Which one is better: HDFC Sky or Zerodha? The way people invest in the stock market has changed a lot, thanks to online trading platforms. People can buy and sell stocks, mutual funds, and other securities with just a few clicks. But it is very important to know the costs and fees of a trading platform before you choose it. We will look at the comparison and fees charged by two well-known trading platforms, HDFC Sky vs Zerodha, so you can make an informed choice.

Introduction

Before we get into the specifics, let’s talk about why the fees that come with online trading platforms are important. It may be tempting to trade in the hopes of making money quickly, but we need to think about the costs that come with it. When we look at fees like account opening fees, brokerage fees, annual maintenance charges (AMC), and other hidden costs, we can make better choices about how to invest our money.

Highlights of HDFC Sky vs Zerodha charges

| Charges | Zerodha | HDFC Sky |

|---|---|---|

| Account Opening Fee | ₹200 | ₹0 |

| Annual Maintenance Charges (AMC) | ₹0 | ₹0 for the first year then ₹20 / Month |

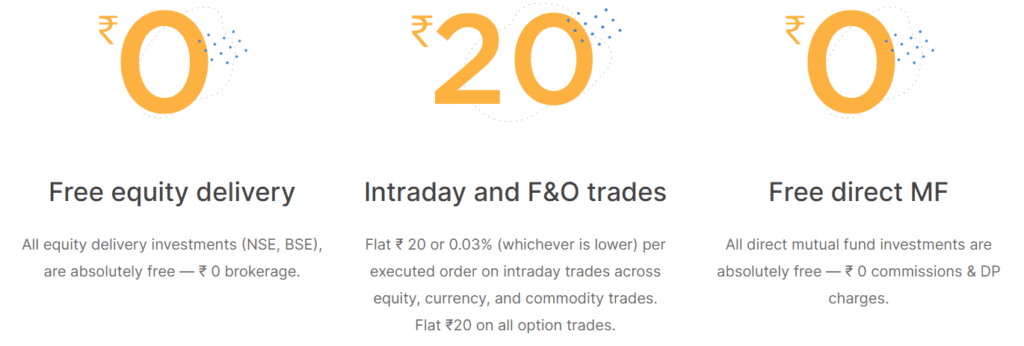

| Equity Delivery | Free | ₹20 or 0.1% (Whichever is Lower) |

| Intraday | 0.03% or ₹20 (whichever is lower) | ₹20 or 0.1% (Whichever is Lower) |

| Currency | 0.03% or ₹ 20/executed order, whichever is lower | ₹20 or 0.1% (whichever is lower) |

| Commodity | 0.03% or ₹20 (whichever is lower) | ₹20 or 0.1% (whichever is lower) |

| Futures | 0.03% or ₹20 (whichever is lower) | ₹20 or 0.1% (whichever is lower) |

| Options | Flat Rs. 20 per executed order | ₹20 / Order |

| DP Charges | ₹13.5 + GST per scrip | ₹20 |

| Taxes | 18% GST | 18% GST |

It can be seen that:

- HDFC Sky charges Annual Maintenance Charges (AMC) whereas Zerodha does not.

- Account opening is free on HDFC Sky but Zerodha charges ₹200

Note

One of the biggest downsides of HDFC Sky is that it charges ₹20 or 0.1% (Whichever is Lower) for Equity Delivery orders, which is not usually charged by any well-known brokers such as Zerodha, Upstox, Groww, Angel One, etc.

Types of account

| HDFC Sky | Online account, Offline account, NRI account (offline only), Partnership, LLP, HUF, or Corporate accounts (offline only) | Online account, Offline account, NRI account (offline only), Partnership, LLP, HUF, or Corporate accounts (offline only) |

| Zerodha | Online account, Offline account, NRI account (offline only), Partnership, LLP, HUF, or Corporate accounts (offline only) | Online account, Offline account, NRI account (offline only), Partnership, LLP, HUF, or Corporate accounts (offline only) |

HDFC Sky vs Zerodha: Stamp Duty charges

The government will charge you this fee in order to issue the contract note necessary for your trading activity.

| Demat | Charge type | Equity Delivery | Equity Intraday | F&O – Futures | F&O – Options |

|---|---|---|---|---|---|

| Zerodha charges | STT/CTT | 0.1% on buy & sell | 0.025% on the sell side | ₹0 on Buy & 0.0125% on sell | – 0.125% of the intrinsic value on options that are bought and exercised – 0.0625% on sell side (on premium) |

| HDFC Sky charges | STT/CTT | 0.1% on Buy and Sell | 0.025% on the sell side | 0.0125% on Sell side | 0.0625% on Sell side (on premium) |

It can be seen that the STT/CTT charges of HDFC Sky and Zerodha are the same for Equity Delivery & Equity Intraday.

HDFC Sky vs Zerodha: SEBI Turnover Charges

| Demat | Charge type | Equity delivery | Equity intraday | F&O – Futures | F&O – Options |

|---|---|---|---|---|---|

| Zerodha charges | SEBI Charges For both Buy & Sell | ₹10 / crore | ₹10 / crore | ₹10 / crore | ₹10 / crore |

| HDFC Sky charge | SEBI Charges For both Buy & Sell | 0.0001% of Turnover | 0.0001% of Turnover | 0.0001% of Turnover | 0.0001% of Turnover |

The Securities and Exchange Board of India assesses this fee in order to cover the costs of regulating the markets. This will cost 0.0001% of the total value of your purchase on both HDFC Sky and Zerodha.

Physical Statement Delivery charge of HDFC Sky and Zerodha

- In the case of HDFC Sky, any statement that is asked to be sent will be charged ₹20 / Contract Note + Courier Charges.

- In the case of Zerodha, it does not charge a separate fee for requesting a physical statement delivery. However, you will be responsible for paying the courier charges, which are typically around ₹20.

Also read: Indmoney Vs Zerodha Charges

HDFC Sky vs Zerodha: Dematerialization Charges

It is possible to turn your paper share certificates into electronic shareholdings. This is called “dematerialization of shares,” which is also the name of the process.

When you use HDFC Sky, you have to pay ₹50 for each share certificate plus courier fees.

In order to dematerialize a share certificate, Zerodha charges ₹150 per certificate plus ₹100 for the courier service and 18% GST.

Deposit via Netbanking on HDFC Sky and Zerodha

These are the fees associated with the payment gateway, and they amount to:

- HDFC Sky charges as per bank fee per transaction that is made via Internet banking. (There is no fee for deposits that are carried out via UPI)

- In Zerodha, ₹9 + GST (Not levied on transfers done via UPI)

HDFC Sky vs Zerodha: Charges for Call and Trade

- An extra fee of ₹20 / Call is charged for each order placed through HDFC Sky trading desk.

- Orders placed through a dealer at Zerodha, including orders with auto square-off, are subject to additional fees of ₹50 per order. Read all the charges by HDFC Sky here.

HDFC Sky vs Zerodha: Regulatory Charges

Exchange Transaction Charges for both Buy and Sell.

| Broker | Type of Charge | Equity Delivery | Equity Intraday | Futures | Options |

| HDFC Sky | Exchange Transaction Charges (Delivery and Intraday for both Buy and Sell) | 0.00325% NSE & BSE | 0.00325% NSE & BSE | – 0.00230%(on contract value) NSE – 0 BSE | – 0.056% (on premium) NSE – 0.0050%(on premium) BSE |

| Zerodha | Exchange Transaction Charges (Delivery and Intraday for both Buy and Sell) | 0.10% Delivery: Buy and Sell | 0.025% Intraday Sell | NSE: 0.0019% BSE: 0 | NSE: 0.05% (on premium) BSE: 0.005% (on premium) |

Also read: Groww vs Indmoney: In-depth comparison

Comparison of HDFC Sky vs Zerodha based on user reviews

HDFC Sky

- The HDFC Sky mobile app’s simple but beautiful user design has been praised by users.

- The platform offers free help with learning and advisory services.

Zerodha

- A lot of people like Zerodha because it has great trading tools and low fees.

- However, some users have said that the process of making an account is slow.

- There are also complaints about technical glitches, especially during peak hours.

- Some users have said that the customer service was bad because they had to tell the same problem more than once.

- Some users have also said they don’t like having to open a Demat account to invest in mutual funds.

Final Verdict

Both brokers have been registered by SEBI and let you invest in stocks, bonds, currencies, and commodities. Both of these brokers offer discounts. In general, HDFC Sky has a lower rating than Zerodha. There are 4.5 out of 5 stars for Zerodha and only 4 out of 5 stars for HDFC Sky. Zerodha has 64,75,590 active customers, while HDFC Sky has 9,94,904 active customers. HDFC Sky doesn’t have as many customers as Zerodha. It turns out that both brokers are good, but Zerodha is better than HDFC Sky when it comes to customer service, trading platforms, and brokerage.

Please keep in mind that the information given is correct as of the time I reviewed it, but it could change at any time.

Post Disclaimer

For informational purposes only:

The information presented on this website is for informational purposes only and should not be construed as financial, legal, or professional advice. While we strive to provide accurate and up-to-date information, we cannot guarantee its completeness or accuracy. Any opinions expressed herein are solely those of the author or individual contributor and do not necessarily reflect the views of any company, organization, or other entity.

Do your own research:

Readers are encouraged to conduct their due diligence and consult with a qualified professional before making any decisions based on the information presented on this website. Trading, investing, and other financial activities involve inherent risks, and you could lose all or a portion of your capital. Past performance is not indicative of future results.