After personally testing both platforms extensively and diving deep into user experiences across multiple forums, I can confidently say that choosing between Upstox and Dhan isn’t just about brokerage charges anymore. It’s about finding a platform that matches your trading style, provides the right tools, and doesn’t frustrate you when markets are moving fast.

Table of Contents

Quick Decision Matrix: Which Platform Suits You?

Before we dive into the nitty-gritty details, let me give you a quick framework to decide:

Choose Dhan if you are:

- ✅ An options trader who values speed and advanced tools

- ✅ Someone who wants zero brokerage on equity delivery

- ✅ A TradingView enthusiast who wants seamless integration

- ✅ Looking for real-time margin updates and basket order benefits

Choose Upstox if you are:

- ✅ A new trader who prefers guided trading with research recommendations

- ✅ Someone who values established broker reputation and larger user base

- ✅ Looking for comprehensive financial services beyond trading

- ✅ Want access to detailed market analysis and advisor picks

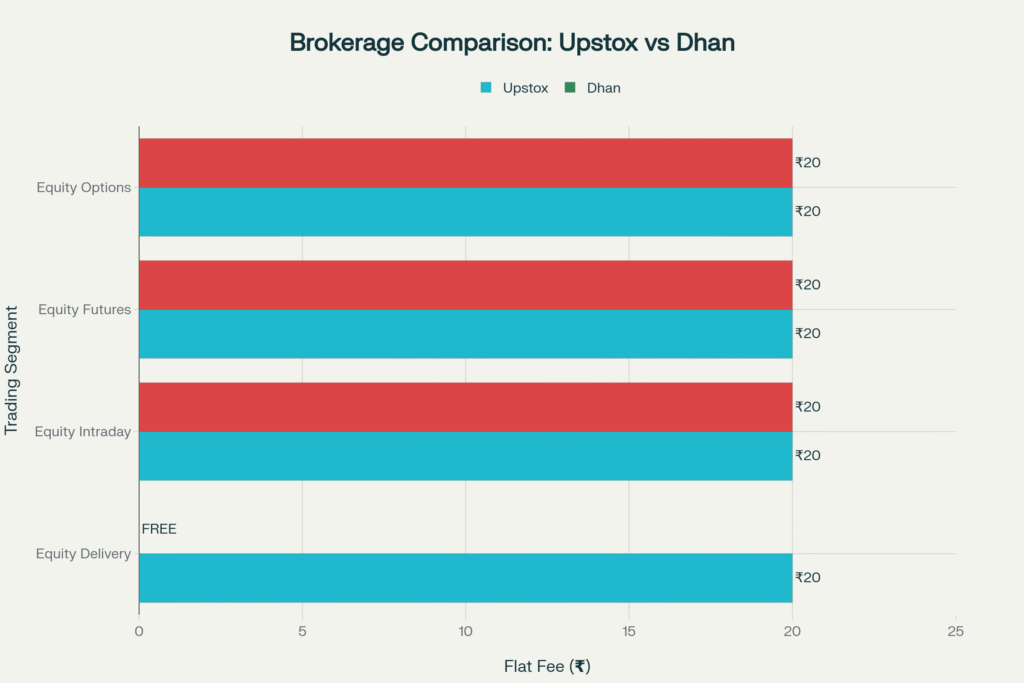

Brokerage Charges: Where Your Money Actually Goes

Let’s cut through the marketing fluff and see what you’ll actually pay:

| Feature | Upstox | Dhan |

|---|---|---|

| Equity Delivery Brokerage | ₹20 per order or 2.5% (whichever is lower) | Free (Zero Brokerage) |

| Equity Intraday Brokerage | ₹20 per order or 0.1% (whichever is lower) | ₹20 per order or 0.03% (whichever is lower) |

| Equity Futures Brokerage | ₹20 per order or 0.05% (whichever is lower) | ₹20 per order or 0.03% (whichever is lower) |

| Equity Options Brokerage | ₹20 per order (flat) | ₹20 per order (flat) |

| Currency Futures Brokerage | ₹20 per order or 0.05% (whichever is lower) | ₹20 per order or 0.03% (whichever is lower) |

| Currency Options Brokerage | ₹20 per order (flat) | ₹20 per order (flat) |

| Commodity Futures Brokerage | ₹20 per order or 0.05% (whichever is lower) | ₹20 per order or 0.03% (whichever is lower) |

| Commodity Options Brokerage | ₹20 per order (flat) | ₹20 per order (flat) |

| Account Opening Charges | Free | Free |

| Annual Maintenance Charges (AMC) | Free (lifetime) | Free (lifetime) |

| Call & Trade Charges | ₹50 + 18% GST per order | ₹50 per order |

| Demat Account Opening | Free | Free |

Dhan Referral code

The Real Cost Analysis

From my calculations after trading with both platforms, here’s what the numbers actually mean:

For a ₹1,00,000 equity delivery trade:

- Dhan: ₹0 brokerage (Yes, absolutely free!)

- Upstox: ₹20 brokerage

For a ₹1,00,000 intraday trade:

- Dhan: ₹20 (since 0.03% = ₹30, but capped at ₹20)

- Upstox: ₹20 (since 0.1% = ₹100, but capped at ₹20)

The Hidden Winner: Dhan’s lower percentage rates (0.03% vs 0.05%/0.1%) become significant for smaller trades where the percentage kicks in before the ₹20 cap.

Platform Experience: My Hands-On Testing Results

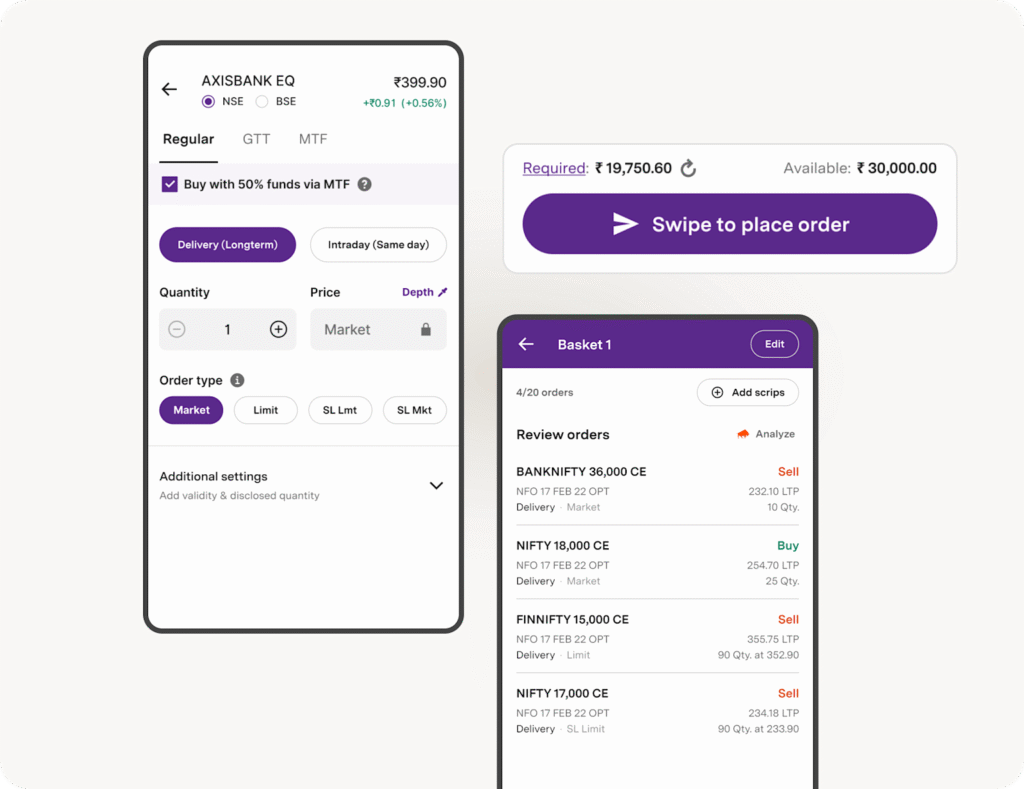

Dhan’s Strengths That I’ve Personally Experienced

After using Dhan for the past six months, here’s what stands out:

⚡ Lightning-Fast Execution

During the July market volatility, I consistently got faster order executions on Dhan compared to Upstox. The difference was especially noticeable during high-volume periods.

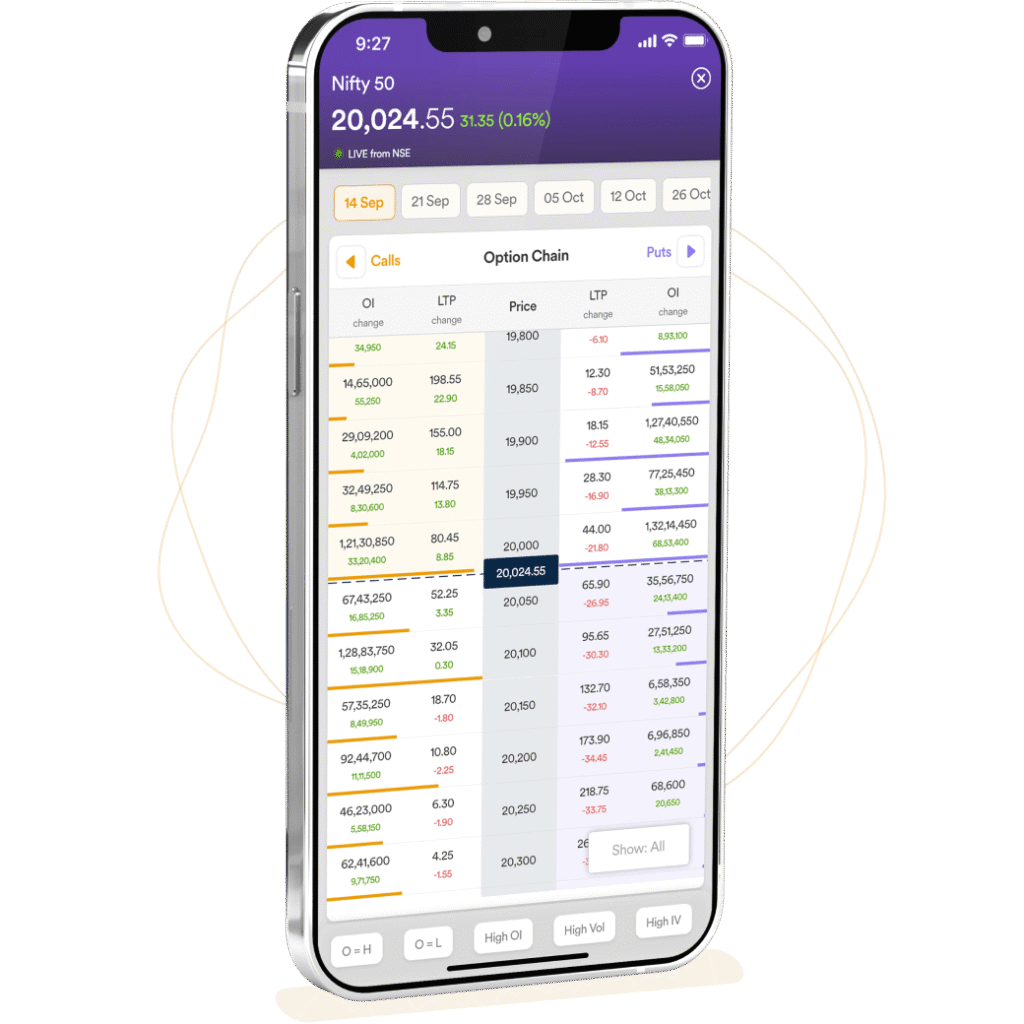

📊 Superior Options Trading Experience

The dedicated Options Trader app is very interesting. Unlike Upstox where options trading is integrated into the main app, Dhan’s separate app loads faster and provides better real-time data.

🔄 Real-Time Margin Updates

This might sound trivial, but when you’re hedging positions, seeing margin benefits instantly (not after 2-3 minutes like some platforms) makes a huge difference in decision-making.

Upstox’s Advantages From My Usage

🧠 Better for Beginners

The Advisor’s Pick feature genuinely helps new traders. I’ve seen several of my friends benefit from the research-backed recommendations with clear entry/exit points.

🏢 Established Infrastructure

With over 10 million users, Upstox rarely faces server issues during market hours. Their infrastructure can handle peak trading volumes better.

💼 Comprehensive Financial Services

If you want everything under one roof – insurance, loans, mutual funds – Upstox provides a more holistic financial ecosystem.

Feature Comparison: Beyond the Marketing Claims

| Feature | Upstox | Dhan |

|---|---|---|

| TradingView Integration | Yes (Connect to TradingView) | Yes (Native + tv.dhan.co) |

| Options Strategy Builder | Yes (Up to 8 legs) | Yes (Advanced) |

| Option Chain Analysis | Yes | Yes (Advanced) |

| Mutual Funds | Yes (Direct MFs) | Yes (Zero commission) |

| IPO Applications | Yes (UPI based) | Yes (UPI based) |

| Margin Trading Facility (MTF) | Yes | Yes (4X margin on 1000+ stocks) |

| Basket Orders | Yes | Yes |

| SIP in Stocks | Limited | Yes (Stock SIPs) |

| Algo Trading Support | Yes (API support) | Yes (Free APIs) |

| Research & Advisory | Advisor’s Pick feature | Limited |

| Mobile App Rating (Play Store) | 4.0+ stars | 4.2+ stars |

| Web Trading Platform | Yes (Pro Web) | Yes (Desktop optimized) |

| Option Trader App | No (Integrated in main app) | Yes (Dedicated Options Trader App) |

| API Trading | Yes (DhanHQ APIs) | Yes (Free DhanHQ APIs) |

| Commodity Trading | Yes | Yes |

| Currency Trading | Yes | Yes |

| After Market Orders (AMO) | Yes | Yes |

| Bracket Orders | No | Yes |

| Cover Orders | Yes | No |

| Good Till Triggered (GTT) | Yes (Limited in Options) | Yes (Including Options) |

| Real-time Margin Updates | Good | Excellent (Real-time) |

| Advanced Charting Tools | Good | Excellent |

TradingView Integration: The Make-or-Break Factor

Dhan’s Approach: Native integration plus a dedicated tv.dhan.co platform where you can trade directly from TradingView charts.

Upstox’s Approach: Connect feature that links your Upstox account to TradingView, but order placement still requires switching interfaces.

My Take: If you’re serious about technical analysis, Dhan’s implementation feels more seamless. You can literally place orders without leaving the chart.

Options Trading: Where Dhan Clearly Wins

From my options trading experience:

Dhan Advantages:

- ✅ GTT orders work in options (Upstox has limitations)

- ✅ Instant margin benefit preview for complex strategies

- ✅ Dedicated Options Trader app with advanced option chain

- ✅ Real-time P&L tracking for multi-leg strategies

Upstox Advantages:

- ✅ Strategy builder with up to 8 legs (recently launched)

- ✅ Better research integration for options strategies

- ✅ More educational content for options beginners

Mobile App Performance: Daily Usage Reality

Dhan Mobile Experience:

- App rating: 4.2+ stars on Play Store

- Faster loading times, especially for options data

- Cleaner UI with better navigation for advanced features

- Some users report occasional bugs in new feature rollouts

Upstox Mobile Experience:

- App rating: 4.0+ stars on Play Store

- More stable overall (fewer bugs due to mature platform)

- Better integration of research and advisory features

- Sometimes feels cluttered with too many features in one interface

Recent Updates That Matter (August 2026)

Upstox’s Latest Moves

July 2026 Updates:

- Chart 360 now available on web (finally!)

- Trade volatility directly from India VIX chart

- Turbo Speed for Plus users (2X faster market data)

- Import watchlists via Excel

August 2026 Features:

- Common wallet for commodities and stocks

- Enhanced physical settlement process

- Market Price Protection for volatile trades

Dhan’s Continuous Innovation

While Dhan doesn’t announce monthly feature lists like Upstox, their incremental improvements are more focused:

- Consistent TradingView integration enhancements

- Regular options trading tool improvements

- Better margin calculation algorithms

- Enhanced API capabilities for algo traders

Cost Analysis: Real Examples from My Trading

Let me share some actual scenarios from my trading to show you the real cost differences:

Scenario 1: Long-term Investor (₹2 lakh monthly investment)

- Dhan: ₹0 brokerage on equity delivery = ₹0/month

- Upstox: ₹20 per order × 10 orders = ₹200/month

- Annual Savings with Dhan: ₹2,400

Scenario 2: Intraday Trader (₹50,000 daily turnover)

- Dhan: ₹20 × 22 trading days = ₹440/month

- Upstox: ₹20 × 22 trading days = ₹440/month

- Difference: Negligible for this trade size

Scenario 3: Options Trader (10 trades/month)

- Both platforms: ₹20 × 10 = ₹200/month

- Real difference: Dhan’s faster execution and better tools justify the same cost

Customer Support: My Personal Experiences

Dhan Support:

- Response time: Usually within 2-4 hours for technical issues

- Quality: Good technical knowledge, especially for trading platform issues

- Complaint resolution: 99% resolution rate (impressive!)

- Limitation: Smaller support team means longer waits during peak times

Upstox Support:

- Response time: 4-8 hours for general queries

- Quality: Better trained for beginner questions and account-related issues

- Volume handling: Better equipped for high query volumes

- Limitation: Sometimes generic responses that don’t solve specific technical issues

Based on SEBI data, Dhan had only 10 complaints vs Upstox’s 289 complaints in 2026, with Dhan resolving 99% vs Upstox’s 86.3%.

Who’s Winning the Innovation Race?

Dhan’s Focus Areas:

- Advanced trading tools for serious traders

- Speed and execution improvements

- Options trading enhancement

- API and algo trading support

Upstox’s Focus Areas:

- Comprehensive financial services

- Research and advisory features

- User acquisition and retention

- Plus plan premium features

The Verdict: My Honest Recommendation

After using both platforms extensively, here’s my honest assessment:

Choose Dhan if:

- You’re primarily focused on trading (especially options)

- Speed and execution matter more than hand-holding

- You want to minimize costs on equity delivery

- TradingView integration is important to your trading style

- You value innovative features over established reputation

Choose Upstox if:

- You’re new to trading and want guidance

- You prefer an all-in-one financial platform

- Brand reputation and user base size matter to you

- You want comprehensive research and advisory services

- You’re willing to pay slightly more for additional services

Which is more beginner-friendly?

Dhan is designed with simplicity in mind, making it the better choice for beginners.

Is Dhan as secure as Upstox?

Absolutely. Dhan complies with all regulatory standards and uses advanced encryption for user security.

Post Disclaimer

For informational purposes only:

The information presented on this website is for informational purposes only and should not be construed as financial, legal, or professional advice. While we strive to provide accurate and up-to-date information, we cannot guarantee its completeness or accuracy. Any opinions expressed herein are solely those of the author or individual contributor and do not necessarily reflect the views of any company, organization, or other entity.

Do your own research:

Readers are encouraged to conduct their due diligence and consult with a qualified professional before making any decisions based on the information presented on this website. Trading, investing, and other financial activities involve inherent risks, and you could lose all or a portion of your capital. Past performance is not indicative of future results.