Choosing between INDmoney and Appreciate Wealth can make or break your investment journey in 2025. Both platforms promise seamless US stock investing for Indians, but their approaches differ dramatically. After personally testing both platforms and analyzing hundreds of user reviews, I’ve discovered that Appreciate Wealth emerges as the clear winner for cost-conscious investors, while INDmoney excels for those seeking comprehensive financial management.

Table of Contents

Platform Overview and Core Philosophy

INDmoney: The All-in-One Financial Ecosystem

INDmoney positions itself as India’s “Super Finance App” – a comprehensive platform that goes beyond just investing. Founded in 2019, it’s designed to be your complete financial companion:

What Sets INDmoney Apart:

- Net Worth Tracking: Links bank accounts, credit cards, SIPs, bonds, NPS, FDs, and investments in one dashboard

- Family Financial Management: Track your entire family’s finances and set collective goals

- Credit Management: Monitor credit scores, get payment reminders, and improve financial health

- Insurance & Loans: Access to insurance products and instant cash loans up to ₹5 lakhs

- Bill Payments: UPI payments with cashback rewards

Market Reach: 10+ million users with 838,493 active clients as of 2025

Appreciate Wealth: The Focused US Investment Specialist

Appreciate Wealth takes a laser-focused approach to US investing, positioning itself as the most cost-effective solution for Indian investors. Founded in 2019 and registered with both SEBI and IFSCA, it specializes in making global investing accessible:

Core Strengths:

- Ultra-Low Costs: Minimum investment of just ₹1 with no subscription fees

- AI-Powered Investing: Advanced AI recommendations for portfolio optimization

- Educational Focus: Comprehensive blogs, podcasts, and learning resources

- Partnership Benefits: Zero-balance savings account through YES Bank partnership

Market Position: 5+ lakh users with a focused community of serious investors

Open Appreciate FREE Account

0️⃣ Zero subscription and zero withdrawal charges

🌎Get a free US trading account

💸 Cashback on Trade Transaction fee

Feature-by-Feature Battle Analysis

Investment Options and Market Access

INDmoney Investment Universe:

- Indian Stocks: Complete access to BSE/NSE with advanced trading tools

- US Stocks: 9,000+ stocks with fractional investing from ₹100

- Mutual Funds: 1,600+ direct plans with zero commission

- ETFs: Indian and global ETFs including sector-specific options

- IPOs: Direct IPO application facility

- Fixed Deposits: High-yield FDs through banking partnerships

Appreciate Investment Focus:

- US Stocks: Premium selection with fractional shares from ₹1

- US ETFs: Comprehensive range including thematic and sector ETFs

- Indian Mutual Funds: Curated selection of direct plans

- SIP Options: Automated investing in US stocks and mutual funds

Cost Structure Deep Dive

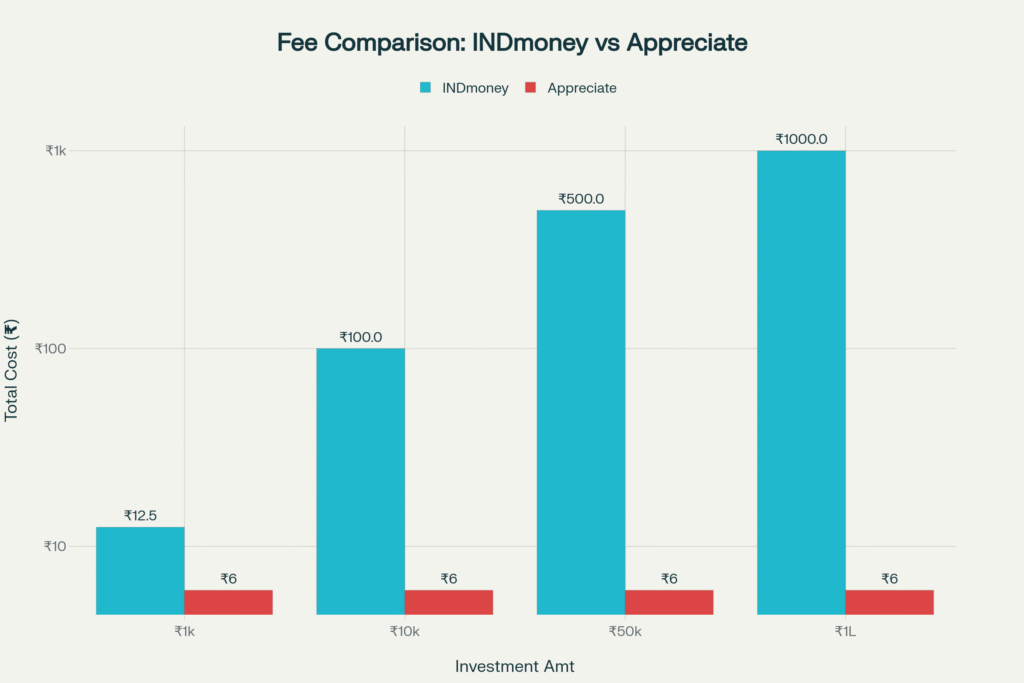

The fee comparison reveals a shocking difference in cost structures. For a ₹1 lakh investment, you’ll pay 166 times more with INDmoney compared to Appreciate Wealth.

INDmoney Fee Breakdown:

- Platform Fee: 0.75% of deposit amount (capped at ₹1,000)

- US Stock Trading: 0.25% per transaction or $25, whichever is lower

- Withdrawal Fee: $5 for amounts below $2,000

- Forex Markup: Minimal through banking partnerships

Appreciate Fee Structure:

- Platform Fee: ₹1 per unit or ticker symbol

- Trading Fee: 0.05% or ₹5, whichever is higher

- Withdrawal Fee: ₹0

- Subscription Fee: ₹0 forever

Technology and User Experience

INDmoney Technology Stack:

- AI Analytics: Basic portfolio insights and fund switching recommendations

- Family Aggregation: Advanced technology to consolidate multiple family accounts

- Flash Trading: 1-click scalping for F&O traders

- Multi-Asset Dashboard: Unified view of all investments and liabilities

- App Rating: 4.6/5 stars with 421,000+ reviews

Appreciate Technology Innovation:

- AI Investment Engine: Advanced algorithms for buy/sell recommendations

- Goal-Based SIPs: Automated investing aligned with financial goals

- Real-Time Analytics: Instant market insights and portfolio performance

- Minimalist Interface: Clean, distraction-free investing experience

- App Rating: 4.8/5 stars with 2,700+ reviews

User Experience: Real Stories from the Ground

INDmoney User Experiences

Positive Feedback:

“I have been using INDMoney for a year now and can say nothing comes close to it in terms of intuitive design, navigation experience and comprehensive understanding of my financial needs” – UX Engineer

“Thanks to this App i discovered that I had been paying a fortune to my MF financial advisor for almost a decade in terms of heavy commissions” – Long-term user

Common Complaints:

- KYC Issues: Multiple users report prolonged KYC processes taking 3-4 months

- Customer Service: Delayed responses and unclear communication

- Fund Transfer Delays: Reports of money getting stuck during US stock transfers

- Hidden Complexities: Premium features often underdelivering on promises

Appreciate Wealth User Experiences

Positive Testimonials:

“After trying out many solutions, I concluded that the Appreciate app would be the best fit for me, and I was absolutely right: the fees are low, the platform is secure, and the customer support team is highly responsive” – CA Professional

“Not getting constant spam and pushes like other apps, making it perfect for hobby investors like me. Maza aa gaya. Thumbs up for the easy remittance” – Retail Investor

User Concerns:

- Limited Market Coverage: Focus only on US stocks may not suit diversified investors

- Newer Platform: Smaller user base means fewer community insights

- Account Opening: Some users report delays in the initial setup process

Pros and Cons: The Unvarnished Truth

INDmoney Advantages

✅ Comprehensive Financial Hub

- Single app for all financial needs

- Net worth tracking across multiple assets

- Family financial management capabilities

- Credit score monitoring and improvement tools

✅ Broad Investment Options

- Access to both Indian and US markets

- Extensive mutual fund selection (1,600+ plans)

- IPO applications and F&O trading

- Fixed deposits with competitive rates

✅ Advanced Analytics

- Portfolio performance insights

- Fund switching recommendations

- Tax planning assistance

- Expense tracking and budgeting

✅ Established Platform

- SEBI registered with strong regulatory compliance

- Large user base (10+ million)

- Proven track record since 2019

- Multiple customer support channels

INDmoney Disadvantages

❌ High Cost Structure

- Platform fees of 0.75% can significantly impact returns

- Higher trading fees compared to specialized competitors

- Withdrawal fees for smaller amounts

- Premium plans with questionable value

❌ Customer Service Issues

- Reports of delayed KYC processing

- Inconsistent customer support quality

- Fund transfer complications

- Limited phone support availability

❌ Complexity Overload

- Too many features can overwhelm beginners

- App performance issues with multiple integrations

- Premium features often underdeliver

- Constant promotional notifications

Appreciate Wealth Advantages

✅ Ultra-Low Cost Structure

- Minimum investment of just ₹1

- Zero subscription and withdrawal fees

- Transparent pricing with no hidden charges

- Best-in-class forex rates through YES Bank

✅ AI-Powered Intelligence

- Advanced recommendation engine

- Goal-based investing automation

- Real-time market insights

- Personalized portfolio optimization

✅ Focused User Experience

- Clean, distraction-free interface

- Purpose-built for US stock investing

- Educational content and market insights

- No spam or aggressive marketing

✅ Strong Regulatory Backing

- SEBI and IFSCA registered

- SIPC insurance up to $500,000

- Partnership with regulated US brokers

- Transparent compliance framework

Appreciate Wealth Disadvantages

❌ Limited Scope

- Primary focus on US stocks only

- No comprehensive financial planning tools

- Limited Indian market options

- No credit management features

❌ Newer Platform

- Smaller user base means less community feedback

- Limited track record compared to established players

- Fewer customer support channels

- Less brand recognition in the market

❌ Feature Limitations

- No family account management

- Limited research and analysis tools

- Basic portfolio tracking compared to INDmoney

- No bill payment or credit features

Who Should Choose Which Platform?

Choose INDmoney If You Are:

🎯 The Comprehensive Financial Manager

- Need all financial services in one app

- Manage family finances and track net worth

- Want both Indian and US market access

- Require credit management and bill payment features

- Don’t mind paying higher fees for convenience

🎯 The Active Trader

- Trade in F&O, intraday, and multiple segments

- Need advanced trading tools and analytics

- Want access to IPOs and fixed deposits

- Require comprehensive research capabilities

- Value established platform reliability

Real-Life Scenario: Rajesh, a 35-year-old software engineer from Bangalore, manages his family’s complete finances. He tracks his parents’ investments, monitors credit cards for his spouse, pays all utility bills, and invests in both Indian and US markets. INDmoney’s comprehensive ecosystem saves him from juggling multiple apps.

Choose Appreciate Wealth If You Are:

🎯 The Cost-Conscious US Investor

- Primarily focused on US stock investing

- Want to minimize fees and maximize returns

- Appreciate AI-driven investment recommendations

- Prefer clean, focused user experience

- Value educational content and market insights

🎯 The Long-Term Wealth Builder

- Building a diversified US stock portfolio

- Want automated SIP investing in US stocks

- Don’t need extensive Indian market features

- Prefer transparent, low-cost investing

- Value quality over quantity in features

Real-Life Scenario: Priya, a 28-year-old marketing professional from Mumbai, wants to invest ₹25,000 monthly in US stocks for long-term wealth creation. She values low fees and AI recommendations over complex features. Appreciate’s focused approach and minimal costs align perfectly with her investment goals.

Feature Comparison: Side-by-Side Analysis

Account Opening and KYC Process

INDmoney Process:

- Online application with PAN and Aadhaar

- Video KYC completion

- Additional documentation requirements

- Average time: 10-15 minutes (when smooth)

- Common issues: KYC delays, documentation problems

Appreciate Process:

- Streamlined digital onboarding

- Integrated YES Bank account opening

- Single-step verification process

- Average time: 5-10 minutes

- Minimal documentation requirements

Educational Resources and Research

INDmoney Learning:

- Basic market insights and news

- Portfolio performance reports

- Fund comparison tools

- Limited educational content

- Promotional webinars and events

Appreciate Learning:

- Comprehensive investment guides and blogs

- Regular market analysis and podcasts

- AI-powered stock recommendations

- Goal-based planning resources

- Real-time market insights and news

Customer Support Infrastructure

INDmoney Support Channels:

- Email: support@indmoney.com

- Phone support with dedicated numbers

- In-app chat assistance

- Social media support (Twitter, LinkedIn)

- Physical office presence in major cities

Appreciate Support Options:

- Email: helpdesk@appreciate.com

- Phone: +91 70393 25849

- Limited chat support

- Grievance redressal system with defined timelines

- CRO and CRAO escalation matrix

Security and Regulatory Compliance

INDmoney Security Framework

Regulatory Registrations:

- SEBI registered as investment advisor and stockbroker

- NSE, BSE member and clearing participant

- CDSL depository participant

- RBI approved for banking partnerships

Security Measures:

- Bank-level encryption and security protocols

- Two-factor authentication

- Secure API integrations

- Regular security audits and compliance checks

Appreciate Security Infrastructure

Regulatory Status:

- SEBI registered broker (SEBI Reg: IFSC/BD/2022-23/0004)

- IFSCA registered for international operations

- FEMA and RBI compliant for remittances

- US SEC regulations through DriveWealth partnership

Protection Measures:

- SIPC insurance coverage up to $500,000

- AI-based fraud monitoring

- Secure fund custody through US regulated brokers

- Regular compliance and audit processes

Performance Analytics: The Numbers Game

Portfolio Performance Tools

INDmoney Analytics:

- Basic P&L tracking across assets

- Monthly and yearly dividend calendars

- Tax loss harvesting suggestions

- Fund performance comparison

- Family portfolio consolidation

Appreciate Analytics:

- Real-time portfolio performance tracking

- USD appreciation impact analysis

- Goal-based progress monitoring

- AI-powered rebalancing suggestions

- Cost analysis and fee transparency

Mobile App Performance

INDmoney App Metrics:

- Download Count: 10+ million

- User Rating: 4.6/5 (421,000+ reviews)

- App Size: Larger due to multiple features

- Loading Speed: Slower due to feature complexity

- Offline Functionality: Limited

Appreciate App Performance:

- Download Count: 5+ lakh

- User Rating: 4.8/5 (2,700+ reviews)

- App Size: Optimized and lightweight

- Loading Speed: Fast and responsive

- Offline Access: Basic portfolio viewing

Investment Strategies: Which Platform Suits Your Style?

For Conservative Investors

INDmoney Approach:

- Balanced allocation between Indian and US markets

- Access to fixed deposits and conservative mutual funds

- Risk management through diversification

- Professional advisory services available

- Insurance integration for comprehensive protection

Appreciate Strategy:

- Focused US market exposure for currency appreciation

- Systematic SIP investing for rupee cost averaging

- AI-driven risk assessment and portfolio optimization

- Goal-based investing with automated rebalancing

- Lower costs enhance long-term compounding

For Aggressive Growth Seekers

INDmoney Options:

- F&O trading with advanced tools

- Intraday and swing trading capabilities

- Access to growth stocks across markets

- Leverage options through margin trading

- IPO participation opportunities

Appreciate Advantages:

- Pure-play US growth stock exposure

- Fractional investing in high-value stocks

- AI recommendations for growth opportunities

- Cost efficiency maximizes investment amounts

- USD appreciation adds growth layer

Tax Implications and Compliance

INDmoney Tax Management

Tax Features:

- Basic capital gains tracking

- TDS management for dividends

- Limited tax optimization tools

- Integration with tax filing platforms

- Professional tax advisory available (premium)

Compliance Support:

- Automated TDS certificates

- Annual statements for tax filing

- LTCG and STCG categorization

- Foreign asset reporting assistance

- Regular compliance updates

Appreciate Tax Considerations

Tax Tracking:

- USD-based transaction records

- Limited INR conversion for tax purposes

- Basic capital gains calculation

- Annual statements in USD format

- Manual tax filing requirements

Important Note: Neither platform provides comprehensive tax advisory. Investors should consult chartered accountants for complex tax situations, especially for US stock investments under LRS compliance.

Technology Integration and API Access

INDmoney Technical Capabilities

Integration Options:

- Banking API integrations for multiple banks

- Credit card linking for expense tracking

- Mutual fund platform connections

- Insurance platform integrations

- Bill payment gateway connections

Advanced Features:

- AI-powered expense categorization

- Automated goal tracking and alerts

- Family account management system

- Cross-platform data synchronization

- Real-time portfolio updates

Appreciate Technical Infrastructure

API Capabilities:

- DriveWealth integration for US markets

- YES Bank API for seamless remittances

- Real-time market data feeds

- AI engine for investment recommendations

- Goal-based automation engine

Performance Optimization:

- Lightweight app architecture

- Fast order execution systems

- Real-time price updates

- Optimized for mobile-first experience

- Minimal system resource usage

Future Roadmap and Platform Evolution

INDmoney Growth Strategy

Upcoming Features:

- Enhanced AI capabilities for portfolio management

- Expansion into cryptocurrency trading

- Advanced tax optimization tools

- International market expansion beyond US

- Enhanced family financial planning features

Market Positioning:

- Strengthening position as comprehensive financial platform

- Targeting mass market with simplified interfaces

- Building ecosystem partnerships

- Enhancing professional advisory services

- Expanding geographic presence

Appreciate Development Plans

Product Roadmap:

- Enhanced AI investment recommendations

- Expanded educational content library

- Advanced portfolio analytics

- Integration with more Indian banks

- Thematic investing options

Strategic Focus:

- Maintaining cost leadership position

- Deepening US market specialization

- Enhancing user education and engagement

- Building community features

- Exploring institutional partnerships

Making the Final Decision: A Personal Framework

Decision Matrix for Platform Selection

Step 1: Define Your Primary Goal

- Comprehensive financial management → INDmoney

- Cost-effective US investing → Appreciate

- Active trading across markets → INDmoney

- Long-term wealth building → Appreciate

Step 2: Evaluate Investment Amount

- Small amounts (₹1,000-₹10,000) → Appreciate (lower fees)

- Medium amounts (₹50,000-₹2,00,000) → Appreciate (significant cost savings)

- Large amounts (₹5,00,000+) → Consider both (fees become less significant percentage-wise)

Step 3: Assess Feature Requirements

- Need net worth tracking → INDmoney

- Want family financial management → INDmoney

- Prefer AI-driven recommendations → Appreciate

- Require credit management → INDmoney

Step 4: Consider Time Commitment

- Limited time for research → Appreciate (AI recommendations)

- Enjoy active portfolio management → INDmoney

- Want automated investing → Appreciate

- Need professional guidance → INDmoney (premium plans)

The Verdict: Platform Recommendations by Investor Profile

🏆 Winner for Beginners: Appreciate Wealth

- Lower minimum investment (₹1 vs ₹100)

- Cleaner, less overwhelming interface

- Better educational resources

- AI-guided investing reduces decision paralysis

- Transparent, low-cost structure

🏆 Winner for Experienced Investors: Depends on Strategy

- Cost-focused US investors: Appreciate Wealth

- Comprehensive traders: INDmoney

- Family financial managers: INDmoney

- Long-term wealth builders: Appreciate Wealth

🏆 Winner for Cost Consciousness: Appreciate Wealth

- Significantly lower fees across all investment amounts

- No hidden charges or subscription fees

- Better forex rates through YES Bank partnership

- Transparent cost structure

🏆 Winner for Feature Richness: INDmoney

- Comprehensive financial ecosystem

- Multiple asset classes and markets

- Advanced trading tools

- Integrated banking and credit management

Conclusion: The 2025 Investment Platform Champion

After extensive analysis of both platforms, Appreciate Wealth emerges as the better choice for most Indian investors in 2025, especially those focused on US stock investing and long-term wealth creation. Its combination of ultra-low costs, AI-powered recommendations, and focused user experience creates superior value for investors.

However, INDmoney remains the right choice for investors who prioritize comprehensive financial management, need access to multiple asset classes, or want an all-in-one platform for their entire family’s financial needs.

The key insight? Don’t choose based on features you might use – choose based on features you will actually use. Most investors overestimate their need for complex features and underestimate the impact of fees on long-term returns.

For the average Indian investor looking to build wealth through US stock investing, Appreciate Wealth’s focused approach, minimal costs, and AI-driven insights provide the optimal combination of simplicity and effectiveness. The platform’s commitment to transparency and education makes it particularly suitable for the growing number of Indians entering global markets.

Final Recommendation: Start with Appreciate Wealth if your primary goal is US stock investing. You can always add INDmoney later if you need comprehensive financial management features. The cost savings alone from choosing Appreciate can fund your investment growth for years to come.

Post Disclaimer

For informational purposes only:

The information presented on this website is for informational purposes only and should not be construed as financial, legal, or professional advice. While we strive to provide accurate and up-to-date information, we cannot guarantee its completeness or accuracy. Any opinions expressed herein are solely those of the author or individual contributor and do not necessarily reflect the views of any company, organization, or other entity.

Do your own research:

Readers are encouraged to conduct their due diligence and consult with a qualified professional before making any decisions based on the information presented on this website. Trading, investing, and other financial activities involve inherent risks, and you could lose all or a portion of your capital. Past performance is not indicative of future results.