People like to use M Stock and Groww to buy and sell stocks, mutual funds, ETFs, initial public offerings (IPOs), and more online. Both of them have low-cost trading, an easy-to-use interface, and many tools to help you reach your financial goals. Which one is better for you? In this article, we will compare M Stock vs Groww on various parameters such as:

- Trading Platform

- Account Opening and Maintenance Charges

- Brokerage Charges

- Margin and Leverage

- Customer Support

- Pros and Cons

M stock Company history

Mirae asset Capital markets (India) private limited was established in 2017 and received it’s SEBI stock broker liscense in January 2018. It offers a wide range of services including equity trading, derivatives, mutual funds, IPOs, and more.

Groww Company history

Groww is also a new player, started in 2016 and has quickly gained popularity due to its user-friendly interface and a wide range of investment options. It allows investors to invest in stocks, mutual funds, Futures and options.

Quick Overview of M stock

- Zero brokerage fees & no hidden charges for life.

- MIRA, an exclusive voice assistant, on their stock trading app.

- Secure and reliable processing of thousands of transactions per second.

- Single dashboard for your portfolio.

- Simple, helpful, & intuitive user interface.

- Fast & Dedicated query solutions.

- One-click order placement for real-time market opportunities.

- Advanced Charts and Indicators with direct trade option.

- One View Portfolio to view investments and P&L on a single page.

- Price Alerts to never miss market opportunities.

Quick Overview of Groww

- Zero brokerage fees: Groww offers zero brokerage fees on all mutual fund investments.

- Minimal charges for stock trading: Users can trade stocks for a flat brokerage fee of ₹20 per trade.

- Free Demat account: Open and maintain a Demat account with Groww for free.

- No minimum balance: Users can start investing with any amount they want.

- User-friendly interface: Groww’s app and website are intuitive and easy to use for both beginners and experienced investors.

- Seamless transactions: Groww provides secure and reliable processing of all investments.

- Single dashboard: View your entire portfolio, investments, and profit and loss on a single page.

- One-click order placement: Place orders quickly and easily for real-time market opportunities.

- Investment guides and resources: Learn about investing with Groww’s comprehensive educational resources.

- Mutual fund SIPs: Invest in mutual funds regularly through systematic investment plans (SIPs).

- Tax management: Groww helps calculate and file your capital gains tax.

M stock vs Groww: Trading Platform

If you’d rather trade on your computer, M Stock has a desktop trading tool that you can use. The platform is quick, dependable, and has powerful tools for research and charting. You can also use a web browser or a mobile app to get to M Stock.

Groww lets you trade on both the web and your phone. The platform is easy to use and provides basic financial information about the company but lacks advanced charting tools compared to M Stock for studying and making charts. But its UI is very smooth and user friendly compared to M stock.

Account Opening and Maintenance Charges

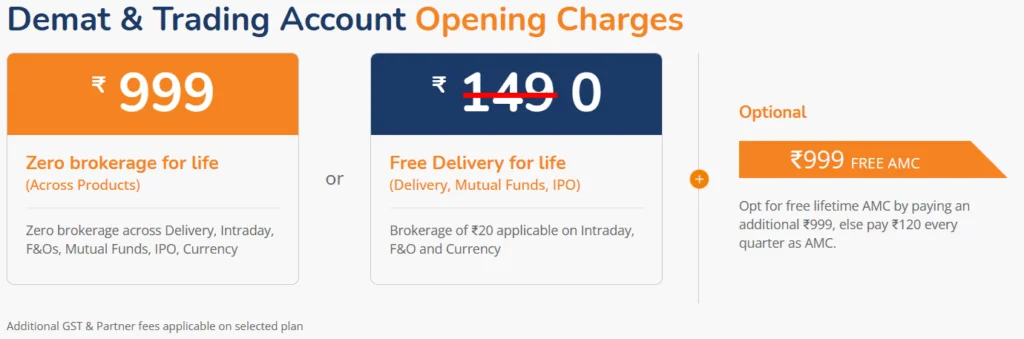

M stock Account Opening and Maintenance Charges: There is a one-time fee of ₹999 for an account opening and ₹120 every quarter as AMC to start an account with M Stock. They also provide the option of ₹999 once for AMC for a lifetime.

Groww Account Opening and Maintenance Charges: There is no fee for opening a demat on Groww. Also, Groww doesn’t charge any AMC.

Brokerage Charges

| Broker | Charge type | Equity delivery | Equity intraday | F&O – Futures | F&O – Options |

|---|---|---|---|---|---|

| Groww charges | Brokerage | Zero Brokerage | 0.05% or Rs. 20/executed order, whichever is lower | Flat ₹20/executed order | Flat ₹20 per executed order |

| M stock charges | Brokerage | Zero Brokerage | Zero Brokerage | Zero Brokerage | Zero Brokerage |

M stock: For stock delivery, intraday, futures, options, currency, and commodities, M Stock charges ₹0

Groww: Groww, on the other hand, costs either 0.05% or Rs. 20 per order whichever is lower. This isn’t as high as some standard brokers charge, but for traders who do a lot of business, it can add up.

M stock vs Groww Charges

| Charges | Groww | M stock |

|---|---|---|

| Account Opening Fee | ₹0 | ₹999 |

| Annual Maintenance Charges (AMC) | ₹0 | ₹120/ quarter |

| Equity Delivery | Free | Free |

| Intraday | 0.03% or ₹20 (whichever is lower) | ₹0 |

| Currency | 0.03% or ₹ 20/executed order, whichever is lower | ₹0 |

| Commodity | 0.03% or ₹20 (whichever is lower) | ₹0 |

| Futures | 0.03% or ₹20 (whichever is lower) | ₹0 |

| Options | Flat Rs. 20 per executed order | ₹0 |

| DP Charges | ₹13.5 + GST per scrip | ₹12 per ISIN (Stock or ETF) per day |

| Taxes | 18% GST | 18% GST |

Note

You have to pay an extra ₹999 on M stock to get free AMC. If you don’t, you have to pay ₹120 every three months as AMC.

M stock vs Groww: Stamp Duty charges

| Demat | Charge type | Equity delivery | Equity intraday | F&O – Futures | F&O – Options |

|---|---|---|---|---|---|

| Groww charges | STT/CTT | 0.0003% on buy | 0.015% on the buy side | 0.002% on Buy | – 0.003% on Buy |

| M stock charge | STT/CTT | 0.015% or ₹1500 / crore on buy side | 0.003% or ₹300 / crore on buy side | 0.002% or ₹200 / crore on buy side | 0.003% or ₹300 / crore on buy side |

M stock vs Groww: SEBI Turnover Charges

| Demat | Charge type | Equity delivery | Equity intraday | F&O – Futures | F&O – Options |

|---|---|---|---|---|---|

| Groww charges | SEBI Charges For both Buy & Sell | ₹10 / crore | ₹10 / crore | ₹10 / crore | ₹10 / crore |

| M stock charge | SEBI Charges For both Buy & Sell | ₹10 / crore | ₹10 / crore | ₹10 / crore | ₹10 / crore |

M stock vs Groww: Physical Statement Delivery charge

- On M stock, you will be charged ₹100 per request + ₹100 per courier charges.

- On Groww, you will be charged ₹10 per page

M stock vs Groww: Remat Charges

Rematerialization of shares refers to the process by which electronic shareholdings may be turned into physical share certificates. This can be done by a shareholder at their own expense.

- In M stock, there is a charge of ₹150 per certificate + ₹100 courier charges + CDSL Charges will be levied.

- Demat/Remat: ₹150 per certification + courier charges

| Broker | Rematerialization Fee per Certificate | Additional Charges |

|---|---|---|

| M stock | ₹150 | ₹100 courier charges + CDSL Charges will be levied. |

| Groww | ₹150 | ₹100 courier charge |

M stock vs Goww: Charges for Call and Trade

- M stock doesn’t charge any fees on Call and trade across any segment: Equity Delivery, Equity intraday, Futures & Options

- Groww doesn’t offer Call and trade feature

M stock vs Groww: Regulatory Charges

Exchange Transaction Charges for both Buy and Sell:

| Broker | Type of Charge | Equity Delivery | Equity Intraday | Futures | Options |

| M stock | STT/CTT | 0.1% on buy & sell | 0.025% on the sell side | 0.0125% on sell side | 0.125% of the intrinsic value on options that are bought and exercised 0.0625% on sell side (on premium) |

| Groww | STT/CTT | 0.1% Delivery: Buy and Sell | 0.025% Intraday Sell | NSE: 0.0125% BSE: 0 | 0.0625% (on premium) |

M stock vs Groww: Other Charges

Apart from the account opening charges, brokerage charges, and AMC charges, there might be other costs associated. These could include charges for SMS alerts, transaction statements, physical contract notes, or additional research and analysis tools.

| Type of Charges | M stock | Groww |

| Deposit using Netbanking | Vary between ₹7 – ₹11 + GST depending on the bank selection | ₹10+GST |

| Auto-square-off charges (For Open intra-day Day Positions) | ₹60 per position | ₹50 per position |

| Call & Trade charges | ₹0 | Does not offer |

| GST On Brokerage, DP Charges, Exchange Transaction Charges, SEBI Turnover Charges and Auto Square-off Charges | 18% | 18% |

Check all other Groww charges and M stock charges.