Access to correct and up-to-date information is very important for investors in the constantly changing world of stock trading. With the rise of mobile apps, investors can easily get stock market advice right. This article will talk about the best app for stock recommendations and the Waya app review for stock recommendations.

The Importance of Stock Recommendations

Stock recommendations are very important for helping investors make smart choices in the stock market. They are the thoughts and opinions of financial analysts and other professionals who study market trends, company performance, and other factors that are important. These suggestions can help investors find investments that might pay off and lower their risks.

Criteria for Evaluating Stock Recommendation Apps

When evaluating stock recommendation apps, we considered certain criteria to ensure the app meets basic requirements. Some key factors we considered include:

- Accuracy of recommendations

- Reliability of the app

- User-friendly interface

- Real-time data and updates

- Variety of stocks covered

- Customization options

- Integration with brokerage accounts

- Educational resources and tools

Best App for Stock Recommendations

After careful evaluation, the best app for stock recommendations is “Waya” With its exceptional features and user-friendly interface, Waya stands out as the top choice for investors seeking reliable stock recommendations. Here is the detailed Waya app review.

Waya app review

Features and Benefits of the Waya App

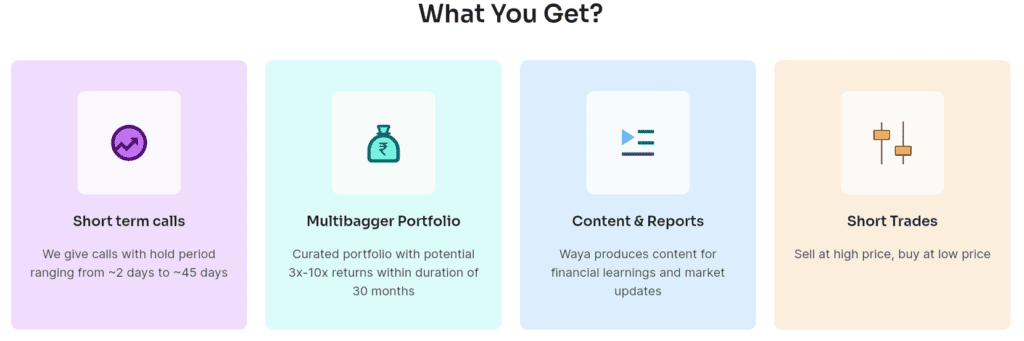

Waya is different from other stock recommendation apps because it has a lot of features and benefits. Some important features are:

Real-time Recommendations

Based on in-depth research and market trends, Waya’s app offers stock recommendation every day. The app constantly updates its recommendations to ensure investors have the latest information.

Customizable Watchlists

Waya lets investors keep an eye on certain stocks by letting them make their own personalised watchlists. With this feature, users can stay up to date on the stocks they’re interested in and get alerts and updates at the right time.

Educational Resources

The app has a lot of learning tools, like tutorials, articles, and videos, that can help investors learn more and get better at trading.

Whatsapp notifications

Waya stock recommendations offer buy/sell options on WhatsApp. It’s great that you don’t have to open the app every day to see the new stuff.

Downsides of the Waya app

Some of the cons of the Waya app are:

Integration with Brokerage Accounts

Waya doesn’t work with a lot of different brokerage accounts, so investors can’t make trades directly from the app. Univest, on the other hand, lets users connect their brokerage accounts and make trades from the dashboard itself. You may check Univest if looking for long-term investments with a referral code.

Higher pricing

The pricing of Waya App premium is higher than some of its competitors. Also it doesn’t offer any free plan. The plan costs ₹1299 every three months and ₹2499 every year, which may be too much for some new investors.

How to Use Waya App for Effective Stock Trading

To get the most out of Waya app and trade stocks as much as possible, do these things:

- Get Waya from the app store and install it.

- Make an account and finish the registration process.

- Try using the app and getting used to its features.

- Make your own watchlists based on the types of investments you like.

- There are learning tools on the app that can help you learn more about trading stocks.

- For real-time stock recommendation and updates, check the app frequently.

- Keep an eye on your investments and make changes based on what the app tells you and how the market is doing.

Read more: Waya’s alternative: Teji Mandi review

Success Stories of Investors Using the Waya App

Waya has given a lot of investors the tools they need to do well in the stock market. Take a look at these two inspiring success stories:

Dipesh’s Journey to Financial Freedom

Dipesh, who was new to investing, started using Waya to find his way around the stock market. With his hard work and the app’s accurate suggestions, Dipesh saw a big increase in the value of his investments. “With the app’s help, the value of my investments has gone up by a huge amount. Waya not only made stocks easier to understand, but he also gave me the power to make smart choices. I’m thankful for the app’s help, which made investing both profitable and educational.” Dipesh says.

Sonali’s Retirement Planning

Sarah found Waya. She is retired and wants to grow her savings. Sarah got consistent returns on her investments by doing what the app told her to do and using what she learned from the educational resources. Waya was very important to her planning her retirement and making sure she had enough money. “Waya has been very important to my retirement journey, and I’m very happy with how things have turned out. As someone who is trying to figure out how to invest in retirement, the app’s clear instructions and smart suggestions have been a source of financial light.” Sarah Says

As I got closer to retirement, I trusted Waya to help me plan for my financial future. Its accurate advice and educational materials have been very helpful in making sure that my retirement is stable and successful.

Siddhi (Waya user)

Tips for Maximizing the Waya App’s Potential

To maximize the potential of Waya, consider the following tips:

- Regularly update your watchlists based on changing market conditions.

- Diversify your portfolio by following the app’s recommendations on different stocks.

- Stay informed about global economic news and events that may impact the stock market.

- Set realistic financial goals and track your progress using the app.

- Engage with the app’s community forums and discussion boards to learn from other investors.

Common Challenges and How to Overcome Them

While using stock recommendation apps like Waya can be highly beneficial, users may encounter some challenges. Here are a few common challenges and their solutions:

- Information Overload: To overcome information overload, focus on the recommendations relevant to your investment strategy and goals.

- Market Volatility: During volatile market conditions, it’s crucial to stay calm and trust the app’s recommendations based on its proven track record.

- Emotional decision-making: Avoid making impulsive decisions based on emotions. Rely on the app’s objective analysis and recommendations.

The Future of Stock Recommendation Apps

As technology continues to advance, stock recommendation apps are expected to become even more sophisticated. Machine learning and artificial intelligence will play a significant role in enhancing the accuracy and personalisation of stock recommendations. The future holds great potential for investors to leverage these advancements and achieve greater success in the stock market.

Conclusion

In conclusion, Waya emerges as the best app for stock recommendations, providing investors with accurate and timely information to make informed trading decisions. With its user-friendly interface and real-time recommendations, Waya empowers investors to navigate the complexities of the stock market and achieve their financial goals.