Are you ready to explore the world of US stocks and discover the best platform for investing? Today, we delve into a comprehensive comparison of INDmoney vs Vested to uncover the ultimate choice for investing in the US.

Diversifying your portfolio with US stocks can open doors to potentially higher returns, but it’s crucial to conduct thorough research beforehand. The US stock market is known to be more volatile, meaning there will be more fluctuations in your investment. Additionally, US stocks may not be as liquid as stocks in other markets, making it a bit more challenging to sell them promptly.

However, if you’re willing to take on these challenges, investing in US stocks can be a fantastic way to expand your portfolio. Today we are going to do a detailed comparison of INDmoney vs Vested and find out the best bet for investing in the US. Investing in US stocks can be a great way to diversify your portfolio and potentially earn higher returns. However, it’s important to do your research before investing, as there are some risks involved. Let’s dive into the comparison of INDmoney vs Vested, two popular platforms for investing in the US.

Key Points

- INDmoney and Vested offer hassle-free investing in international stocks.

- Analyze your needs and preferences to decide between INDmoney and Vested.

- Both platforms provide account opening benefits.

- Vested offers over 1500 US equities and ETFs with no commission.

- INDmoney allows you to buy fractional shares and offers a user-friendly interface.

- Vested partners with DriveWealth for account protection.

- INDmoney offers customized portfolio management services.

- Vested offers pre-built portfolios called “Vests.”

- Both platforms have straightforward user interfaces.

- Consider factors like fees, automation, and investment options when choosing.

- Vested’s automated investments and dollar cost averaging are advantages.

- Evaluate your unique requirements before making a decision.

Comparison Table: INDmoney vs Vested for Investing in US Stocks

| Aspect | INDmoney | Vested |

|---|---|---|

| Investment Options | US Stocks and ETFs | 1500+ US equities and ETFs |

| Commission | No commission | No commission |

| Fractional Shares | Available | Available |

| Account Protection | Up to $500,000 | Up to $500,000 |

| Portfolio Management | Available (Rs. 99/month) | Vests for pre-built portfolios |

| Account Fees | No account opening fees | No account opening fees |

| Withdrawal Fees | $5 per transaction | $5 per transaction |

| Free Plan | Available with free stocks | Free with 1000 Vested points |

| Automation | Limited | Automated investments available |

| Documentation & Support | Room for improvement | Extensive FAQs and competent support |

| Consistent Investments | Not mentioned | Free account with a $10 bonus |

| Offers | Free account opening | Free account with a $10 bonus |

Star Ratings:

- INDmoney: ⭐⭐⭐

- Vested: ⭐⭐⭐⭐

Testimonial: Investor X: “I found INDmoney easy to use, but Vested’s range of investment options and automated features won me over.”

INDmoney vs Vested to invest in US stock market from India

Vested and INDmoney are two entirely distinct mobile applications that have certain similarities.

The fact that both Vested and INDmoney allow for hassle-free investing in international stocks is the most significant similarity between the two platforms.

Because of this, we are going to concentrate this comparison article just on this one aspect i.e., investing in the US stocks, and attempt to draw a conclusion about which app is better suited for the aims of your US investment.

Also read: How to earn money daily online without investment

It is important to keep in mind that the needs for your portfolio and investments and the requirements for what you’re looking for from your investing software could be different from person to person. Both INDmoney and Vested offer account opening benefits.

You’ll get a $10 reward when you fund your account on Vested. Signup on Vested here

Depending on the specifics of your situation, you could discover that one of the two applications, INDmoney vs Vested, is more valuable to you than the other.

In order to come to an analytical conclusion on which app is best suited for investing in U.S. stocks, let us now take a look at the features of each platform in turn.

Vested features

Vested offers a lot of features for Free and premium users. Let’s look at them one by one.

Investment Options

More than 1500 different U.S. equities and exchange-traded funds (ETFs) are accessible for investing via Vested. You may also pay an additional $3 per portfolio to acquire selected investment profiles that are exclusive to Vested and known as “Vests.” With the Premium plan, you may get up to nine vests completely free.

There is no commission

When it comes to investments in U.S. equities, Vested does not charge a commission. Both occasional traders and those who trade on a more consistent basis will find this to be a useful tool. If you are planning to invest for the long term, taking advantage of this feature where there is no commission may be rather advantageous.

Buy fractional shares

As an alternative to purchasing a whole share, you have the option of purchasing a share’s parts or fractions. This tool is fantastic for novices and small investors who are looking to get their feet wet with more manageable investments. A significant number of equities traded in the United States are rather expensive.

For instance, the price of one share of Microsoft is $278 at the time of writing the article. In Indian currency, it amounts to very close to 21,860 rupees.

An investment of Rs. 21,000 in a single share could be out of reach for the majority of Indian investors, given that just 6.25% of the country’s population is subject to income tax. Buying fractional shares is a fantastic method to invest in lucrative and well-paying U.S. equities.

Trading Account Protected in the United States

Vested has formed a partnership with DriveWealth, a reputable brokerage business in the United States that will handle any accounts that are opened through Vested. All of the accounts that are opened with Vested come with a maximum insurance coverage of $500,000.

Vests are also known as pre-built portfolios

Vests are pre-built investment portfolios that have been carefully selected and compiled by Vested.

Vests may be divided into two categories: those based on themes and those based on goals. The term “theme-based” refers to the process of selecting investment possibilities based on criteria associated with certain sectors. The objectives of goal-based vests may include, amongst other things, the diversification of an investor’s portfolio, the reduction of investment-related risk, and so on.

Also read: Teji Mandi Review: Should you invest in the Teji Mandi portfolio?

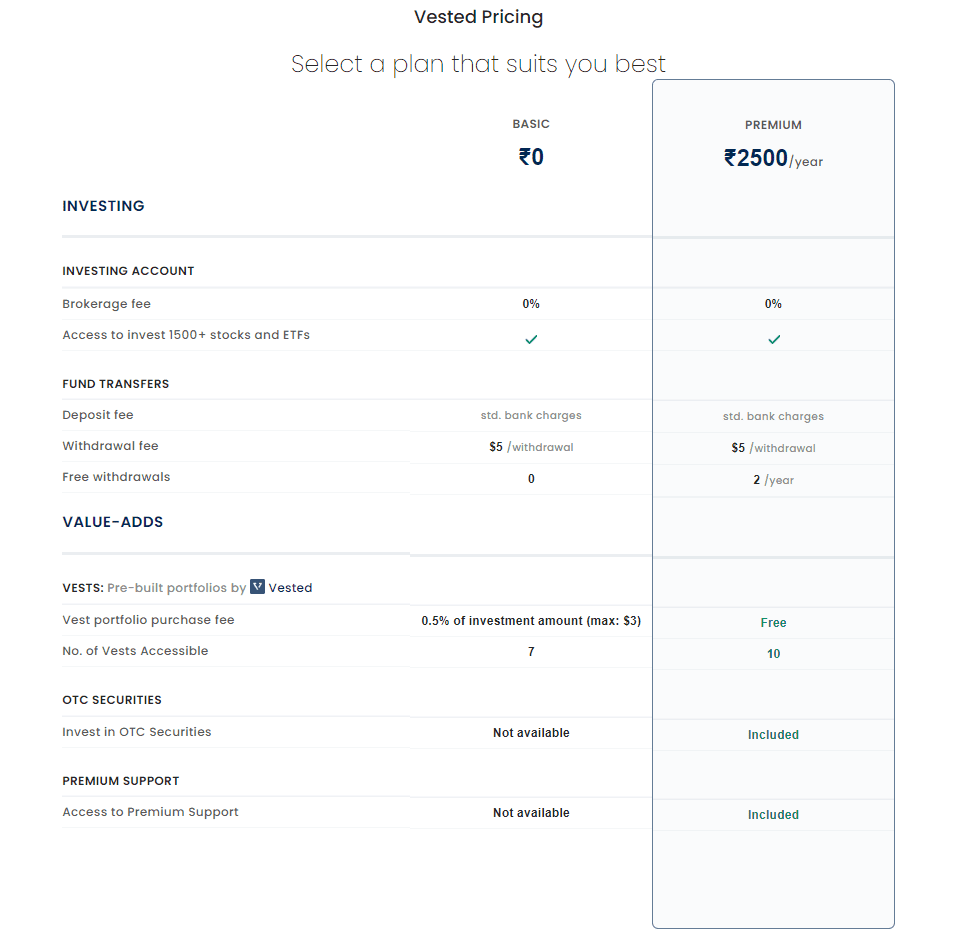

Costs and Expenses

Vested has a clean and uncomplicated pricing structure for its services.

Vested does not charge any money to make an account with them, thus there are no account opening fees associated with working with them.

No minimum balance: In order to keep your Vested account active, you do not need to maintain any kind of minimum amount.

There is no charge for inaction, unlike some other applications that demand that you engage with them within a certain time frame (usually at least one activity per 12 months). You will not incur a penalty from Vested for being inactive.

Deposit fees: Vested does not charge any fees associated with deposits. However, the usual fees associated with the bank will apply.

Note: There is a withdrawal charge of $5 for each transaction.

Plans And Cost Breakdowns

Vested offers a plan that is completely free forever. In addition, there is a premium plan available for a yearly fee of Rs. 4500. You are allowed one free withdrawal if you have the Premium plan (otherwise, each withdrawal will cost you $5). With a vested premium, you’ll have access to perks like unlimited free withdrawals, no-fee investments in Vests and OTC equities (crypto funds, European companies), and faster service. Read a more detailed review of Vested.

Also read: Dhan app (fastest trading app) review

INDmoney features

There is no commission on the sell or buy.

Buying and selling U.S. equities and exchange-traded funds (ETFs) with INDmoney does not incur any commission fees.

Fractional Shares

Additionally, INDmoney provides the option to buy fractional shares.

Free and Fully Protected Trading Account in the United States

Through its partnership with the American company DriveWealth, through which it manages all of its accounts, INDmoney is able to provide its services.

Each and every account is protected up to a maximum of $500,000. DriveWealth is subject to the rules and regulations of the Securities Investor Protection Corporation (SIPC) as well as the Financial Industry Regulatory Authority (FINRA), all of which are reputable financial bodies in the United States.

In addition to this, INDmoney provides free access to a two-in-one trading account for the United States as well as an Indian savings account via the State Bank of Mauritius (SBM). The speed with which SBM completes FX transactions is well known.

Advisory Services and Management of Portfolios

INDmoney provides customized portfolio management services as well as advice on investments depending on the amount of risk you are willing to accept and the sector preferences you have. A monthly charge of Rs. 99 is required to access the prime benefits.

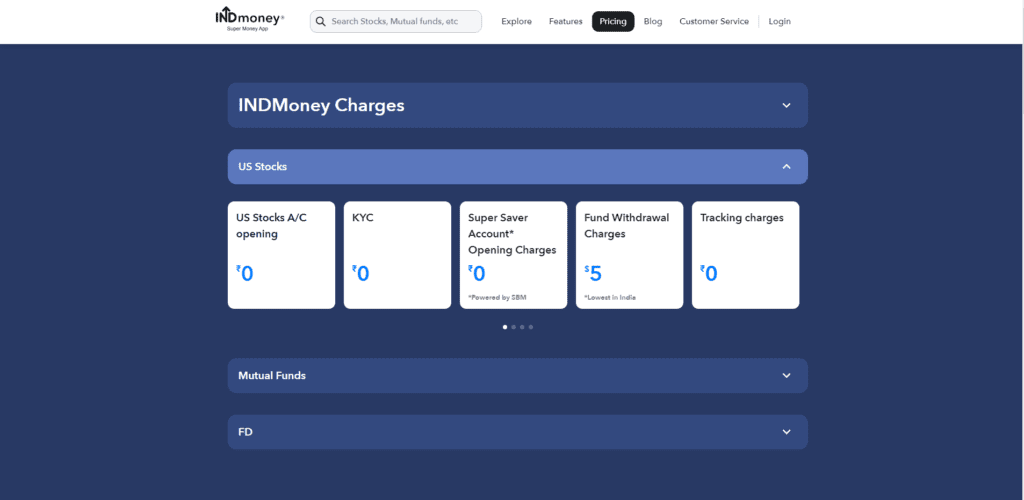

INDmoney charges

- INDmoney US Stocks charges

- US Stocks A/C opening- ₹0/-

- KYC- ₹0/-

- Super saver account opening charges- ₹0/-

- Fund Withdrawal Charges- $5 (lowest in India)

- Tracking charges- ₹0/-

- Account maintenance charges- ₹0/-

- Trading charges- ₹0/-

- Charges outside of lNDmoney- Check here

Opening a new account does not incur any fees.

Free-of-charge buying of U.S. Stocks and Exchange Traded Funds

Transfer of funds via the Super Saver SMB account at no additional cost

$5 is charged in INDmoney for withdrawals, and withdrawal charges over $2,000 are free.

Vested vs Indmoney charges

| Criteria | Vested | INDmoney |

|---|---|---|

| Account opening fee | ₹250 one-time fee | Zero |

| Commission on US stocks and ETFs | Zero | Zero |

| Forex markup charge | Around 1.2% | Around 0.0001% |

| AMC | Zero | Zero |

| Features | Tracking investments, creating personalized financial plan, fractional investing | Saving money, tracking spending, robo-advisory, fractional investing |

| Plans | Basic (free), Essential ($3/month), Plus ($5/month), Premium ($10/month) | Free, Gold (₹999/year), Platinum (₹9,999/year), Diamond (₹99,999/year) |

Inferences:

- Vested has a higher forex markup charge than INDmoney, which can affect the returns of the investors.

- INDmoney offers more plans with varying pricing structures, depending on the level of services and features desired by the user.

- Vested has a wider range of features than INDmoney, but it is also a paid app, whereas INDmoney is free.

- Both platforms offer zero commission and AMC, and allow fractional investing in US stocks and ETFs.

Plans And Cost Breakdowns

Along with the free plans, there are four premium plans available, each catering to a distinct range of possible investment sums.

IND Prime costs 99 Indian rupees per month for investments of up to 1 crore.

A detailed review of INDmoney can be accessed here.

An in-depth comparison between INDmoney vs Vested

When it comes to investing in US stocks, INDmoney vs Vested is the common question. Let’s do a comparison one-to-one.

Compliance With Regulations And Safety

DriveWealth is a licensed financial entity in the United States, and it has worked with both Vested and INDmoney. Therefore, any platform may be used for financial transactions without risk.

Both Vested and INDmoney operate in accordance with the principles laid down by the RBI’s Liberalized Remittance Scheme (LRS).

Security

Because it is software for managing, monitoring, and investing money, INDMoney requires a lot of permissions, some of which are very sensitive, such as access to your personal Gmail account.

Vested, on the other hand, does not have this condition since it focuses only on stock trading in the United States.

Giving someone permission to read your email is a delicate matter that has to be thought through very carefully. You can choose only to invest and not track or monitor your portfolio if not willing to give access to messages on your Gmail account. So in terms of security between INDmoney vs Vested, Vested looks like a better choice.

Ease of Operation

It is simple to create an account on any of these two sites. Because Vested and INDmoney work with the same U.S. banking partners, the procedure is basically the same for both of them.

User Interface, As Well As Features For the Dashboard

The user interfaces and dashboards of both systems are straightforward and simple to navigate.

Charges, in addition to the Commission

On both platforms, the purchase and sell transactions incur no commission fees. The minimum withdrawal amount for Vested is $2,000, but the minimum withdrawal amount for INDmoney is just $5. Both INDmoney and Vested charge a fee of $5 for withdrawal.

If you do not intend to make frequent or temporary withdrawals, it is best to have your investments fully vested. If you want to trade heavily and want to make regular withdrawals, INDmoney is the best option for you between INDmoney vs Vested.

Plans at a Premium and Consultative Functions

The vest feature offered by Vested is of high quality and competitively priced. Each carefully selected investment portfolio, also known as a vest, may be purchased for $3. You will get access to 9 Vests if you subscribe to the Premium plan, which costs Rs. 2500 per year.

The premium plans offered by INDmoney start at Rs.99 per year and include advising services that are provided by independent financial advisers. The advice function does not seem to get very positive feedback.

Due to the fact that independent advisors are not employees of INDmoney, independent advisers are not held to the same level of accountability as one would want.

Freebies

INDmoney offers free stocks to customers who register an account and successfully complete the KYC registration process. Vested gives you 1000 Vested points when you fund your account for the first time. 100 vested points equal $1.00

It is a fantastic advertising feature that INDmoney and Vested offer and the gifts may seem enticing to certain people.

When it comes to investing applications, however, it is important to look beyond promotional considerations and determine whether or not the platform meets the requirements that are unique to you. The structure of the fees and commissions is another significant aspect to take into consideration.

Documentation and Technical Assistance

Vested provides a substantial amount of paperwork as well as an extensive frequently asked questions (FAQ) section to address the majority of the investing inquiries that you may have. Additionally, Vested’s customer service and support teams are quite competent.

The documentation component of INDmoney has room for improvement. Additionally, customer care has a lot of room for improvement.

Consistent Investments

You are able to make automated investments in U.S. equities, ETFs, and Vested’s own Vests via Vested. This implies that you will be able to specify an amount to automatically invest via Vested on a weekly or monthly basis. In the same manner that you would make a systematic investment plan (SIP) with mutual funds or recurrent deposits. This makes Vested a great choice between INDmoney vs Vested.

You may also do dollar cost averaging with Vested thanks to this feature.

There are a few things to consider when deciding whether to invest in US stocks through INDmoney vs Vested. Both platforms have their pros and cons, so it’s important to evaluate your individual needs and goals before making a decision.

Conclusion

There are many reasons why I like the INDmoney app for US stock investment. One reason is that it is very user-friendly and easy to navigate. Another reason is that it provides a lot of useful information, such as stock quotes, news, and analyst ratings. Finally, I like that it has a built-in tool for tracking my portfolio, so I can see how my investments are performing.

INDmoney offers a user-friendly interface and mobile app, making it a good choice for beginner investors. It also has a low minimum deposit of Rs. 500, so you can start investing with a smaller amount of money. However, INDmoney doesn’t offer a lot of investment options, so you may be limited in how you can diversify your portfolio.

Vested is a good choice for more experienced investors. It offers a wider range of investment options, including stocks, bonds, and ETFs. You can also set up automatic deposits and withdrawals, so you can easily manage your investment portfolio. Not previously, However, Vested’s Free plan now allows you to invest in OTC securities.

FAQs

INDmoney vs Vested

Both are great. Vested focuses on US companies and offers customized portfolios, whereas INDmoney offers both US and Indian stock investments. With Vested, you may invest in OTC securities (Crypto funds, European firms) for $0.05/share. Vested also provides a $10 deposit bonus.

Vested referral code

The vested referral code is DEGU05106. It offers a $10 bonus on the first funding of your account.

Is Vested safe?

Vested has formed a partnership with DriveWealth, a reputable brokerage business in the United States that will handle any accounts that are opened through Vested. All of the accounts that are opened with Vested come with a maximum insurance coverage of $500,000.

Post Disclaimer

For informational purposes only:

The information presented on this website is for informational purposes only and should not be construed as financial, legal, or professional advice. While we strive to provide accurate and up-to-date information, we cannot guarantee its completeness or accuracy. Any opinions expressed herein are solely those of the author or individual contributor and do not necessarily reflect the views of any company, organization, or other entity.

Do your own research:

Readers are encouraged to conduct their due diligence and consult with a qualified professional before making any decisions based on the information presented on this website. Trading, investing, and other financial activities involve inherent risks, and you could lose all or a portion of your capital. Past performance is not indicative of future results.