The two companies, Groww and Upstox, are both online discount brokers that help people buy and trade in the Indian market. Investors can buy and sell a lot of different types of financial assets through both companies. These include stocks, mutual funds, and exchange-traded funds (ETFs). After reading this blog post, you’ll be able to choose between Groww and Upstox. Let’s look more closely at the ways that Groww and Upstox are different and how they are the same.

Groww vs Upstox Comparison Highlights

| Category | Groww | Upstox |

|---|---|---|

| Type of Broker | Discount Broker | Discount Broker |

| Exchange Membership | NSE and BSE | BSE, NSE, MCX |

| Year of Incorporation | 2016 | 2012 |

| Platforms | Mobile and Web-based | Mobile, Web-based, Upstox Pro (Advanced) |

| Services Offered | Stocks, Mutual Funds and IPOs, UPI payments; Mobile recharge; Bill payments | Stocks, Currency, Commodities, Futures, Options, Mutual Funds, IPOs |

| Customer Service | Fast customer service | We had to wait longer to get a reply |

| Fees | Competitive | Stock and mutual fund, UPI payments, Mobile recharge, Bill payments |

| Advanced Trading | Limited | Upstox Pro offers advanced features for experienced traders |

| Stock Focus | Diverse Investment Options | Primarily Stock Trading |

| Demat Account Charges | Free | Free |

| Brokerage Charges | ₹20 per executed order or 0.05% | ₹20 per executed order or 2.5% (Equity Delivery), ₹20 per executed order or 0.05% (Equity Intraday) |

| Account Features | Stock, Mutual fund, UPI payments, Mobile recharge, Bill payments | Charting, Algo Trading, Margin Trading, Online Demo, Online Portfolio |

| Order Types | Normal order, SL order, GTT order & AMO | CNC, MIS, NRML, Cover, Bracket, AMO, GTC |

Groww and Upstox basics

First, let’s talk about the basics of Groww and Upstox.

- Type of Broker: Both Groww and Upstox are discount brokers, which means they offer cost-effective trading services.

- Exchange Membership: Upstox is a member of BSE, NSE, and MCX, while Groww is associated with NSE and BSE.

- Year of Incorporation: Upstox started in 2012, whereas Groww came into play in 2016.

Groww vs Upstox platforms

Groww and Upstox both offer trading tools that can be used on phones or the web. The extra step that Upstox takes is to offer Upstox Pro, a more demanding platform made for professional traders.

When it comes to services, Upstox is mostly about dealing stocks, currencies, commodities, futures, options, and mutual funds. Groww, on the other hand, lets you buy stocks and mutual funds.

Customer support

Groww is known for its excellent customer service. Upstox also has customer support, but some users have reported longer waiting times.

Also read: 5Paisa vs Upstox

Groww vs Upstox: Key Differences

Here are some key differences between Upstox and Groww:

| Feature | Groww | Upstox |

|---|---|---|

| Investment Options | Equity, F&O, and Currency | Equity, F&O, Currency, and Commodities |

| Brokerage | Rs 20 or 0.05% per order | Rs 20 or 0.05% per order |

| Margin Funding | Yes | No |

| NRI Trading | No | No |

| Account Opening Fee | Free | Rs 249 |

| Call & Trade | Not available | Rs 20 per trade |

| Minimum Brokerage | Rs 20 | Rs 20 |

| Margin for Intraday | Up to 20% | Up to 20% |

| User Interface | User-friendly | More complex |

| Research & Analysis | Limited | More comprehensive |

| Exchange Membership | BSE, NSE, MCX | NSE and BSE |

| Year of Incorporation | 2012 | 2016 |

As its main business, Upstox helps people trade stocks, currencies, commodities, futures and options, as well as invest in mutual funds and initial public offers (IPOs). Groww gives investors another choice by letting them buy US stocks. However, the company charges more for transactions and processing when US accounts receive their payments. You might want to check out Vested or Indmoney if you want to invest in US stocks.

Groww is known for having great customer service, and the company has a support team that is always ready to help buyers with any issues or questions they may have. You can also get help from Upstox’s customer service staff, but some customers say they had to wait longer for help.

It would be wrong to say that Upstox is better than Groww because each broker has its own pros and cons in this business. As a trader, you should think about your own preferences and needs when choosing a broker. These are just a few of the many reasons why someone might like Upstox more than Groww:

Upstox Offers:

- Tool for advanced trading: Upstox has a trading app called Upstox Pro that is more advanced. This platform is for experienced traders only, and it has a lot of advanced features, such as real-time market data, different types of orders, and advanced charting tools. You might like Upstox more if you are an experienced trader looking for a more advanced tool.

- Upstox charges a fee for its brokerage services that changes based on the size of the deal and is lower for bigger trades. These words mean that the fee you pay for each trade is based on how big the trade is. Most of the time, it costs less than Groww’s fixed rate of Rs 20 per trade for big deals. For trading purposes, Upstox’s commission system is better if you want to make trades often.

- Upstox may be a better choice for you than other brokers because its main service is trading stocks. This is especially true if trading stocks is your main goal. Groww provides trading such as direct mutual funds, and ETFs as its services, but in addition, it provides other services like bill payments, Mobile recharge, etc.

Note

Groww has discontinued its feature of investing in US stocks now. Hence, if you are looking to invest in US equities, you may consider Indmoney or Vested for the same.

Groww vs Upstox- Account Opening Charges

| Charges | Upstox | Groww |

|---|---|---|

| Trading Account Opening Fees | Promotion offer: Free | Free |

| Trading AMC | Free | Free |

| Demat Account Opening Fees | Free | Free |

| Demat AMC | Free | Free |

| Provide DP Service | Yes | Yes |

Brokerage plans

| Plan Types | Upstox | Groww |

|---|---|---|

| Multiple Plans | No | No |

| Monthly Plans | No | No |

| Yearly Plans | No | No |

Also read: M.stock Review: A Closer Look at Mirae Asset’s Brokerage

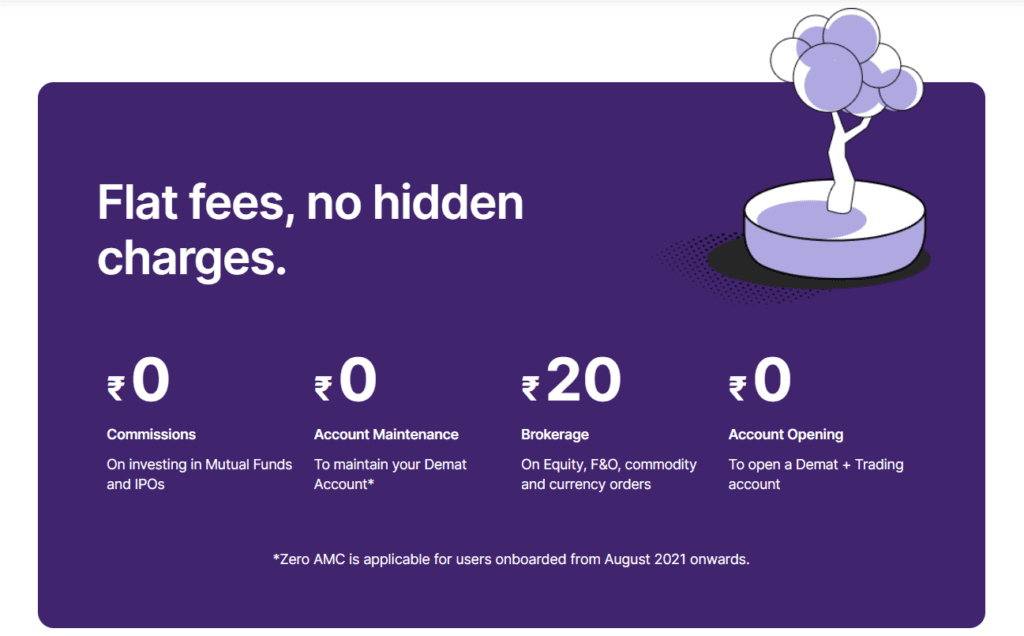

Brokerage Charges

| Brokerage Charges Compare | Upstox | Groww |

|---|---|---|

| Plan Name | Max Rs 20 Per Order Trading Plan | Flat Brokerage Plan |

| Equity Delivery | Free | Free |

| Equity Intraday | 0.05% or Rs 20 whichever is lower | 0.05% or Rs 20 whichever is lower |

| Equity Futures | 0.05% or Rs 20 whichever is lower | Flat Fee Rs 20 |

| Equity Options | Flat Fee Rs 20 | Flat Fee Rs 20 |

| Currency Futures | 0.05% or Rs 20 whichever is lower | Not Available |

| Currency Options | Flat Fee Rs 20 | Not Available |

| Commodity Trading | Flat Fee Rs 20 | Not Available |

| Minimum Brokerage | NIL | NIL |

| Hidden Charges | Info Not Available | Info Not Available |

| Funding | Info Not Available | Info Not Available |

| Call & Trade Charges | Rs 50 Per Executable Order | Service not provided |

| Auto Square off Charges | Rs 20 Per Executable Order | Rs 50 Per Executable Order |

Groww vs Upstox: Exchange Transaction Charges

Groww Exchange Transaction Charges for Equity Futures are 0.002%, while Groww Exchange Transaction Charges for Equity Options are 0.053%. The Upstox Exchange Transaction Charges for Equity Future are NSE Rs 200 per Cr (0.002%), while the Upstox Exchange Transaction Charges for Equity Options are NSE Rs 5300 per Cr (0.053%) (on premium).

Groww vs Upstox – Account Features

| Account Features Compare | Upstox | Groww |

|---|---|---|

| 3-in-1 Account | Yes | No |

| Charting | Yes | Yes |

| Algo Trading | Yes | No |

| SMS Alerts | Yes | No |

| Online Demo | Yes | No |

| Online Portfolio | Yes | Yes |

| Margin Trading Funding Available | No | Yes |

| Combined Ledger for Equity and Commodity | Yes | No |

| Intraday Square-off Time | 3:15 PM | 3:10 PM |

| NRI Trading | No | No |

| Other Features | NIL | NIL |

Groww vs Upstox: Order Types

Both brokers provide CNC orders, MIS orders, and NRML orders. The distinction is made by the advance order type, which includes cover orders, bracket orders, AMO orders, and GTC orders. The distinction is made by the advance order type, such as cover order, bracket order, AMO order, and GTC orders.

Cover Orders (CO): Upstox provides Cover Orders (CO) that Groww does not. Cover Orders (CO) are set with a mandatory stop loss, and this is an intraday position. As this trade is placed with a mandatory SL, the broker will provide you with an extra margin via a cover order.

Bracket Orders (BO): Upstox offers Bracket Orders (BO) that Groww does not. By bracketing one order with two opposite-side orders, you may lock in a profit. A BUY order is covered by a high-side sell limit order and a low-side sell stop order. You will obtain a more significant margin in bracket order since you are minimizing your losses.

After Market Orders (AMO): Both brokers provide After Market Orders.

GTC Orders: Both brokers support Good Till Cancelled (GTC) orders.

Also read: What is the best Stocks Investment method?

| Order Type Compare | Upstox | Groww |

|---|---|---|

| CNC order | Yes | Yes |

| MIS order | Yes | Yes |

| NRML order | Yes | Yes |

| Cover order | Yes | No |

| Bracket order | Yes | No |

| AMO-After Market Orders | Yes | No |

| GTC-Good Till Cancelled | No | No |

Note

Upstox allows trading in SME shares, while Groww does not.

Upstox trading features

- Receive up to a fivefold margin on the top 500 stocks.

- Conduct market research using TradingView and ChartIQ’s library resources.

- GTT will help you time your entry and exit effectively. Stop loss orders and set profit targets

- You may trade straight from the charts on TradingView.

Options trading

- Trade in deep ITM/OTM contracts

- Using the Margin Pledge tool, you can double your margin.

- Trade quickly with the help of the option chain.

- Pre-built Option Strategies

Upstox Chart

With Upstox, you get Tradingview premium free, a place that simplifies monitoring, analysing, and trading in financial markets, which normally costs 12,000 per year. There are other ways to get TradingView Premium for free.

You have the option of using TradingView or ChartIQ.

Conduct in-depth analysis of patterns using more than 100 studies and 80 different drawing tools.

Multi-chart view, with the ability to display up to eight charts on a single screen

Direct trading from charts

Groww: Advantages & Disadvantages

| Groww Advantages | Groww Disadvantages |

| The opportunity to invest online in gold ETFs, gold funds, and gold stocks and bonds | Does not provide a capability for three accounts in one. |

| Zero-Demat AMC Charges | Does not offer trading in commodities |

| Clearing Charges Are Free | Does not provide a facility for trading in Bracket orders. |

| Free Demat and Trading account, and there are no fees associated with setting up the account. | No services for Call and Trade are provided. |

| Investing in mutual funds without any fees. | No services for Call and Trade are provided. |

| There are no DP fees associated with buying and low brokerage. | Does not provide services for NRI Trading |

| Providers of no-cost research services | Do not offer a mechanism for trading with a margin |

Upstox: Advantages & Disadvantages

| Upstox Advantages | Upstox Disadvantages |

| No Commissions or Brokerage Fees on Mutual Funds | Does not offer Tips & recommendation |

| Free Demat AMC for Life | The turnover fees on futures and options are more than those charged by peers. |

| Brokerage with low fees | There are no unlimited monthly trading options available. |

| Online learning that is user-driven, intuitive, and accessible for everyone of all levels. | Does not provide services that are based on research. |

| Aadhar-based signup makes it simple to get things started. | Transfer fees are currently set at ₹7 for each single money transfer. |

| A Reliable Calculator for Brokerage Fees and Margin | |

| Margin funding available | |

Download Free Upstox account | Open FREE Groww account |

Why choose Upstox

Reason to choose Upstox over Groww:

- After Market Order (AMO), Cover Order, and BO are all possible to be placed through mobile and online platforms respectively.

- Both the online and mobile versions provide Trailing-Stop/Stop-Loss (SL) features.

- Zero Demat AMC, completely free Demat account for life

- Provides trading for NRIs.

- Offers Mutual Fund Investment, and SIP Investment.

- Ratan Tata, Kalaari Capital, and GVK Davix are among the notable investors that have supported Upstox.

- Upstox provides traders with the most advanced available technologies. The Upstox Platform, which can be accessed on mobile and online, is widely considered to be among the most effective trading platforms for the Indian stock market.

Why choose Groww

Reason to choose Groww over Upstox:

- For delivery trading, Groww levies a fee of either Rs.20 per completed order or 0.05% of the order amount, whichever is lesser.

- Opening a Demat account online is completely paperless and comes with 128-bit SSL encryption.

- Get a free thorough stock analysis including business financials such as the profit and loss statement and the balance sheet, and choose the best shares for you to invest in.

- On purchases, there are no DP fees.

- Groww is a highly-rated smartphone app that facilitates investments in US stocks. However, Vested or Indmoney provides better options and services with lesser fees for investing in US stocks

Groww vs Upstox promotional offers

Currently, the promotional offers available for Upstox and Groww include the following:

Upstox Promotional Offers:

- Free Account Opening & Demat AMC: Right now, Upstox is giving away free account opening and demat account maintenance charges (AMC) for life. This keeps you from having to pay the account opening fee and the annual fees.

- Upstox Pro: If you want to use advanced features like margin trading, algo trading, and streaming market data, you can pay less for Upstox Pro compared to regular brokerage plans.

- Refer Friends and Earn: Upstox has a programme where you can get paid when your friends and family sign up. For every referral that works, you can get up to ₹200 and 20% brokerage sharing.

Groww Promotional Offers:

- Free Account Opening & Demat AMC: Just like Upstox, Groww lets you open an account and demat AMC for free for life.

- Free Mutual Funds and Equity Delivery: Groww doesn’t charge any fees for direct mutual fund investments or equity delivery trades, which means you hold stocks overnight. For long-term investors, this could be good.

Conclusion

In the end, the broker that is ideal for you will be determined by the particular investing requirements and preferences that you have. It is a good idea to evaluate the fees, investment possibilities, and trading platforms of both Groww and Upstox in order to choose which one is the better option for you to use. Intraday trading, futures and options trading, and trading of any type involving currencies or commodities are all areas in which I believe Upstox to be better. Groww is preferable for long-term investments, whether such investments are in equities or mutual funds.

User Testimonial

“I’ve been using Upstox for a while, and their advanced trading platform is very useful for me. It suits my needs as an experienced trader.”

Sinha A.

Star Ratings

- Groww: ⭐⭐⭐⭐

- Upstox: ⭐⭐⭐⭐⭐

Key Takeaways

- Both Groww and Upstox are reputable discount brokers in India.

- Groww offers diverse investment options, including US equities, but charges higher transaction costs for US accounts.

- Upstox provides advanced features, low brokerage, and is ideal for stock trading.

- For long-term investor, choosing Groww will be ideal choice and for trading you may choose Upstox.

Do both brokers offer Good Till Cancelled (GTC) orders?

Yes, both Upstox and Groww support Good Till Cancelled (GTC) orders.

Do both brokers support After Market Orders (AMO)?

Yes, both Upstox and Groww support After Market Orders (AMO).

Does Upstox offer Bracket Orders?

Yes, Upstox offers Bracket Orders (BO).

Does Upstox provide Cover Orders?

Yes, Upstox provides Cover Orders (CO).

What are the specific order types offered by Upstox and Groww?

Upstox offers Bracket Order, Cover Order, After Market Order (AMO), Good Till Cancelled (GTC).

None of them provide Buy Today Sell Tomorrow (BTST) & Sell Today Buy Tomorrow (STBT) orders