A lot of people invest in the stock market online, but it can be difficult to pick the right platform. You should think about a lot of things, like costs, features, customer service, safety, and reliability. We will compare Mstock vs Zerodha, two of the most popular online trading platforms in India, in this article.

Quick Overview of Mstock

Quick Overview of Zerodha

Mstock vs Zerodha Charges

| Charges | Zerodha | Mstock |

|---|---|---|

| Account Opening Fee | ₹200 | ₹999 |

| Annual Maintenance Charges (AMC) | ₹0 | ₹0 |

| Equity Delivery | Free | Free |

| Intraday | 0.03% or ₹20 (whichever is lower) | ₹0 |

| Currency | 0.03% or ₹ 20/executed order, whichever is lower | ₹0 |

| Commodity | 0.03% or ₹20 (whichever is lower) | ₹0 |

| Futures | 0.03% or ₹20 (whichever is lower) | ₹0 |

| Options | Flat Rs. 20 per executed order | ₹0 |

| DP Charges | ₹13.5 + GST per scrip | ₹12 per ISIN (Stock or ETF) per day |

| Taxes | 18% GST | 18% GST |

Note

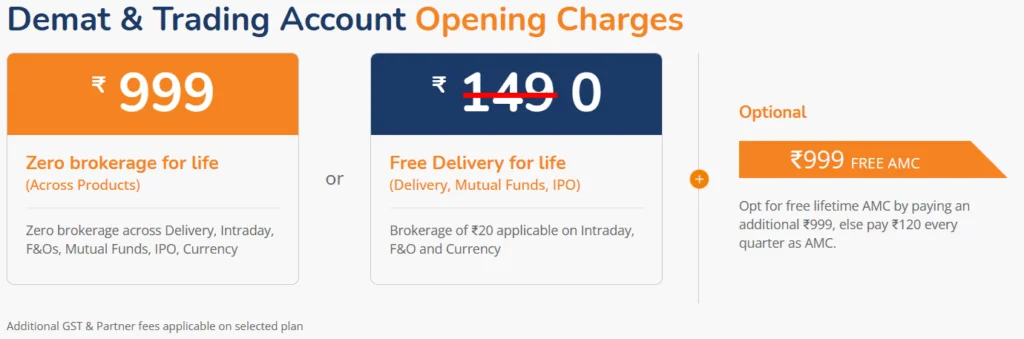

On Mstock, you will need to pay an extra ₹999 to get free AMC, else you need to pay ₹120 every quarter as AMC.

Mstock

- Account Opening Charges: ₹999

- Brokerage: Zero brokerage across all segments (Delivery, Intraday, F&Os, Mutual Funds, IPO, Currency)

- AMC: Free lifetime AMC by paying an additional ₹999, else pay ₹120 every quarter.

- DP Charges: ₹12 + GST per ISIN per transaction per day for sell transactions.

- Pledge creation and closure charges: ₹25 per Pledge Sequence Number (PSN) per day (+GST) for traders under the ‘Lifetime free AMC’ plan.

- Other Charges: Vary between ₹7 – ₹11 + GST depending on the bank selection for deposit via net banking

Zerodha

- Account Opening Charges: ₹200 for online account opening.

- Brokerage: ₹20 or 0.03% (whichever is lower) per executed order on intraday trades across equity, currency, and commodity trades. Flat ₹20 on all option trades. Zero brokerage on equity delivery

- AMC: ₹300 plus GST annually

- DP Charges: ₹13.5 + GST per scrip

- Other Charges: ₹20 or 0.03% (whichever is lower) per executed order for Currency futures

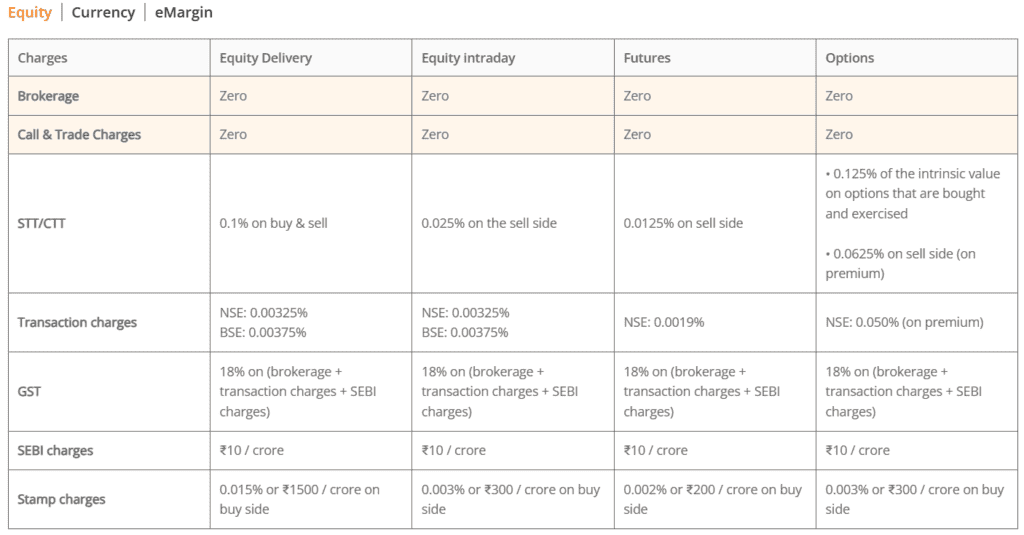

Mstock vs Zerodha: Stamp Duty charges

| Demat | Charge type | Equity delivery | Equity intraday | F&O – Futures | F&O – Options |

|---|---|---|---|---|---|

| Zerodha charges | STT/CTT | 0.1% on buy & sell | 0.025% on the sell side | ₹0 on Buy & 0.0125% on sell | – 0.125% of the intrinsic value on options that are bought and exercised – 0.0625% on sell side (on premium) |

| Mstock charge | STT/CTT | 0.015% or ₹1500 / crore on buy side | 0.003% or ₹300 / crore on buy side | 0.002% or ₹200 / crore on buy side | 0.003% or ₹300 / crore on buy side |

Mstock vs Zerodha: SEBI Turnover Charges

| Demat | Charge type | Equity delivery | Equity intraday | F&O – Futures | F&O – Options |

|---|---|---|---|---|---|

| Zerodha charges | SEBI Charges For both Buy & Sell | ₹10 / crore | ₹10 / crore | ₹10 / crore | ₹10 / crore |

| Mstock charge | SEBI Charges For both Buy & Sell | ₹10 / crore | ₹10 / crore | ₹10 / crore | ₹10 / crore |

Mstock vs Zerodha: Physical Statement Delivery charge

- In Zerodha, there is no separate fee for requesting a physical statement delivery. However, you have to pay the courier charges, which are typically around ₹20.

- On Mstock, you will be charged ₹100 per request + ₹100 per courier charges.

Mstock vs Zerodha: Off-market Transfer charges

- Zerodha charges ₹25 or 0.03% of the transfer value (whichever is higher).

- Mstock charges ₹20 per transaction or 0.50% whichever is lower.

Mstock vs Zerodha: Remat Charges

Rematerialization of shares refers to the process by which electronic shareholdings may be turned into physical share certificates. This can be done by a shareholder at their own expense.

- In Mstock, there is a charge of ₹150 per certificate + ₹100 courier charges + CDSL Charges will be levied.

- The rematerialization charges for Zerodha are ₹150 per certificate + CDSL charges + ₹100 courier charges.

| Broker | Rematerialization Fee per Certificate | Additional Charges |

|---|---|---|

| Mstock | ₹150 | ₹100 courier charges + CDSL Charges will be levied. |

| Zerodha | ₹150 | CDSL charges + ₹100 courier charge |

Mstock vs Zerodha: Deposit via Netbanking

These are the fees associated with the payment gateway, and they amount to:

- On Mstock UPI Transactions are Free and in case of Net banking, charges will vary between ₹7 – ₹11 + GST depending on the bank selection

- In Zerodha, ₹9 + GST (Not levied on transfers done via UPI)

Mstock vs Zerodha: Charges for Call and Trade

- Mstock doesn’t charge any fees on Call and trade across any segment: Equity Delivery, Equity intraday, Futures & Options

- Orders placed through a dealer at Zerodha, including orders with auto square-off, are subject to additional fees of ₹50 per order.

Also read: HDFC Sky vs Zerodha: Which is better?

Mstock vs Zerodha: GST charges

This is the tax that the government imposes on services that are provided.

In both Mstock and Zerodha, brokerage fees, SEBI fees, deposits made via net banking, DP fees, auto-square-off fees, call and trade fees, demat/remat fees, and physical statement fees are all subject to this 18% tax.

Mstock vs Zerodha: Account Opening Charges

Mstock charges ₹999 account opening fees. Zerodha charges ₹200 account opening fee. The fee depends on the type of account you choose, such as an individual account or a corporate account.

| Type of account | Mstock charges | Zerodha Charges |

|---|---|---|

| Online account | ₹ 999 | ₹ 200 |

| Offline account | NA | ₹ 500 |

| NRI account (offline only) | NA | ₹ 500 |

| Partnership, LLP, HUF, or Corporate accounts (offline only) | NA | ₹ 500 |

Brokerage Charges: Mstock vs Zerodha

Both Zerodha and Mstock charge Zero Brokerage for equity delivery. With 0.03%, Zerodha provides the cheapest rate compared to Mstock which charges 0.05% in intraday and also within the industry.

| Broker | Charge type | Equity delivery | Equity intraday | F&O – Futures | F&O – Options |

|---|---|---|---|---|---|

| Zerodha charges | Brokerage | Zero Brokerage | 0.03% or Rs. 20/executed order, whichever is lower | 0.03% or Rs. 20/executed order whichever is lower | Flat Rs. 20 per executed order |

| Mstock charges | Brokerage | Zero Brokerage | Zero Brokerage | Zero Brokerage | Zero Brokerage |

Also read: Indmoney Vs Zerodha Charges

Mstock vs Zerodha: Depository Charges

For Zerodha, there is a simple charge of ₹13.5 + GST per scrip (irrespective of quantity), which is debited from the trading account when stocks are sold. This is charged by the depository (CDSL) and the depository participant (Zerodha).

For Mstock, the depository charge is ₹12 per scrip (irrespective of quantity)

Mstock vs Zerodha: AMC Charges

- Mstock levies an annual maintenance charge to maintain your demat account.

- In Zerodha for the BSDA demat account, there is a zero AMC charge if the holding value is less than ₹50,000. For non-BSDA demat accounts: ₹300/year + 18% GST charged quarterly (90 days).

Also read: Groww vs Indmoney for Indian stocks

Mstock vs Zerodha: Regulatory Charges

Exchange Transaction Charges for both Buy and Sell:

| Broker | Type of Charge | Equity Delivery | Equity Intraday | Futures | Options |

| Mstock | STT/CTT | 0.1% on buy & sell | 0.025% on the sell side | 0.0125% on sell side | 0.125% of the intrinsic value on options that are bought and exercised 0.0625% on sell side (on premium) |

| Zerodha | STT/CTT | 0.10% Delivery: Buy and Sell | 0.025% Intraday Sell | NSE: 0.0019% BSE: 0 | NSE: 0.05% (on premium) BSE: 0.005% (on premium) |

Mstock vs Zerodha: Other Charges

Apart from the account opening charges, brokerage charges, and AMC charges, there might be other costs associated. These could include charges for SMS alerts, transaction statements, physical contract notes, or additional research and analysis tools.

| Type of Charges | Mstock | Zerodha |

| Deposit using Netbanking | Vary between ₹7 – ₹11 + GST depending on the bank selection | ₹10+GST |

| Auto-square-off charges (For Open intra-day Day Positions) | ₹60 per position | ₹50 per position |

| Call & Trade charges | ₹0 | ₹50 per order |

| GST On Brokerage, DP Charges, Exchange Transaction Charges, SEBI Turnover Charges and Auto Square-off Charges | 18% | 18% |

Check all other Zerodha charges and Mstock charges.

Mstock vs Zerodha: Key Differences

Account opening charges: Zerodha charges a one-time fee of ₹200 for online account opening, while Mstock charges ₹999 for the same. However, Mstock offers free annual maintenance charges (AMC) for life, while Zerodha charges ₹300 per year for non-BSDA accounts.

Brokerage charges: Both platforms offer zero brokerage for equity delivery, but Zerodha charges 0.03% or ₹20 (whichever is lower) for intraday, futures, options, currency, and commodity trading. Mstock offers zero brokerage for all these segments as well.

Depository charges: Zerodha charges ₹13.5 + GST per scrip for selling stocks, while Mstock charges ₹12 per scrip. Both platforms charge ₹150 per certificate + courier charges + CDSL charges for rematerialization of shares.

Other charges: Zerodha charges ₹9 + GST for depositing money via net banking, ₹50 per order for call and trade, and ₹50 per position for auto-square-off. Mstock does not charge for any of these services, except for net banking deposits, which vary between ₹7-₹11 + GST depending on the bank selection.

Mstock and Zerodha Similarities

- Free Equity Delivery Trades: Both Mstock and Zerodha offer zero brokerage for equity delivery trades, making them attractive for long-term investors.

- Minimal Intraday Charges: Both have low intraday brokerage charges, with Zerodha at 0.03% or Rs. 20/executed order, whichever is lower, and Mstock at Rs. 0.

- Margin Trading: Both offer margin trading facilities for intraday and F&O trading, allowing you to leverage your capital.

- User-Friendly Platforms: Both platforms are designed to be user-friendly, even for beginners. They offer a range of features, including live market data, charting tools, and order placement capabilities.

Who Should Choose Mstock?

Both Mstock and Zerodha don’t charge any fees for delivering stocks. Zerodha does charge ₹20 or 0.03% (whichever is lower) for trading in intraday, futures, options, currencies, and commodities, while Mstock doesn’t charge any fees for any of these segments. Mstock might help you save more on brokerage fees if you trade frequently.

Mstock lets you trade on margin with low interest rates, which means you can borrow money from the broker to trade more than you have on hand. Zerodha doesn’t offer margin trading, but it does offer margin leverage for trading during the day and for foreign exchange. Mstock might be a better choice if you want to trade on credit.

Also read: Mstock detailed review

Who shoud choose Zerodha?

- Zerodha charges ₹200 to open an account, while Mstock charges ₹999. Zerodha might be a better choice if you want to save money on the initial setup cost.

- Zerodha has great customer service and quickly fixes problems. Since Mstock is new to the Indian market, it might not have as much customer service. Zerodha might be a better choice if you care about customer satisfaction and reliability.

Also read: Best app for buying stocks in India

Mstock vs Zerodha: Which is more Begineer friendly?

Mstock is user-friendly with a simple, helpful, and intuitive user interface. It offers a single dashboard for your portfolio and one-click order placement for real-time market opportunities. These features can make it easier for beginners to navigate and understand the platform.

Zerodha, on the other hand, offers a range of educational and research tools that can be very useful for beginners. Their Varsity mobile app provides easy-to-understand lessons on stock market fundamentals. Also, their Kite platform is known for its user-friendly interface and advanced features.