Picking the right broker is very important because it will help you find your way in this huge and changing market. Even though Zerodha is the leader, which broker is better than Zerodha?

There are several other brokers that are ready to help you have a smooth and profitable journey. We will compare Zerodha with Upstox and Groww, three well-known choices, to help you find the right trading platform.

Zerodha: The Well-Known Broker

Since its launch, Zerodha has become a popular online discount provider thanks to its easy-to-use platform, low prices, and mobile app. A lot of people use it because it’s easy to use, has educational tools, and lets you trade stocks for free. But Zerodha might not be the best choice for everyone, especially those who want advanced features or a lot of study materials. It does have some problems, such as rare downtime and a steep learning curve for new users.

Upstox: A Strong Player

Upstox stands out as a strong contender thanks to its low brokerage fees, a wide range of investment choices, and easy-to-use trading platforms. It has advanced charting tools, study reports, and algorithmic trading features that both experienced traders and people who want a more complete trading experience will find useful. Upstox also has an easy-to-use mobile app that lets you trade while you’re out and about.

Today’s Offer

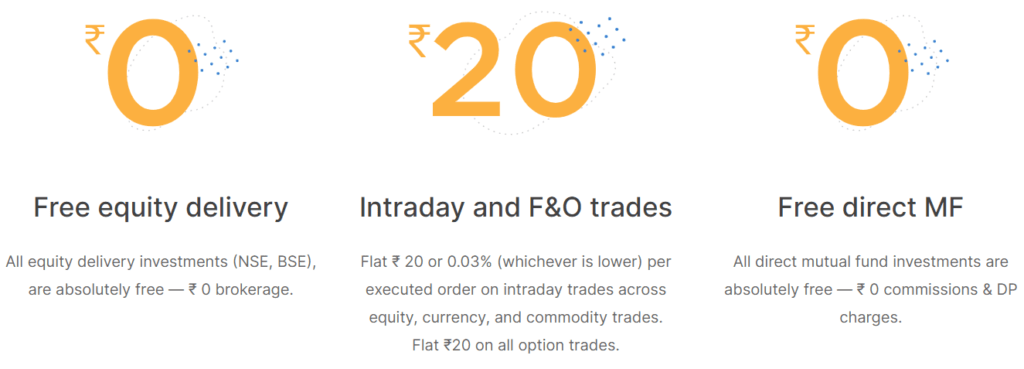

Groww is the emerging player

Groww has become a popular choice for new investors and people who want an easy-to-use interface with fewer investing options. Its UI is amazing, which makes it beginner-friendly. It lets you invest in mutual funds, which makes it a good choice for managing a diverse portfolio. But Groww’s study and trading tools might not be as complete as those on Zerodha or Upstox.

Groww vs Upstox vs Zerodha: Side-by-side comparison

We’ve compared Zerodha, Upstox, and Groww in several factors to help you choose the best trading platform for you:

| Feature | Zerodha | Upstox | Groww |

|---|---|---|---|

| Brokerage Charges | Flat ₹ 20 or 0.03% (whichever is lower) | Flat ₹20 or 0.05%, whichever is lower | Flat ₹20 or 0.05%, whichever is lower |

| Investment Options | Stocks, F&O, Currency Derivatives | Stocks, F&O, Currency Derivatives, IPOs, Mutual Funds | Stocks, F&O, Currency Derivatives, Mutual Funds, Fractional Shares |

| Trading Platforms | Kite web, Kite Mobile | Pro Web, Pro Mobile, Upstox Connect (Algorithmic Trading) | Groww Web, Groww Mobile |

| Educational Resources | Varsity (educational articles and courses) | Upstox Learn (educational articles and videos) | Groww Academy (articles, videos, and webinars) |

| Customer Support | Chat and ticket support | Chat, call, and email support | Chat and ticket support |

Today’s Offer

Review by Users

Zerodha is liked for its prices, but Upstox and Groww are better for their customer service and how easy their platforms are to use.

Is Zerodha the best?

Zerodha does very well in a number of areas, such as:

- Zerodha is a popular choice for traders who want to save money because it has low brokerage fees and no hidden costs.

- The platform that is easy to use: Both the web and mobile versions of Kite are simple and straightforward, even for new users.

- There are a lot of articles and classes on Zerodha’s Varsity platform that can help you learn about trading.

- A lot of different products: As well as direct mutual funds, Zerodha lets you trade stocks, foreign exchange, currencies, commodities, and more.

That being said, Zerodha also has some limitations:

- Few research tools: Zerodha has some basic research tools, but they might not be enough for experienced buyers who need more in-depth analysis.

- Help desk: Some users say that Zerodha’s help desk is slow and doesn’t respond to them right away.

- Trading on margin: Zerodha has higher rates for trading on margin than some of its competitors.

A detailed comparison of Zerodha with some other popular online brokers

| Feature | Zerodha | Upstox | Groww | Angel One | 5paisa |

|---|---|---|---|---|---|

| Brokerage Charges | Flat fee (₹20 or 0.01%, whichever is lower) | Flat fee (₹20 or 0.05%, whichever is lower) | ₹20 per order | Tiered structure, starting at 0.25% | Flat fee (₹10 or 0.01%, whichever is lower) |

| Investment Options | Stocks, F&O, currency derivatives | Stocks, F&O, currency derivatives, IPOs, mutual funds | Stocks, F&O, currency derivatives, mutual funds, fractional shares | Stocks, F&O, currency derivatives, IPOs, mutual funds, global markets | Stocks, F&O, currency derivatives, mutual funds, fractional shares |

| Trading Platforms | Kite Web & Mobile | Pro Web & Mobile, Upstox Connect (Algo Trading) | Groww Web & Mobile | Angel One Web & Mobile, Full-service branch network | 5paisa Web & Mobile |

| Research Tools | Basic | Advanced | Limited | Extensive | Basic |

| Educational Resources | Varsity platform | Upstox Learn | Groww Academy | Angel One Smart Money | Limited |

| Customer Support | Chat & Ticket | Chat, Call & Email | Chat & Ticket | Chat, Call & Email | Chat & Ticket |

| Margin Trading Rates | Higher than some competitors | Competitive | N/A | Competitive | Competitive |

| Fractional Shares | No | No | No | No | No |

| Algo Trading | No | Yes | No | Yes | No |

| Global Markets | No | Yes | No | Yes | No |

| Platform Complexity | Beginner-friendly | Moderate | Beginner-friendly | Advanced | Moderate |

| Mobile App Features | Basic | Advanced | Basic | Basic | Basic |

Zerodha

Strengths:

- Low brokerage: Flat charges and no hidden fees.

- User-friendly platform: Intuitive and easy to navigate, even for beginners.

- Variety of products: Stocks, F&O, currencies, commodities, and direct mutual funds.

- Educational resources: The varsity platform offers articles and courses on various trading topics.

Weaknesses:

- Limited research tools: This may not be adequate for experienced investors.

- Customer support: Some users report slow and unresponsive support.

- Margin trading: Rates are higher than some competitors.

Upstox

Strengths:

- Advanced charting tools and research reports.

- Algorithmic trading capabilities.

- Mobile app with advanced features.

- Competitive brokerage charges.

Weaknesses:

- The platform can be complex for beginners.

- Customer support has received mixed reviews.

Groww:

Strengths

- Simple and user-friendly interface.

- Good for beginners.

- UPI Payments, Bills, Mobile recharge, etc

Weaknesses:

- Limited investment options compared to Zerodha.

- Limited research tools.

- Customer support can be slow.

Angel One:

Strengths:

- Wide range of research tools and educational resources.

- Access to global markets.

- Full-service brokerage options.

Weaknesses:

- The platform can be complex for beginners.

- Higher brokerage charges than some competitors.

5paisa:

Strengths:

- Competitive brokerage charges.

- Various subscription plans are available to offer extra discount

- There are a variety of investment options.

Weaknesses:

- Platform can be buggy and unreliable.

- Customer support is slow and not very helpful.

Conclusion

| Feature | Zerodha | Upstox | Groww | Angel One | 5paisa |

|---|---|---|---|---|---|

| Pricing | Most competitive flat fee | Competitive flat fee | Flat fee per order | Tiered structure, can be less competitive for frequent traders | Competitive flat fee |

| Platform | Beginner-friendly, intuitive interface | Moderate complexity, advanced features | Beginner-friendly, mobile-first design | Advanced, full-service options available | Moderate complexity |

| Customer Service | Limited, primarily chat and ticket support | Average, chat, call, and email support | Limited, primarily chat and ticket support | Average, chat, call, and email support | Limited |