Waya is a SEBI-registered investment advisory platform (Registration: INH000010876) that leverages predictive algorithms and machine learning to provide stock recommendations to Indian investors. Launched in 2022 by Mumbai-based Waya Financial Technologies Private Limited, the platform specifically targets millennials and Gen-Z investors seeking technology-driven investment guidance.

Key Company Details:

- SEBI Registration Numbers: INH000010876 (Research Analyst), INP000008987 (Portfolio Management Services)

- Founded: 2022

- Headquarters: Mumbai, Maharashtra

- Active Subscribers: 100,000+ paying users

- Assets Under Management: ₹300+ crores

Waya App Features: What You Actually Get for Your Money

🎯 Core Investment Services

Stock Recommendations

- Daily stock calls expecting 10% returns within 30 days

- Buy, hold, and exit zone guidance with specific price ranges

- Coverage of fundamentally strong stocks from NSE/BSE

Multibagger Portfolio

- Long-term investment ideas targeting 3x to 5x returns

- Hold periods ranging from 30 months for maximum growth potential

- Focus on small and mid-cap companies with high growth prospects

Short Selling Features

- Trade recommendations when stocks are expected to decline

- Separate advisory for bearish market conditions

- ⚠️ Warning: High risk involved, especially for new traders

🔧 Technical Features

Integration & Accessibility

- Compatible with 16 major brokers including Zerodha, Angel One, Upstox

- WhatsApp notifications for buy/sell alerts

- iOS and Android mobile applications

- Real-time market and sectoral trend analysis

Educational Resources

- Basic tutorials and market concept explanations

- Limited educational content compared to competitors

- Fundamental parameter displays for stock analysis

Waya App Pricing 2025: Complete Cost Breakdown

The pricing structure varies significantly across different sources, creating confusion for potential subscribers:

Official App Store Pricing:

- Quarterly Plan: ₹1,299 (₹433/month)

- Annual Plan: ₹2,499 (₹208/month)

Alternative Pricing Plans:

- Premium “Waya Believer” Plan: ₹2,500 quarterly, ₹4,500 annually

- Reported Third-Party Pricing: ₹1,750 quarterly, ₹2,700 annually

❌ Major Pricing Issues:

- No free trial or free plan available

- No transparent pricing on official website

- Multiple conflicting price points across platforms

- Expensive compared to competitors offering free trials

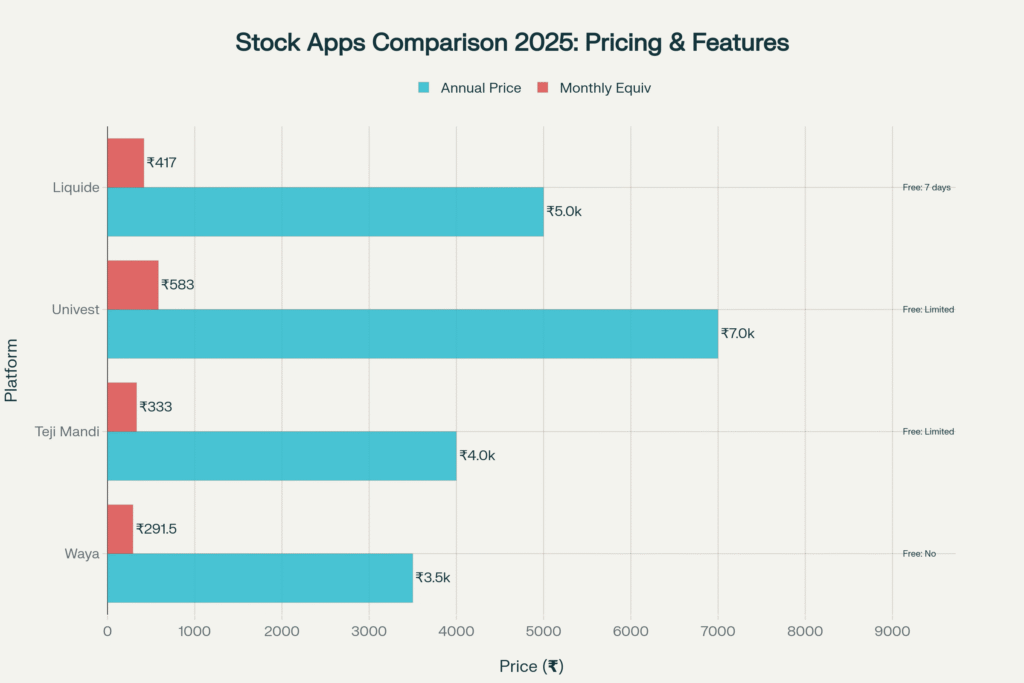

Waya vs Competitors: How Does It Really Stack Up?

Based on comprehensive market analysis, here’s how Waya compares to leading alternatives:

🏆 Teji Mandi (Winner)

- Pricing: ₹999 quarterly, ₹3,999 annually

- Advantages: Portfolio rebalancing, comprehensive education, phone support

- Rating: 4.5/5 stars

- Free Plan: Yes (limited features)

🥈 Univest

- Pricing: ₹1,999 quarterly, ₹6,999 annually

- Advantages: Multi-asset coverage, real-time alerts, excellent support

- Rating: 4.3/5 stars

- Free Plan: Yes (limited features)

🥉 Waya

- Free Plan: ❌ None available

- Pricing: ₹1,299-2,500 quarterly, ₹2,499-4,500 annually

- Advantages: SEBI registered, WhatsApp notifications

- Rating: 4.2/5 (main app), 3.2/5 (F&O app)

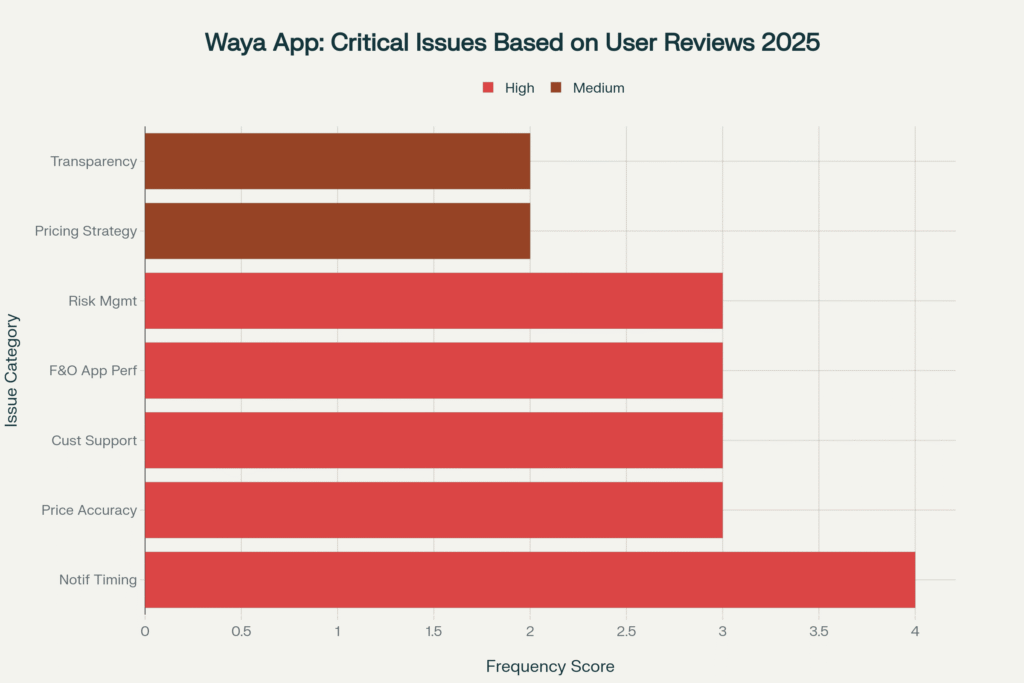

🚨 High-Severity Problems

1. Delayed Notifications (Most Critical)

- Users report 30-45 minute delays in receiving trade alerts

- By the time notifications arrive, stock prices have already moved beyond buying range

- This timing issue makes profitable execution nearly impossible

2. Price Accuracy Issues

- Recommended buying prices often don’t match current market prices

- Creates significant execution challenges for subscribers

- Users unable to buy at suggested price ranges

3. Poor Customer Support

- Only email support available (support@thewaya.com)

- No phone support or live chat

- Slow response times to user queries

4. F&O App Performance Crisis

- Separate F&O app has devastating 3.2/5 rating

- Users report massive losses following F&O recommendations

- Multiple reviews mentioning losses of ₹50,000-₹1,00,000

⚠️ Medium-Severity Concerns

Transparency Issues

- Some users claim losing trades are not properly documented

- Only profitable trades prominently displayed

- Lack of comprehensive performance tracking

Risk Management Gaps

- No quantity guidance for position sizing

- Limited risk management tools for beginners

- Insufficient educational content compared to competitors

Real User Experiences: Success Stories vs Warning Signs

✅ Positive User Feedback

- “Unreal accuracy… feels like they are manipulating prices” – Mukul (App Store review)

- Users appreciate clear buy/hold/exit signals

- SEBI registration adds credibility for many investors

❌ Warning Signs from Users

- “Wasted 5k on subscription and 1 lakh in their calls” – F&O App user

- “All trades are making losses” – Multiple F&O users

- “Notifications are totally inconsistent” – Main app user

- “I never made a single penny from this app” – Verified user

Should You Subscribe to Waya App? My Honest Recommendation

❌ DON’T Subscribe If:

- You’re a beginner trader needing guidance and support

- You require real-time notifications for profitable execution

- You want comprehensive customer service

- You’re interested in F&O trading (their F&O app has terrible reviews)

- You prefer trying before buying (no free trial available)

✅ Consider Waya If:

- You’re an experienced trader who can handle delayed notifications

- You specifically want SEBI-registered advisory services

- You’re comfortable with email-only support

- You don’t mind paying premium pricing without trial options

🏆 Better Alternatives to Consider:

For Beginners: Teji Mandi (comprehensive education + portfolio management)

For Active Traders: Univest (real-time alerts + multi-asset coverage)

For Budget-Conscious: Liquide (7-day free trial + analytics focus)

Final Verdict: Waya App Rating

Overall Rating: 2.5/5 ⭐⭐⚠️

Strengths:

- SEBI registration provides regulatory credibility

- Decent main app performance (4.2/5 rating)

- WhatsApp notification convenience

Critical Weaknesses:

- Severe notification timing delays affecting profitability

- No free trial or customer support infrastructure

- Problematic F&O app with user loss reports

- Expensive pricing without corresponding value delivery

Bottom Line: While Waya offers SEBI-registered advisory services, the critical execution issues, poor customer support, and lack of transparency make it difficult to recommend over established competitors like Teji Mandi or Univest. The company needs to address fundamental operational problems before justifying premium pricing.

For most investors, especially beginners, I recommend starting with platforms offering free trials and comprehensive support systems. Waya might improve with time, but currently, the risk-reward profile doesn’t favor subscribers given the available alternatives in 2025.

As I got closer to retirement, I trusted Waya to help me plan for my financial future. Its accurate advice and educational materials have been very helpful in making sure that my retirement is stable and successful.

Siddhi (Waya user)

Post Disclaimer

For informational purposes only:

The information presented on this website is for informational purposes only and should not be construed as financial, legal, or professional advice. While we strive to provide accurate and up-to-date information, we cannot guarantee its completeness or accuracy. Any opinions expressed herein are solely those of the author or individual contributor and do not necessarily reflect the views of any company, organization, or other entity.

Do your own research:

Readers are encouraged to conduct their due diligence and consult with a qualified professional before making any decisions based on the information presented on this website. Trading, investing, and other financial activities involve inherent risks, and you could lose all or a portion of your capital. Past performance is not indicative of future results.