If you’re searching for an in-depth “M.stock review,” you’ve come to the right place. We’ll cover all aspects, good and not-so-good, so you can decide whether M.stock review is a good choice for you.

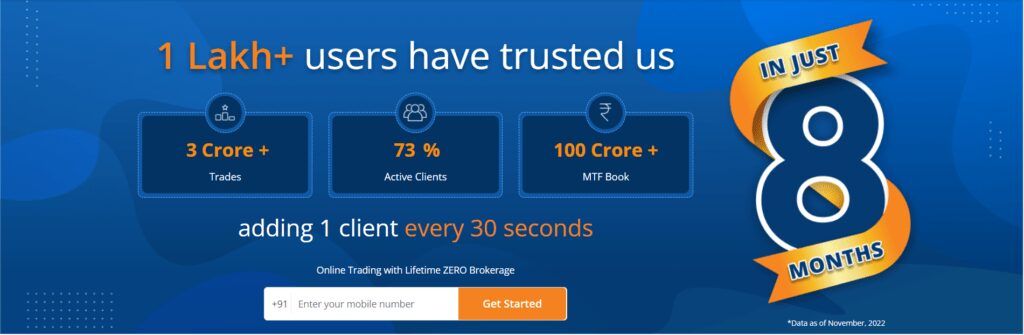

The “Zero Brokerage for Life” promise that M.stock makes is helping it gain popularity, and it is Mirae Assets’ ambitious entry into the highly competitive Indian brokerage market. This indicates that you are able to trade without having to worry about any brokerage fees, which is something that traders find appealing.

M.stock review by Mirae asset

Mirae Asset, a huge financial company with offices all over the world, is now the most popular stockbroker in both South Korea and Indonesia. By using its 19 years of experience in 15 global markets and ability to manage assets worth nearly USD 700 billion, Mirae Asset hopes to change the way Indian brokers work with their innovative “Zero Brokerage for Life” offer. If Mirae Asset does this, it will be able to make the most of its M.stock platform and change the way Indian trading works.

Note

The Mirae Asset company has been managing assets worth nearly $700 billion for more than 19 years in 15 global markets. They’re using this knowledge to change the way broking works in India.

M.stock: Key Highlights

Here’s a detailed breakdown of the key highlights of M.stock:

| Aspect | M.stock |

|---|---|

| Unique Proposition | Zero Brokerage for Life |

| Brokerage Fees | None on all order types |

| Assets Under Management | Nearly $700 Billion |

| Experience | 19+ Years in 15 Global Markets |

| Instant Cashback | Rs. 333 with account opening |

Exploring M.stock’s Features

Here’s a closer look at what M.stock is offering:

In this M.stock review, it is worth mentioning that investors looking to take advantage of intraday and F&O trading can now do so without paying any brokerage. The platform is built on the latest technology and provides real-time updates, making it extremely stable and fast. The M.stock app and web platform are also very fast and have the newest features, but they do have some bugs that we will talk about below. But first, let’s look at what makes M.stock different from other brokers.

- Zero Brokerage: Trade without paying any brokerage fees, including Intraday, Delivery, and F&O orders.

- Transparent Pricing: No hidden charges, and up to 80% delivery funding at just 7.99%.

- IPO Accessibility: Quick and paperless access to upcoming IPOs

- User-Friendly Platform: A fast, reliable, and user-centric trading platform.

Mirae Asset launched M.stock in April 2022 with an offer of no brokerage fees at all for all Intraday, Delivery, and F&O orders. This was a major effort. Most of the time, for intraday and F&O trades, brokers charge a very high flat fee or a percentage of the trade’s value. It is the first time any broker has made brokerage free for a lifetime but account opening fees are highest compared to any other discount broker such as Zerodha, Upstox, Groww, etc.

A New Feature of M.stock: It’s easier to take part in initial public offerings (IPOs) with M.stock, which lets you do it quickly and without paper.

Before going ahead, if you are interested in opening a M.stock account, go to M.stock here to get a cashback of ₹333.

M.stock trading features

Mirae Asset places a strong emphasis on technology as a brand. This is made obvious by the fact that both their mobile application and their web platform are fast, uncomplicated, reliable, and user-friendly, with the convenience and satisfaction of the consumer serving as the primary focus.

Nowadays, finding a brokerage that doesn’t charge hidden fees can be difficult. eMargin is a brokerage that offers zero brokerage and no hidden charges on stocks. This means that you can hold unlimited stocks for as long as you want without having to worry about any subscription fees. M.stock offers up to 80% delivery funding at some of the lowest rates, at 6.99%.

Caution

M.stock offers up to 80% delivery funding at the lowest rate of 6.99% but there is a catch. The funding should be above ₹5 crore. For below ₹25 lakhs, the effective interest rate would be 9.99%, which is high.

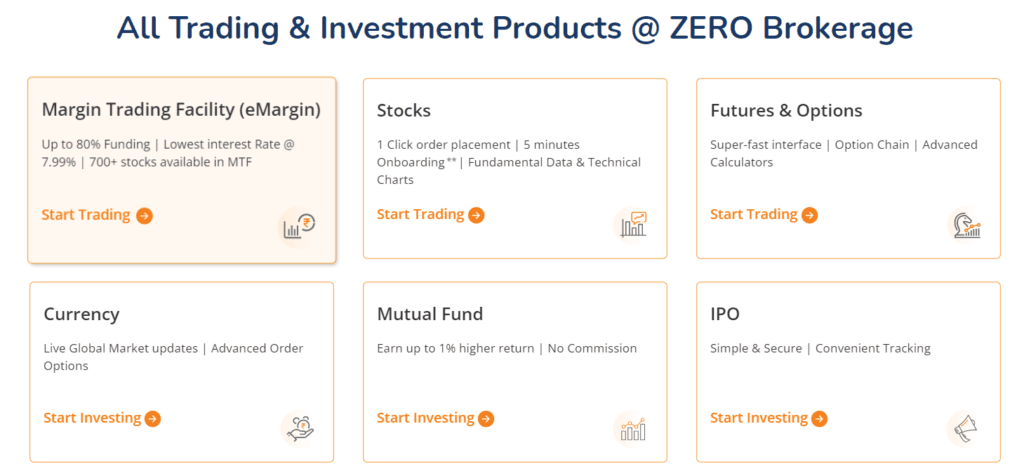

Here are M.stock’s products and their features:

| Trading & Investment Products | Features |

| Margin Trading Facility (eMargin) | Up to 80% Funding | Lowest interest Rate @ 7.99% | 700+ stocks available in MTF |

| Stocks | 1 Click order placement | 5 minutes Onboarding** | Fundamental Data & Technical Charts |

| Futures & Options | Super-fast interface | Option Chain | Advanced Calculators |

| Currency | Live Global Market updates | Advanced Order Options |

| Mutual Fund | Earn up to 1% higher return | No Commission |

| IPO | Simple & Secure | Convenient Tracking |

Who should create an account with M.stock Demat?

The M.stock Demat and Trading account is ideal not only for experienced traders and investors but also for millennials or newbie stock market newcomers.

Also read: Upstox account opening & other benefits

Is M.stock Right for You?

Let’s break down who can benefit from M.stock:

- Experienced Investors and Traders: Since M.stock offers no brokerage on Trading, Investors and traders can benefit from it if they are willing to pay high account opening fees.

- Stock Market Beginners: If you are new to the stock market, other platforms like Groww, Indmoney, Dhan, etc. are easier to use and have better user interfaces than M.stock.

M.stock Review for Experienced Investors and Traders

M.stock’s “zero brokerage” plan could be helpful for traders with a lot of experience. It gives you all the tools you need to trade. It can be very helpful to have access to charts, fundamental analysis, technical data, different order types, historical market data, watchlists, and a portfolio.

M.stock review for Stock Market Beginners

People who are new to the stock market should use platforms like Groww, Indmoney, Dhan, and others instead of M.stock because they are easier to use and have better interfaces. Groww, for example, stands out because it is easy to use and has a lot of educational materials. This makes it great for people who are new to trading stocks. Indmoney and Dhan are also great at designing user interfaces. There may be some good things about M.stock, but these other platforms might be better for people who are just starting out with investing in the stock market.

Also read: Univest stock buy/sell recommendations

M.stock security

The M.stock App and Web platforms are built on technology that is both scalable and reliable. They also have bank-level security and an easy-to-use interface. They are great for traders with a lot of experience.

M.stock unique selling proposition

The unique selling proposition of M.stock is its unbelievable pricing, as well as its industry-unique features, such as one-click order placement, 5 – minutes onboarding, advanced voice search, fundamental analysis & technical charts, and in-app audio-video assistance, all of which make trading and investing incredibly simple.

M.stock reviews

“M.stock made trading a breeze for me. Zero brokerage is a game-changer!”

– Sahil J.

Speedy and Reliable ⭐⭐⭐⭐⭐The trading platform at M.stock is lightning fast and reliable. I stay in the loop with real-time updates, and it’s easy for me to carry out orders. This platform makes me feel good about the trades I make.

Subodh T.

Perfect for Newbies ⭐⭐⭐⭐⭐As someone new to stock trading, M.stock has been a godsend. The simple interface, one-click buying, and voice-activated search have made my journey into the stock market incredibly smooth. It’s a fantastic platform for beginners.

Diya R.

A Game-Changer! ⭐⭐⭐⭐⭐M.stock has truly revolutionized my trading experience. The “Zero Brokerage for Life” feature is a game-changer. I can trade without worrying about high fees eating into my profits. Plus, the user-friendly platform makes navigation a breeze. Highly recommended!

Deepansh

Great for IPOs ⭐⭐⭐⭐If you’re into IPOs, M.stock is your go-to platform. The quick and paperless access to upcoming IPOs is a real time-saver. It’s opened up new investment opportunities for me without the hassle.

Anirudh M.

Cost-Effective Choice ⭐⭐⭐⭐⭐I appreciate the upfront costs of M.stock. The “Zero Brokerage for Life” might seem like a trade-off, but it’s been a cost-effective choice for me as an active trader. The savings in brokerage fees have been huge.

Harish H.

Comparison Table

For a quick overview, here’s a side-by-side comparison:

| Aspect | Mstock | Upstox | Zerodha |

|---|---|---|---|

| Brokerage Fees | Zero | Varies | Varies |

| User-Friendly Interface | ✔️ | ✔️ | ✔️ |

| IPO Accessibility | ✔️ | ✔️ | ✔️ |

| Commodities Trading | ❌ | ✔️ | ✔️ |

| News & Research Features | ❌ | ✔️ | ❌ |

M.stock disadvantages

The app interface is simple and user-friendly. However, many features are yet to be implemented. For example, commodities are not available to trade. This is a major downside, as commodities are an important asset class. Another downside is that the app does not provide news or research. This is a major downside, as traders need access to news and research in order to make informed decisions. We also had problems with the M.stock app stopping to work and responding during the live market. Watch a video below of the same.

The app’s option chain only shows open interest (OI) and last traded price (LTP), and the charts take time to load or refresh, which can be frustrating for users. However, the app does offer a variety of other features that can be helpful for those interested in tracking their portfolios or researching stocks. For example, the app includes a news feed, stock screener, and earnings calendar. Overall, while the app’s option chain and charting capabilities could be improved, it still offers a decent range of features for investors.

Our opinion

We think there are other brokers with simple, easy-to-use, zero-fee platforms that have a lot of features. Even though M.stock has some good points, it’s important to remember that it doesn’t have all the news and research that other platforms do. These missing details could be important for traders who depend on these parts a lot. But M.stock is a good platform for people who want to trade without having to pay brokerage.

Conclusion

To sum up the M.stock review, the Lifetime free AMC and Zero brokerage options cost you more when you first open your account. In the long run, though, you save money on brokerage fees, which makes this a good choice for active traders who want to save money. However, if you do not trade often then you might want to save account opening fees and choose a broker with No account opening fees.