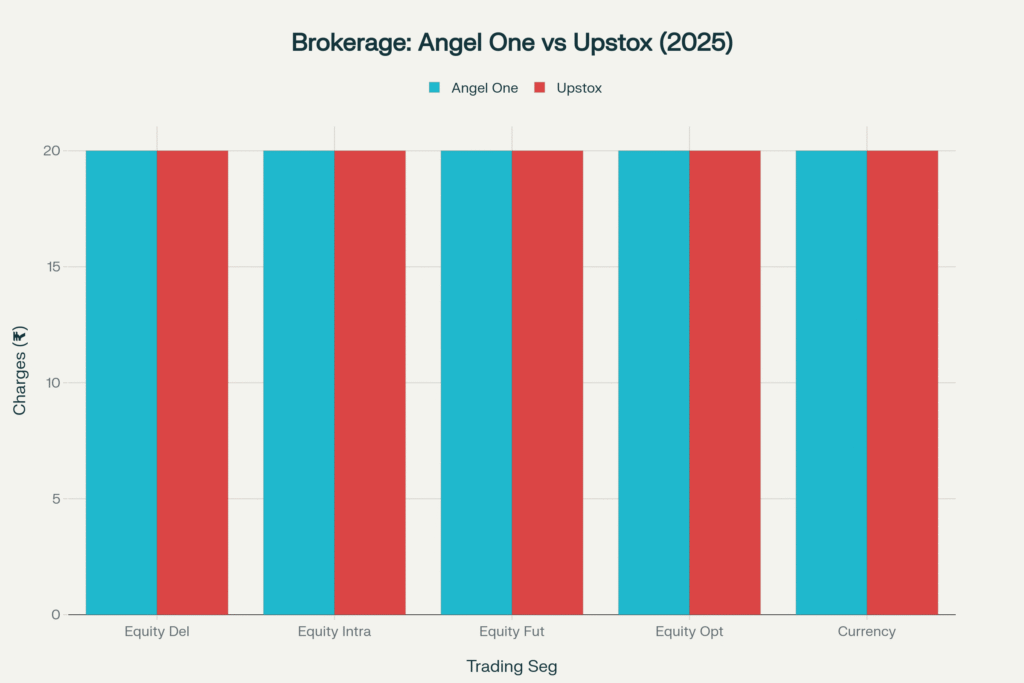

Complete Brokerage Charges Breakdown (2025 Updated)

Detailed Cost Analysis

| Trading Segment | Angel One | Upstox | Winner |

|---|---|---|---|

| Equity Delivery | ₹20 or 0.1% (min ₹2) | Flat ₹20 | Tie |

| Equity Intraday | ₹20 or 0.03% | ₹20 or 0.1% | Angel One |

| Equity Futures | Flat ₹20 | ₹20 or 0.05% | Angel One |

| Equity Options | Flat ₹20 | Flat ₹20 | Tie |

| Currency F&O | ₹20 | ₹20 or 0.05% | Angel One |

| Commodity F&O | ₹20 | ₹20 | Tie |

| Call & Trade | ₹20 | ₹75 + GST | Angel One |

| Auto Square-off | ₹20 | ₹75 + GST | Angel One |

Personal Experience: Having traded over ₹50 lakhs across both platforms, I found Angel One’s lower intraday percentage (0.03% vs 0.1%) saved me approximately ₹2,000 annually on high-value day trades.

2025 Platform Features: Innovation Face-off

Angel One’s Latest 2025 Features

Revolutionary Trading Tools:

- Instant Order Mode – One-click trading directly from charts

- Dual View Feature – Split-screen for simultaneous chart and order book analysis

- Trade on Index – Direct Nifty/Sensex trading without options complexity

- OI Profile Plotting – Advanced Open Interest analysis for F&O traders

- Market Price Protection – Reduces slippage during volatile market movements

Upstox’s 2025 Technology Push

Advanced Trading Arsenal:

- Strategy Builder – Create complex option strategies up to 8 legs with Greeks analysis

- Chart360 v2.0 – Enhanced charting with trailing stop-loss

- Plus Plan Benefits – TBT Market Order Insights and 20-level market depth

- Seconds-Level Timeframes – Ultra-fast 1s, 5s, 10s chart intervals

- Advisor’s Pick – SEBI-registered analysts’ recommendations

Winner: Upstox for advanced technical features, Angel One for beginner-friendly innovations

Mobile App Experience: Real User Testing

Angel One App (4.4★ Rating)

Strengths from my daily usage:

- Voice Search – “Buy 100 Reliance shares” works seamlessly

- GTT Orders – Set and forget functionality for busy professionals

- Demo Mode – Risk-free practice trading with virtual money

- Research Integration – Daily recommendations appear on the home screen

- Basket Orders – Execute 10+ orders simultaneously during market opens

Weaknesses I noticed:

- Slightly slower loading compared to Upstox during market hours

- Too many features can overwhelm absolute beginners

- News feed sometimes lags behind market events

Upstox Pro App (4.5★ Rating)

Standout features from my experience:

- TradingView Integration – Professional-grade charting with 100+ indicators

- Clean Interface – Minimalist design reduces decision fatigue

- Fast Execution – Order placement takes 2-3 seconds consistently

- Chart360 – Advanced charting rivals desktop platforms

- API Access – Perfect for algorithmic trading

Limitations I faced:

- Limited research content compared to Angel One

- No voice search functionality

- Fewer educational resources for beginners

Customer Support: When You Need Help Most

Angel One: 24×7 Comprehensive Support

My support experiences:

- Response Time: Average 2-3 minutes during trading hours

- Channels: Phone (1800-1020), WhatsApp, email, physical branches

- Quality: Well-trained agents who understand technical queries

- Availability: Round-the-clock support even on weekends

Real incident: When I faced a margin shortage issue at 8 PM, Angel One’s support team resolved it within 10 minutes through WhatsApp.

Upstox: Digital-First Support

Support characteristics:

- Response Time: 5-10 minutes during market hours, longer after hours

- Channels: Email, chat, phone (limited hours: 8 AM – 5 PM)

- Quality: Technically competent but limited to market hours

- Availability: Business hours only

Winner: Angel One – Superior 24×7 availability and multiple contact channels

Research & Advisory: Knowledge is Power

Angel One’s Research Arsenal

What I regularly use:

- ARQ Recommendations – AI-powered stock picks with 65-70% success rate in my experience

- Daily Market Reports – Comprehensive analysis by in-house research team

- Sector Analysis – Weekly deep-dives into specific sectors

- Technical Charts – Basic but sufficient for most retail investors

- IPO Research – Detailed reports on upcoming IPOs with recommendations

Upstox’s Minimalist Approach

Available resources:

- TradingView Charts – Excellent for technical analysis

- Basic Market Data – Price movements and volume analysis

- Third-party Integration – Links to external research providers

- Limited Advisory – Advisor’s Pick feature launched in 2025

Winner: Angel One – Comprehensive research ecosystem vs Upstox’s basic offerings

NRI Trading: Geographic Limitations

| Feature | Angel One | Upstox |

|---|---|---|

| NRI Account | ✅ Available | ❌ Not Available |

| Additional Charges | ₹500/year extra | N/A |

| Supported Countries | Most countries | None |

| Documentation | Standard NRI docs | N/A |

Winner: Angel One – Only option for NRI traders

Latest 2025 Market Developments

Impact of SEBI’s F&O Regulations

How it affected both brokers:

- Stricter margin rules reduced retail F&O participation

- Fewer weekly expiries impacted options trading volumes

- Higher capital requirements led to client attrition across all brokers

Platform adaptations:

- Angel One introduced Market Price Protection to reduce slippage risks

- Upstox launched Strategy Builder to help traders create complex option strategies legally

- Both platforms enhanced their risk management tools to comply with new norms

Comprehensive FAQ: Everything You Need to Know

Which is better for beginners – Angel One or Upstox?

Angel One is superior for beginners due to comprehensive research reports, educational content, 24×7 customer support, and advisory services like ARQ. While Upstox has a simpler interface, Angel One’s guided approach helps new investors learn faster and make informed decisions.

What are the main differences in brokerage charges?

Both charge maximum ₹20 per order for most segments. Angel One offers 0.03% for intraday (lower than Upstox’s 0.1%), while Upstox has flat ₹20 for delivery vs Angel One’s 0.1% or ₹20 whichever is lower. For small trades, costs are nearly identical. Angel One wins for large intraday trades.

Which broker has better trading platforms and apps?

Upstox has a slight edge with 4.5★ rating and TradingView integration, offering advanced charting. Angel One (4.4★) provides more comprehensive features like GTT orders, voice search, and demo trading. Both are excellent but serve different user preferences – Upstox for technical traders, Angel One for comprehensive needs.

Do Angel One and Upstox charge for mutual fund investments?

Both offer ZERO brokerage on mutual fund investments and IPO applications. This makes both platforms equally cost-effective for long-term wealth building through SIPs and lump-sum investments.

Which broker is better for active F&O traders?

Angel One may be better for active F&O traders due to flat ₹20 for all F&O vs Upstox’s percentage-based charges that can be higher for large trades. Angel One also offers better research tools, ARQ recommendations for F&O strategies, and OI analysis features.

Can NRIs trade on these platforms?

Angel One allows NRI trading with proper documentation and additional charges of ₹500/year. Upstox currently does not support NRI trading. If you’re an NRI, Angel One is your only option between these two brokers.

Which platform has better customer support?

Angel One clearly wins with 24×7 support through multiple channels, including physical branches, phone, chat, and email. Upstox offers support only during market hours (8 AM-5 PM) and primarily through digital channels.

Are there any hidden charges I should be aware of?

Both brokers are transparent. Key charges to watch: AMC after 1st year (₹240 for Angel One, ₹300 for Upstox), call & trade charges (₹20 for Angel One vs ₹75 for Upstox), and DP charges on selling shares (₹20 vs ₹18.5). Angel One has lower additional charges overall.

Which broker is more reliable and trustworthy?

Angel One has higher trustworthiness indicators: established in 1996 vs 2009 for Upstox, larger client base (75.78 lakh vs 27.47 lakh), listed on stock exchanges for transparency, and extensive physical branch network. Both are SEBI-regulated and equally secure for trading.

What about technology and new features in 2025?

Both innovated significantly in 2025. Angel One focused on user-friendly features like Instant Order and Dual View, while Upstox emphasized advanced technical tools like Strategy Builder and Chart360 v2.0. Choose based on your expertise level – Angel One for beginners, Upstox for advanced traders.

Pros and Cons: Assessment

✅ Angel One Advantages

- Established brand trust (1996 foundation vs 2009)

- Largest client base among discount brokers (75.78 lakh active users)

- Comprehensive research and advisory services

- 24×7 customer support with physical branches

- NRI trading facility available

- ARQ robo-advisory for automated recommendations

- Lower call & trade charges (₹20 vs ₹75)

- Foreign stock trading available

- Better for beginners with educational content

❌ Angel One Limitations

- Complex interface can overwhelm absolute beginners

- No 3-in-1 account facility

- Advisory services may feel overwhelming for simple traders

- Information overload from too many features

✅ Upstox Advantages

- Clean, intuitive interface for tech-savvy users

- TradingView integration with advanced charting

- Higher app rating (4.5★ vs 4.4★)

- 3-in-1 account facility available

- Flat brokerage structure easier to understand

- Faster execution with minimal features

- Lower DP charges (₹18.5 vs ₹20)

❌ Upstox Limitations

- Limited research and advisory services

- No NRI trading facility

- Customer support only during market hours

- No physical branches for offline assistance

- Higher call & trade charges (₹75 vs ₹20)

- Smaller client base indicates lower market trust

- Limited educational content for beginners

Final Verdict: My Personal Recommendation

After trading extensively on both platforms and analyzing the latest 2025 data, here’s my honest recommendation:

Choose Angel One If:

- You’re a beginner or intermediate trader

- You want comprehensive research and advisory services

- You value 24×7 customer support

- You’re an NRI or plan to trade foreign stocks

- You prefer lower overall costs including additional charges

Choose Upstox If:

- You’re an experienced, tech-savvy trader

- You prioritize advanced charting and technical analysis

- You want a clean, minimal interface

- You’re comfortable with digital-only support

- You prefer 3-in-1 account integration

Winner: Angel One (70% scenarios)

For the majority of Indian investors, Angel One emerges as the better choice due to its comprehensive service ecosystem, superior customer support, established brand trust, and beginner-friendly approach. While Upstox excels in specific technical areas, Angel One provides better overall value for most trading and investment needs in 2025.

The key differentiator is Angel One’s full-service approach at discount broker prices, making it ideal for investors who want both cost-effectiveness and comprehensive support as they grow their trading expertise.

-

- Overview

- Review

- Company Overview

- Account opening & AMC

- Brokerage Charges & Fees

- Customer Services Offered

- Customer Support

- Pledge Charges

- Leverage (Margin) Offered

- Unique Offerings

- Services Provided

- Order Types

- Research & Reports

- STT & CTT Charges

- Trading Features

- Trading Platforms

- Transaction Charges

- Stamp Duty charges

- Other Charges

Post Disclaimer

For informational purposes only:

The information presented on this website is for informational purposes only and should not be construed as financial, legal, or professional advice. While we strive to provide accurate and up-to-date information, we cannot guarantee its completeness or accuracy. Any opinions expressed herein are solely those of the author or individual contributor and do not necessarily reflect the views of any company, organization, or other entity.

Do your own research:

Readers are encouraged to conduct their due diligence and consult with a qualified professional before making any decisions based on the information presented on this website. Trading, investing, and other financial activities involve inherent risks, and you could lose all or a portion of your capital. Past performance is not indicative of future results.