How to Invest in Gold in India

There are several benefits to buying digital gold rather than actual gold. When it comes to determining the greatest form of gold investment, however, digital gold investment is not the best option available.

There is a way to double the returns on your gold investment and a secret to get 5-10% return in a single day in gold investment that is used by some people which we will discuss here. For now, let’s start with the best Gold Investment method.

First of all, identify the reason why you want to buy gold. If you want to buy it as jewellery then you have to ignore its investment returns because that is not impressive.

There is a lesser-known alternative in real gold if you wish to buy gold as an INVESTMENT. It is true that while purchasing gold, you must pay GST. When purchasing real gold, you must additionally pay a Making Charge. However, if you purchase pure 24-carat gold that is not in any form, such as a coin, or jewelry, you will not have to pay a Making Charge.

If you buy gold in any form, suppose you bought a Gold Coin, then you have to pay around 7% Making Charge.

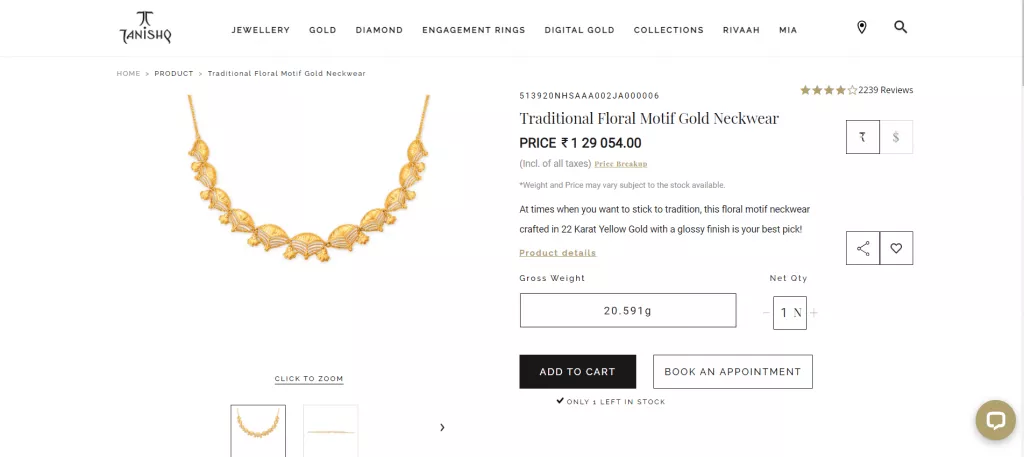

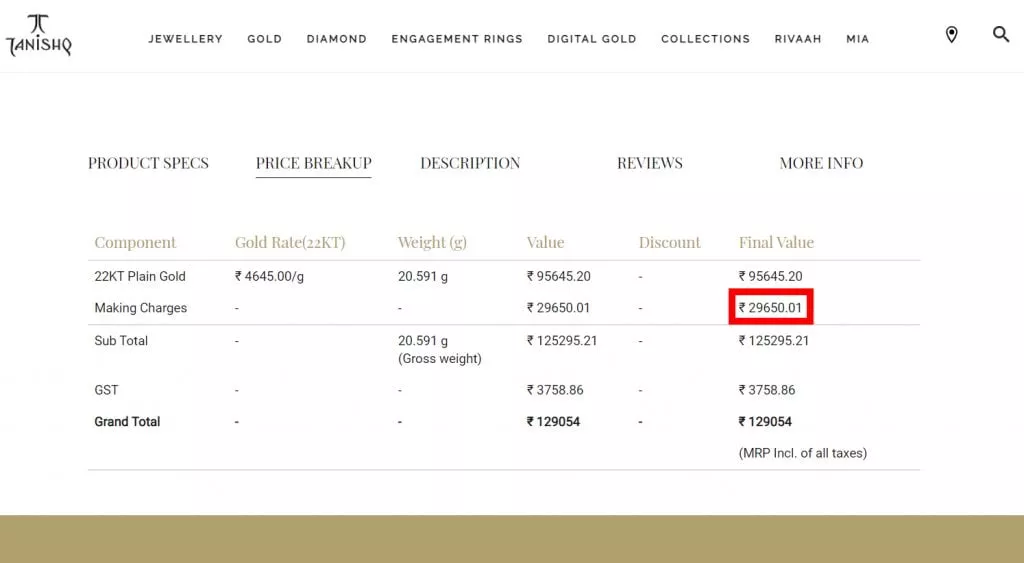

The data is taken from Tanishq’s website.

As of today’s date, if a person buys neckwear for ₹95,645 he has to pay about 31% Extra Making Charge and 3% GST on the total of these two prices. Finally, in 129054, he will be able to purchase the neckwear.

The purpose of this article is not to describe jewelry price calculations but to explain what is the best way to buy gold as an investment and how to double your gold returns.

Let’s look at the Pros and Cons of Digital Gold investment

Benefits of Digital Gold Investment

- If you purchase digital gold, the company will store that quantity of digital gold in its safe. That means you won’t have to be concerned about theft or security problems.

- The second advantage is that you do not have to pay a making charge when you buy it, which lowers the cost of purchasing digital gold.

However, you must pay a 3% GST on the purchase amount, just like physical gold. - The third advantage is that you can request actual delivery if you so choose. However, you will have to pay certain additional fees, including making charges in some circumstances.

- Another amazing advantage is that you may buy digital gold worth 1 or 2 rupees. As a result, there is no condition for a minimum investment.

Now, let us look at the disadvantages of Digital gold investment.

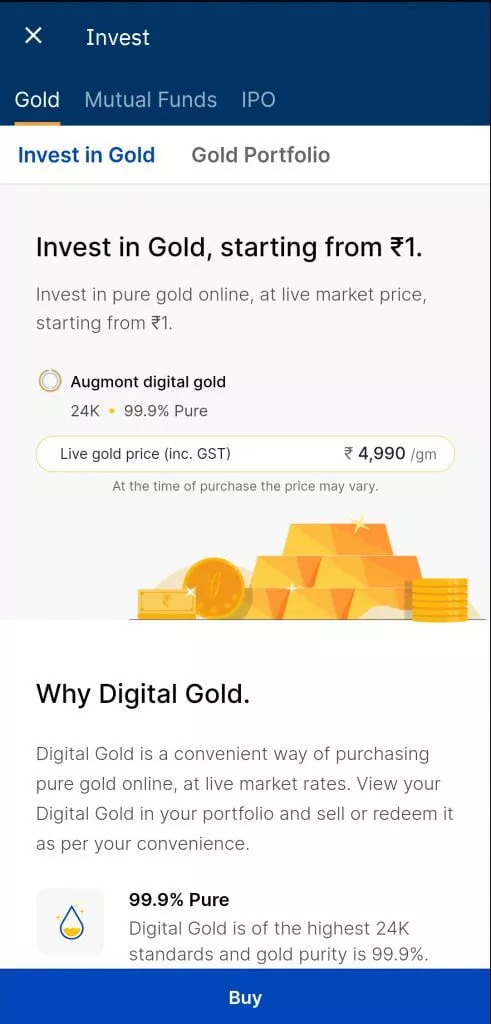

Assume I’m using my mutual fund app to purchase digital gold. You may purchase it using any app. The digital gold is not sold by the App. In India, there are just three companies: MMTC, SafeGold, and Augmont.

MMTC is a government-owned company. The other two are private companies.

If you buy digital gold using an app, it implies that one of these 3 companies is selling it to you.

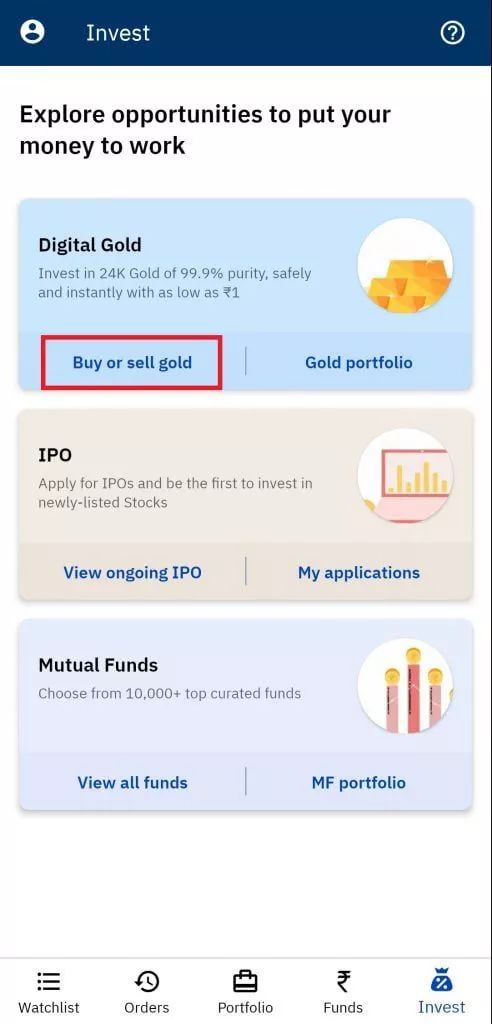

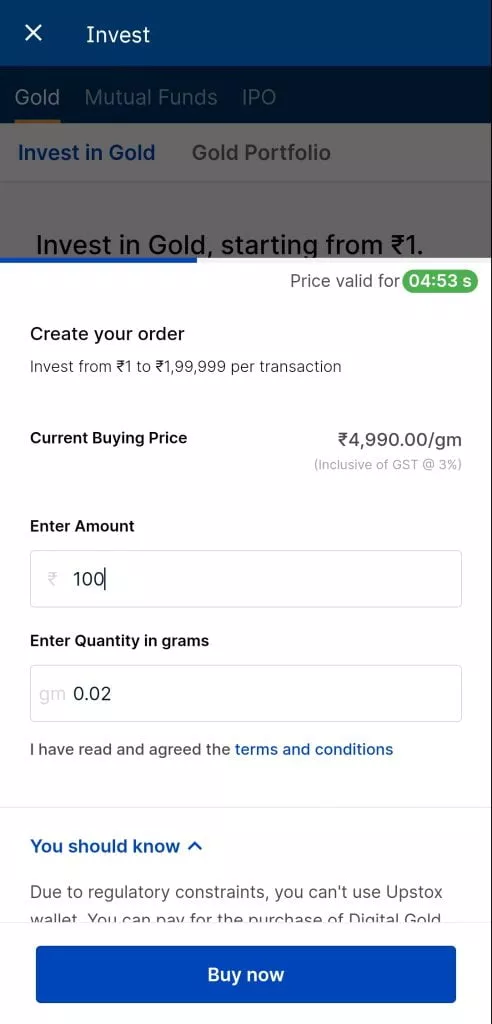

So I am going to use my Upstox App to purchase the digital gold for ₹100. (Please note, Upstox is not providing a Gold buying option now. You can use 5paisa to buy Buy and sell gold). Make Free account on 5paisa here.

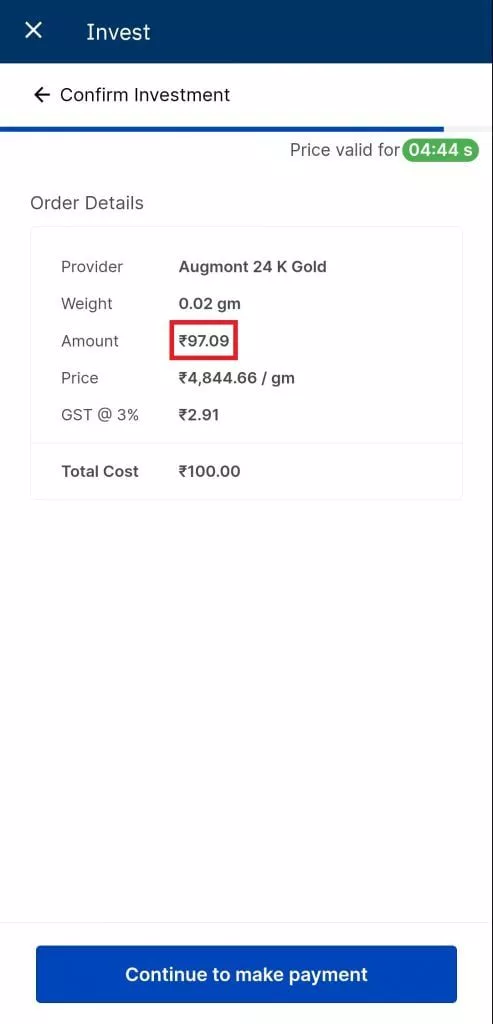

As previously discussed, I am required to pay a 3% GST when purchasing digital gold.

Disadvantages of Digital Gold Investment

I’d want to sell the digital gold I received for Rs.100.

When I sell 100 rupees worth of gold, I can’t sell it at the previous buying price of 4844.6 rupees.

I’ll have to sell it at a 3 percent reduction.

My digital gold’s worth has automatically changed from 97 Rupees to 94 Rupees.

My sale rate is 4,699.33, but I paid 4844.6 for it as it was my buying price.

What is the cause of the 3% difference?

This is called SPREAD, and it includes a variety of expenditures such as storage and insurance.

Because the company held the gold on our behalf, they are asking for storage and insurance fees.

It’s also possible that the company is deducting its profit margin from your payment.

So, while you save money by buying digital gold instead of real gold, you still have to pay a minimum of a 3% spread when selling it.

This 3% spread isn’t even close to being flat. It can readily fluctuate between 3 to 6%.

These are its drawbacks, but it also presents some difficulties.

No Indefinite Holdings is the first problem.

You won’t be able to keep this digital gold in your App permanently.

You will be forced to sell it or accept actual delivery after a certain period of time.

If you accept physical delivery, you may be subject to Making Charges.

If you decide on another alternative i.e., selling it.

You’ll have to pay capital gains tax on it.

It’s as if you have to accept losses in both scenarios.

Another issue is that these three companies, MMTC, SafeGold, and Augmont, are unregulated.

It is not regulated by SEBI, RBI, or any other regulatory authority.

These are all reputable businesses that adhere to all laws.

Assume that company X has 100 kg of gold.

However, this company receives requests for 200kg of digital gold.

As a result, the company will be able to complete all 200kg orders on that day.

You may believe you have gold based on what you see in your app.

However, there’s no guarantee that the company possesses that gold on your behalf.

Again, I’m stating that all three of these businesses are well-known and follow all rules and regulations and don’t blame any of them.

But if this industry is not controlled, there may be consequences.

Summarizing Digital gold investment can have these disadvantages and challenges:

1. 3% GST

2. 3% – 6% Spread

3. No indefinite Holdings

4. Capital gain tax

5. Unregulated Suppliers

Question- What is the greatest method to invest in gold if digital gold isn’t the best option?

Answer- Sovereign Gold Bonds

What are Sovereign Gold Bonds (SGB)?

RBI issues SGBs (Sovereign Gold Bonds) regularly throughout the year.

You must submit your application between the specified issue dates.

Interestingly, there is no Gold behind this. Actually, this isn’t gold actually

It’s a piece of paper that costs the same as gold.

And it will be redeemed at the gold price in the future.

In a given period, this piece of paper will produce the same return as gold bullion.

But how satisfied will investors be with the paper? Gold has its value.

First and foremost, because this paper is issued by the government, it is widely accepted.

Second, the risk of default is almost nil. It is completely secure.

Benefits of Sovereign Gold Bonds

First and foremost, let me inform you of its charges.

There are no charges associated with it.

Except for SGB and ETF, you have to pay the 3% GST that applies to all forms of gold such as physical and digital gold.

Second, because there is no actual gold, there are no making charges, insurance, or storage fees.

It indicates the elimination of any charge i.e., you purchase it for the price of pure gold.

If you apply for SGB online (you are urged to do so).

Then you’ll get a ₹50/gm discount.

Only ₹50/gm? Not looking interesting?

Its most significant benefit is that it is exempt from capital gains tax.

Your SGB investment profit is fully tax-free.

Another advantage is that if you keep it for a year, the RBI will pay you 2.5 percent interest.

Conclusion

There are no charges for it.

You can get a discount whenever you buy

It makes a profit that is tax-free.

When you keep it, you earn an extra 2.5 percent interest.

Sovereign Gold Bonds Interests

It’s a simple interest.

It implies that you will get a predetermined amount of interest on your investment each year.

It comes twice a year. After every six months, you will receive 1.25 percent interest.

This interest income is not tax-free but nothing is wrong with it.

Because this 2.5 percent interest is a bonus that you don’t get with other options. That’s a better deal.

As a result, you may comfortably pay tax on the interest you earn.

Sovereign Gold Bonds minimum investment

You must purchase at least 1 SGB, which is equal to 1 gram of gold.

After investing, you have to hold this bond for a period of eight years.

After 8 years, you can redeem it from RBI and receive a tax-free profit.

But if you can’t wait that long, The RBI then provides you the option of redeeming your bond early after 5 years.

In this situation, the profit will likewise be tax-free, not taxable.

Again, if you redeem your bond through RBI, you won’t have to pay any taxes.

Either after 5 years or after 8 years, you can redeem it.

Once you’ve completed 5 years, you can conduct early redemption numerous times rather than just once.

Every six months, you will have a choice.

Q. But what if you even don’t want to wait for even 5 years?

If that’s the case, don’t receive it on paper.

While filling out the form, you will be given the option of entering your DP ID.

In the application form, enter your stock broker’s 16-digit DP ID.

Your SGB will appear in your Demat account as a holding.

Q. How is taking SGB in demat account beneficial?

Answer: You will be able to sell SGB on stock exchanges using a Demat account, similar to you buy/sell shares on BSE/NSE.

As stock prices change based on demand and supply, the price of your SGB will likewise fluctuate based on demand and supply, much like stock prices.

As a result, you’ll hardly be able to sell it for actually gold price.

So, depending on the pricing, your SGB will be sold at a little profit or at a little loss.

There is, however, a technique involved.

Using this technique, many users are able to sell their SGB for up to 10% more.

You will only have to pay tax on your capital gain if you sell your SGB on the stock exchange, regardless of whether it is LTCG or STCG.

Q. But what about the person who bought the SGB at the stock market from you?

The same guidelines will apply. If he retains it until it matures and then redeems it through the RBI, then he is exempt from paying any taxes.

If he sells it on the stock exchange to someone else, however, he has to pay tax.

Concluding, if you get your money back from RBI after maturity, you don’t have to pay tax.

Sovereign Gold Bonds dates and how to purchase?

The RBI publishes dates on its website, www.rbi.org.in.

By visiting that site, you may find out when the next SGB issue will be released.

Its subscription window typically lasts 3-4 days, and you must apply during that time.

After one week, the SGB will appear in your Demat account.

It requires having a Demat account.

You can use a stock broker or online net banking to apply. In both cases, the procedure is the same.

In both situations, you’ll save $50 per gram.

There have been complaints that certain banks are acting arbitrarily.

In their application forms, banks do not provide the DP ID option.

According to one bank, to receive SGB in a Demat account, you must have a Demat account with their bank.

I think this is wrong.

Your account will be available to use in 24 to 48 hours and you can easily apply for SGB.

All you have to do now is write in the number of grams.

If you input 2, you will be given two SGB units, which are equivalent to three grams of gold.

Note: On the last day of the subscription window, the order will be placed.

The order will be canceled if your UPSTOX account does not have sufficient funds on that day.

Let’s look at the trick: individuals may sell their gold for a 5-10% premium or purchase gold at a 5-10% discount if they know the method.

On stock exchanges, this technique is used. It will be delivered to your Demat account.

Orders are divided into two categories i.e., LIMIT ORDER and MARKET ORDER.

LIMIT ORDER indicates that I wish to purchase at a specified price. That is to say, I will only sell my SGB if it reaches that amount (10% higher than the current amount); otherwise, I will not.

When I place a buying market order, I’m telling the stock exchange that the price doesn’t matter. I’d want to get SGB right now, at whatever price is given.

These two types of orders are the only ones that the stock exchange can match.

The inverse is also true. If I set a buying limit order, say the current SGB price is 5000 and I place a 4600 limit order.

I’m telling the stock exchange that they should only acquire it if it reaches 4600.

Let’s pretend that another seller has placed a market order to sell his SGB.

The SGB with the price of 5000 will then match my order, and I will purchase it for 4600.

And that person has to bear this loss.

The inverse is also true. If I set a purchasing limit order, say the current SGB price is 5000 and I place a 4600 limit order.

I’m telling the stock exchange that they should only acquire it if it reaches 4600.

Let’s pretend that another seller has placed a market order to sell his SGB.

The SGB with the price of 5000 will then match my order, and I will purchase it for 4600.

And that person has to bear this loss.

Why doesn’t this happen with the stock of big companies?

Because there is high liquidity.

I’m referring to a case in which just 5 or 10 SGB orders are placed.

Because the number of buyers and sellers is so small in this situation, there’s a good probability that individuals will take advantage of such arbitrage possibilities.

I’m not encouraging you to buy SGB at a 10% discount by tricking someone.

I simply want to remind you that you should never place a market order for SGB if you want to buy or sell it.

Always check the order book and market depth before placing an order at a price that is close to the real gold price.

Always place a limit order to avoid accidentally selling it for 5-10% less.

Or you won’t buy it at the 5-10% higher price by accidentally.

SGB was the subject of this discussion. There are two additional methods to invest in gold.

And many individuals are unaware of such alternatives.

Next is Gold ETF

What is a Gold ETF?

On the stock exchange, you may buy and sell it.

Its price should normally be equivalent to 1gm of gold, but because it is accessible in fractions, you may easily begin with a small quantity.

There is real gold in exchange for the money you put in a gold ETF, but it is not the same as digital gold.

Benefits of Gold ETF

– We can definitely state that there is equal gold behind our amount because ETFs and Gold mutual funds are regulated by SEBI. Gold returns will also be tracked by ETFs.

– There is no lock-in time, therefore it is quite flexible.

– At stock exchanges, you can buy and sell whenever you want, although there may be less liquidity.

– You won’t have to pay the 3% GST or any other charges similar to SGB.

– No Spread

So, these are some advantages of Gold ETF

Disadvantages of Gold ETF

– The corresponding AMC will charge you a specified expense ratio, which was once large but is now as little as 0.1 percent.

– Taxable Capital gains

– Can be tough to sell due to low liquidity

The last way to invest in Gold is Gold Mutual fund.

What is Gold Mutual fund?

Gold mutual funds invest in gold exchange-traded funds (ETFs).

So, although the product is the same, the investing methods really aren’t.

For Gold mutual funds, you’ll want a Demat account. A mutual fund app is required.

For Gold ETF, you can get started with it even if you don’t have a Demat account.

Because this is a mutual fund, you may begin a SIP with as little as 100.

There are 2 types of hidden costs.

The first is the expense ratio (0.1 percent )

The second cost is not a cost, but it is a significant point. A mutual fund is required to have a specific amount of cash on hand at all times.

Assume a mutual fund’s AUM is 2000 crores.

As a result, the mutual fund may keep 2.5 percent, 5%, or 10% cash.

There are certain guidelines for keeping the minimum and maximum amounts of cash on hand. You can check the cash and cash equivalent factors of the Mutual fund.

Assume a mutual fund holds 2.5 percent of its assets under management in cash.

It means that if you deposit 1 lakh rupees in a gold mutual fund, just 2.5 percent of that money would be invested.

You shouldn’t suppose only 97.5 percent of a lakh to be invested.

That isn’t how it works.

Your fund’s NAV will fall somewhat when you invest at NAV in that fund. You’ll also be able to redeem it at NAV.

In your NAV, the expense ratio and cash holdings are automatically adjusted.

To compare the results, an Excel sheet was prepared by ‘Labor law advisor’.

On July 20, 2016, you deposited a particular amount in six different forms of gold investments.

Assume you redeemed your investment on May 26, 2021.

They computed the redemption price of the SGB using RBI guidelines.

The NAVs of 20 July 2016 and 26 May 2021 were used to invest in mutual funds.

The price of gold bullion is used to determine to invest in physical gold and digital gold as per India Bullion and Jewellers Association Ltd.

In this sheet, they estimated the returns on several gold investments. You can download the Excel sheet here- Download excel sheet

There is a calculation of both the pre-tax and post-tax returns.

Conclusion

Here are the results of different types of gold investment options:

- SGB’s IRR is 11.6 percent.

- Digital gold it is 8.34

- In the case of earing, it is 2.8 percent (Jewellery)

- In the case of mutual funds, it is 8.9%.

- SGB is giving higher returns than any other of the Gold investments like clearly the winner compared with digital gold.

After-tax IRR

- With 11.6 percent, SGB is in the lead.

- However, in the case of earrings, it is just 1.7 percent.

- The return on digital gold is 7.1 percent.

- The return on a mutual fund is 7.8%.

- During the same time span, from 2016 to 2021, real gold increased 9.7%.

- The SGB is providing you with higher returns than the bullion form of gold, which is rising at a pace of 9.7%.

If you want to learn how this excel sheet was made and has calculated returns – Check this video.

We can clearly see here that SBG is providing the best returns among any other form of gold such as Digital gold, Physical gold etc.

Q. What can we do if we are unable to purchase SGB Issue or if we are unable to purchase it in a Demat account despite submitting many orders? What is the best way to seize such an opportunity?

Answer- It is preferable to invest in an ETF or a gold mutual fund, which are the second-best options and better than digital gold from an investment view.

Feel free to ask any information on Gold Investments, Digital gold, SGB, Gold ETF etc.,

Disclaimer: Information provided on this website is for Educational & Informational purposes only and is not considered to be advice, recommendation, invitation, or persuasion of any kind whatsoever. Anyone who wishes to apply the concept & ideas contained in this shall take full responsibility for their actions. We accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon.

Source- Labor Law Advisor

Post Disclaimer

For informational purposes only:

The information presented on this website is for informational purposes only and should not be construed as financial, legal, or professional advice. While we strive to provide accurate and up-to-date information, we cannot guarantee its completeness or accuracy. Any opinions expressed herein are solely those of the author or individual contributor and do not necessarily reflect the views of any company, organization, or other entity.

Do your own research:

Readers are encouraged to conduct their due diligence and consult with a qualified professional before making any decisions based on the information presented on this website. Trading, investing, and other financial activities involve inherent risks, and you could lose all or a portion of your capital. Past performance is not indicative of future results.