Indmoney vs Zerodha charges, which offers more value? Online trading platforms have revolutionized the way individuals invest in financial markets. With just a few clicks, people can buy and sell stocks, mutual funds, and other securities. However, when choosing a trading platform, it is crucial to understand the charges and fees associated with it. In this article, we will compare the charges of two popular trading platforms, Indmoney vs Zerodha Charges, to help you make an informed decision.

Introduction

Let’s first discuss the importance of the fees associated with online trading platforms before getting into the specifics. Even though the hope of quick earnings may be attractive, we must take into account the expenses related to trading. We can make better decisions about our investing plans by analyzing fees such as account opening fees, brokerage fees, annual maintenance charges (AMC), and other hidden expenses.

Highlights of Indmoney vs Zerodha charges

| Charges | Zerodha | Indmoney |

|---|---|---|

| Account Opening Fee | ₹200 | ₹0 |

| Annual Maintenance Charges (AMC) | ₹0 | ₹0 |

| Equity Delivery | Free | Free |

| Intraday | 0.03% or ₹20 (whichever is lower) | 0.05% or ₹20 (whichever is lower) |

| Currency | 0.03% or ₹ 20/executed order, whichever is lower | Does not provide |

| Commodity | 0.03% or ₹20 (whichever is lower) | Does not provide |

| Futures | 0.03% or ₹20 (whichever is lower) | ₹20 per executed order |

| Options | Flat Rs. 20 per executed order | ₹20 per executed order |

| DP Charges | ₹13.5 + GST per scrip | ₹13.5 + GST per ISIN (Stock or ETF) per day |

| Taxes | 18% GST | 18% GST |

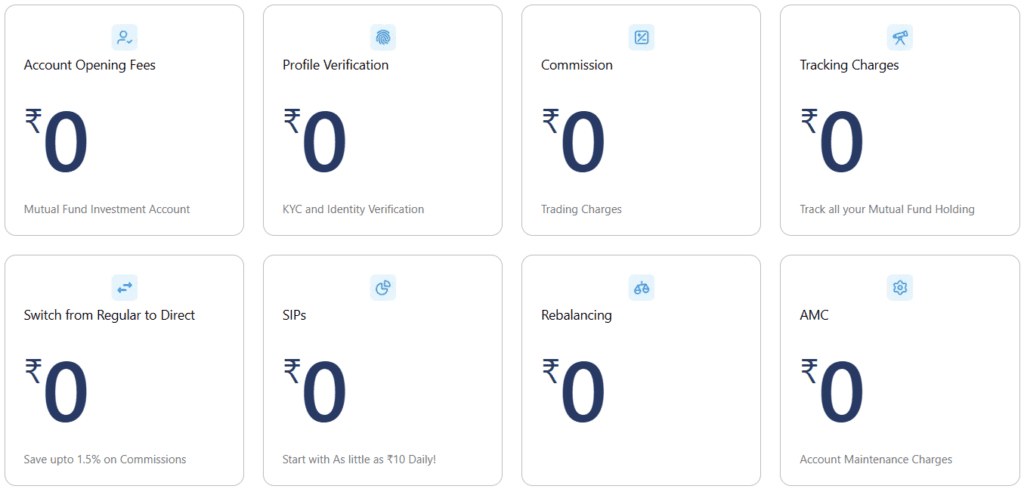

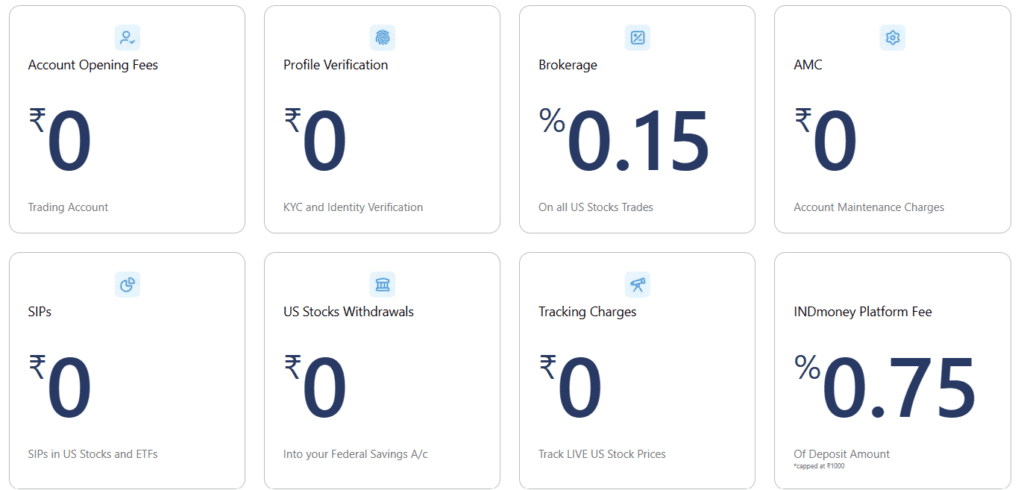

INDmoney does not collect any fees on a yearly maintenance basis known as the annual maintenance charge (AMC), nor does it have any hidden fees. It also gives you the ability to invest in US stocks, whereas Zerodha does not. However, INDmoney charges a platform fee of 0.75% of the deposit amount (capped at ₹1000) in the case of US stocks. The brokerage charge is 0.15% on all US stock trades.

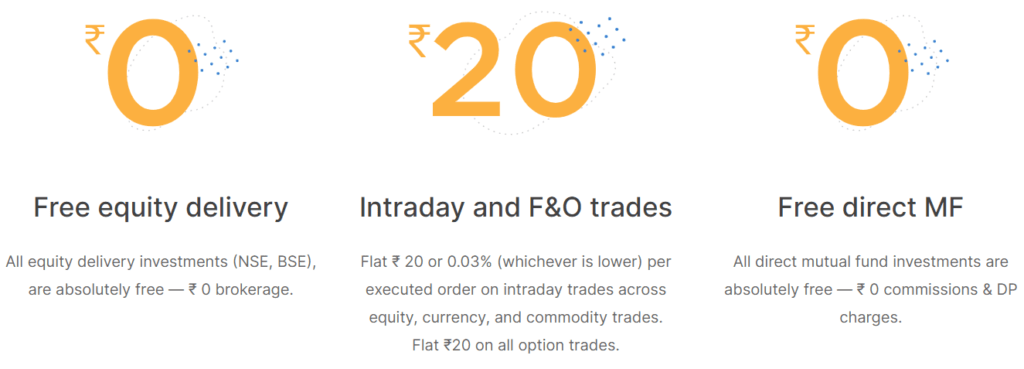

Zerodha provides free equity delivery and direct mutual funds, the same as Indmoney. For Intraday, it provides a flat fee of ₹20 or 0.03% (whichever is lower). On the other hand, INDmoney charges ₹20 or 0.05% (whichever is lower). Thus, with 0.03%, Zerodha provides the cheapest rate compared to INDmoney and also within the industry. Open a Zerodha account at the cheapest rate here.

Note: In the case of US stock on Indmoney, the money withdrawal charge is $5. Dividends are taxed at source at a rate of 25%. For above Rs 7 lakh, there is 5% TCS.

₹0 Free equity delivery

₹ 0 brokerages on Equity & Mutual fund

- All equity delivery investments (NSE, BSE), are absolutely free — ₹ 0 brokerage.

- Free direct MF

Indmoney vs Zerodha: Stamp Duty charges

The government will charge you this fee in order to issue the contract note necessary for your trading activity.

| Demat | Charge type | Equity delivery | Equity intraday | F&O – Futures | F&O – Options |

|---|---|---|---|---|---|

| Zerodha charges | STT/CTT | 0.1% on buy & sell | 0.025% on the sell side | ₹0 on Buy & 0.0125% on sell | – 0.125% of the intrinsic value on options that are bought and exercised – 0.0625% on sell side (on premium) |

| Indmoney charge | STT/CTT | 0.1% Buy and Sell | 0.025% on the sell side | – ₹0 on Buy & – 0.0125% on Sell | – 0 on Buy – 0.0625% (on premium) Sell |

It can be seen that the STT/CTT charges of Indmoney and Zerodha are the same.

Indmoney vs Zerodha: SEBI Turnover Charges

| Demat | Charge type | Equity delivery | Equity intraday | F&O – Futures | F&O – Options |

|---|---|---|---|---|---|

| Zerodha charges | SEBI Charges For both Buy & Sell | ₹10 / crore | ₹10 / crore | ₹10 / crore | ₹10 / crore |

| Indmoney charge | SEBI Charges For both Buy & Sell | 0.0001% of Turnover | 0.0001% of Turnover | 0.0001% of Turnover | 0.0001% of Turnover |

The Securities and Exchange Board of India assesses this fee in order to cover the costs of regulating the markets. This will cost 0.0001% of the total value of your purchase.

Physical Statement Delivery charge of Indmoney and Zerodha

- In the case of Indmoney, any statement that is asked to be sent physically will incur a fee of 300 per request, in addition to ₹300 for the cost of the courier service.

- In the case of Zerodha, it does not charge a separate fee for requesting a physical statement delivery. However, you will be responsible for paying the courier charges, which are typically around ₹20.

Off-market Transfer charges: Charges not made on the market

- Zerodha charges ₹25 or 0.03% of the transfer value (whichever is higher).

- In Indmoney, you will be charged a fee of 10 for any off-market transactions that you choose to execute, and this fee will include any depository fees that may be applicable.

Indmoney vs Zerodha: Remat Charges

Rematerialization of shares refers to the process by which electronic shareholdings may be turned into physical share certificates. This can be done by a shareholder at their own expense.

- In Indmoney, there is a charge of INR 250 per certificate that is rematerialized, and it includes any expenses that may be incurred by the Depository.

- The rematerialization charges for Zerodha are ₹150 per certificate + CDSL charges + ₹100 courier charges.

| Broker | Rematerialization Fee per Certificate | Additional Charges |

|---|---|---|

| Indmoney | INR 250 | Inclusive of Depository charges |

| Zerodha | INR 150 | CDSL charges + INR 100 courier charge |

Indmoney vs Zerodha: Dematerialization Charges

These fees are assessed whenever a request for dematerialization of shares is completed on your behalf. Your physical share certificates may be turned into electronic shareholdings via a process called dematerialization of shares, which is a term that refers to the procedure itself.

- In Indmoney, there is a charge of INR 250 per certificate that is dematerialized, and it includes any expenses that may be incurred by the depository.

- Zerodha charges ₹150 per share certificate for dematerialization, plus a courier charge of ₹100 per dematerialization request and 18% GST.

Deposit via Netbanking on Indmoney and Zerodha

These are the fees associated with the payment gateway, and they amount to:

- Indmoney charges ₹10 for each deposit that is made via Internet banking. (There is no fee for deposits that are carried out via UPI)

- In Zerodha, ₹9 + GST (Not levied on transfers done via UPI)

Indmoney vs Zerodha: Charges for Call and Trade

- Orders that are made via Indmoney support or the trading desk are subject to an additional fee of ₹500 per order. You can place buy and sell orders by calling Indmoney at 07314852023

- Orders placed through a dealer at Zerodha, including orders with auto square-off, are subject to additional fees of ₹50 per order.

Indmoney vs Zerodha: GST charges

This is the tax that the government imposes on services that are provided.

In both Indmoney and Zerodha, brokerage fees, SEBI fees, deposits made via net banking, DP fees, auto-square-off fees, call and trade fees, demat/remat fees, and physical statement fees are all subject to this 18% tax.

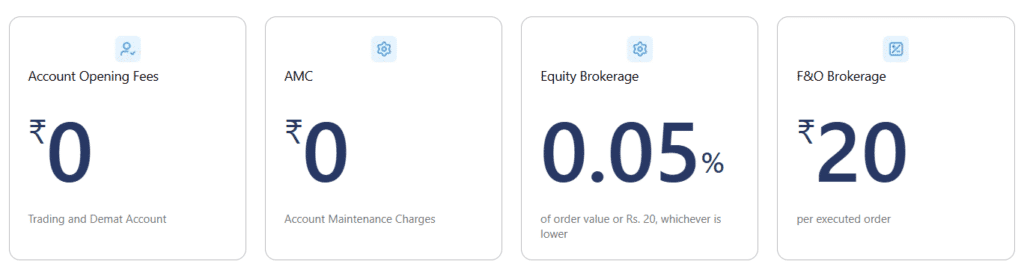

Indmoney vs Zerodha: Account Opening Charges

Indmoney charges no account opening fees. Zerodha charges a one-time account opening fee. The fee depends on the type of account you choose, such as an individual account or a corporate account.

| Type of account | Indmoney charges | Zerodha Charges |

|---|---|---|

| Online account | ₹ 0 | ₹ 200 |

| Offline account | ₹ 0 | ₹ 500 |

| NRI account (offline only) | ₹ 0 | ₹ 500 |

| Partnership, LLP, HUF, or Corporate accounts (offline only) | ₹ 0 | ₹ 500 |

Brokerage Charges: Indmoney vs Zerodha

Both Zerodha and Indmoney charge Zero Brokerage for equity delivery. With 0.03%, Zerodha provides the cheapest rate compared to INDmoney which charges 0.05% in intraday and also within the industry.

| Broker | Charge type | Equity delivery | Equity intraday | F&O – Futures | F&O – Options |

|---|---|---|---|---|---|

| Zerodha charges | Brokerage | Zero Brokerage | 0.03% or Rs. 20/executed order, whichever is lower | 0.03% or Rs. 20/executed order whichever is lower | Flat Rs. 20 per executed order |

| Indmoney charges | Brokerage | Zero Brokerage | 0.05% of order value or Rs. 20, whichever is lower | ₹20 per executed order | ₹20 per executed order |

Depository Charges on Zerodha and Indmoney

For Zerodha, there is a simple charge of ₹13.5 + GST per scrip (irrespective of quantity), which is debited from the trading account when stocks are sold. This is charged by the depository (CDSL) and the depository participant (Zerodha).

For Indmoney, the depository charge breakdown is as follows:

| Charge type | Indmoney | Zerodha |

| DP Charges for Delivery (on Sell Orders) | ₹0 Intraday: Buy & Sell | ₹13.5/scrip Delivery Sell |

| Modification in CML | ₹25 per request | |

| Physical Statement Courier | ₹300 per request + ₹300 courier charges | |

| Off-market Transfers from the Demat Account Including the depository transaction charges | ₹10 per transaction | |

| Remat Charges Including the depository transaction charges | ₹250 per certificate | |

| Demat Charges Including the depository transaction charges | ₹250 per certificate |

Indmoney vs Zerodha: AMC Charges

- Indmoney levies an annual maintenance charge to maintain your demat account.

- In Zerodha for the BSDA demat account, there is a zero AMC charge if the holding value is less than ₹50,000. For non-BSDA demat accounts: ₹300/year + 18% GST charged quarterly (90 days).

Also read: HDFC Sky vs Zerodha: Which is better?

Indmoney vs Zerodha: Regulatory Charges

Exchange Transaction Charges for both Buy and Sell:

| Broker | Type of Charge | Equity Delivery | Equity Intraday | Futures | Options |

| Indmoney | Exchange Transaction Charges (Delivery and Intraday for both Buy and Sell) | 0.00325% NSE | 0.00375% BSE | – 0.0019% (on contract value) NSE – 0 BSE | – 0.050% (on premium) NSE – 0.0050%(on premium) BSE |

| Zerodha | Exchange Transaction Charges (Delivery and Intraday for both Buy and Sell) | 0.10% Delivery: Buy and Sell | 0.025% Intraday Sell | NSE: 0.0019% BSE: 0 | NSE: 0.05% (on premium) BSE: 0.005% (on premium) |

Indmoney vs Zerodha: Other Charges

Apart from the account opening charges, brokerage charges, and AMC charges, there might be other costs associated with Indmoney. These could include charges for SMS alerts, transaction statements, physical contract notes, or additional research and analysis tools.

| Type of Charges | Indmoney | Zerodha |

| Deposit using Netbanking | ₹10 | ₹10+GST |

| Auto-square-off charges (For Open intra-day Day Positions) | Rs 20 per position | ₹50 per position |

| Call & Trade charges | ₹500 per order | ₹50 per order |

| GST On Brokerage, DP Charges, Exchange Transaction Charges, SEBI Turnover Charges and Auto Square-off Charges | 18% | 18% |

Example: Zerodha’s All Intraday Equity charges

Consider purchasing 400 shares for 1000 and selling them for 1100.

Charges incurred

| Turnover | 840000 |

| Brokerage | 40 |

| STT total | 110 |

| Exchange txn. charge | 27.3 |

| Clearing charge | 0 |

| GST | 12.11 |

| SEBI charges | 0.99 |

| Stamp duty | 12 |

| Total tax and charges | 202.4 |

| Points to breakeven | 0.51 |

| Net P&L | 39797.6 |

The net profit is 39,976 after all the charges are deducted. Let’s see the charges in detail.

Comparison with other platforms

Zerodha’s cost structure and low brokerage charges have made it a popular choice among traders and investors. However, it’s important to evaluate the overall value proposition, including the platform’s features, customer support, and usability, in addition to charges. Indmoney started Indian stock trading in 2021 and is comparatively new to Zerodha.

Also read: Best app for buying stocks in India

Indmoney and Zerodha charges explained

Exchange Transaction/Turnover Charges This is charged by the exchange : NSE/BSE; on the value of your transactions executed on the respective exchange. For NSE, The charge is 0.00325% of the transaction value for all stocks. For BSE, The charge depends on the group of the traded stock, and is as follows : Stocks part of Group A,B,E,F,FC,G,GC,I, and W are charged @ 0.00375% of transaction value. Stocks part of Group M,MT,TS,MS,IF,IT, and R are charged @ 0.00275% of transaction value. Stocks part of Group X,XT,Z are charged @ 0.1% of transaction value. Stocks part of Group P,ZP are charged @ 1% of transaction value. Stocks traded under the odd lot mechanism (excluding scrips belonging to M,IF, and IT) are charged @ 1% of transaction value. DP (Depository Participant) Charges (On Delivery Sell Orders) This is charged by the depository and depository participant for debiting shares from your demat account and inter-settlement BTST transactions. This is charged as: DP charges when buying : ₹ 0 DP charges when selling: ₹ 13.5 + GST per ISIN (stock or ETF) per day, regardless of quantity sold. Examples to understand how this works? Example 1: Say you execute 5 delivery sell orders in Stock X in one trading session. For this activity you will be charged ₹ 13.5+GST. As in this case you sold only 1 ISIN (Stock X) multiple times, and DP charges depends on the number of unique ISINs sold as delivery orders (in this case 1), regardless of the individual quantity/orders of each ISIN sold. Example 2: Say you execute 10 delivery sell orders , 3 in Stock X, 5 in Stock Y, and 2 in Stock Z. For this activity, you will be charges a total of 3*(₹ 13.5+GST). As in this case you sold 3 ISINs (Stock X, Stock Y,and Stock Z) multiple times, and DP charges depends on the number of unique ISINs sold as delivery orders (in this case 3), regardless of the individual quantity/orders of each ISIN sold. Securities Transaction Tax (STT) This is charged by the government when you transact on the exchanges. Charged as above on both buy and sell orders for equity delivery trades. Charged as above only for sell order for equity intraday trades. When trading at INDmoney, STT can be alot more than the brokerage we charge. Important to keep a tab on. This is charged as: For equity deliver orders (Buy and Sell) : 0.1% of order amount. For equity intraday orders (charged only on the sell order) : 0.025% of order amount.

Conclusion

Both platforms offer competitive charges and strive to provide user-friendly experiences. Indmoney stands out with its flat fee structure and comprehensive research tools, while Zerodha appeals to cost-conscious investors with its low-cost brokerage model and no AMC charges.